Question: Use the below information to prepare an INDIRECT METHOD Statement of Cash Flows for Bard Corporation for the year ended December 31, 2022. Dec. 31,

Use the below information to prepare an INDIRECT METHOD Statement of Cash Flows for Bard Corporation for the year ended December 31, 2022.

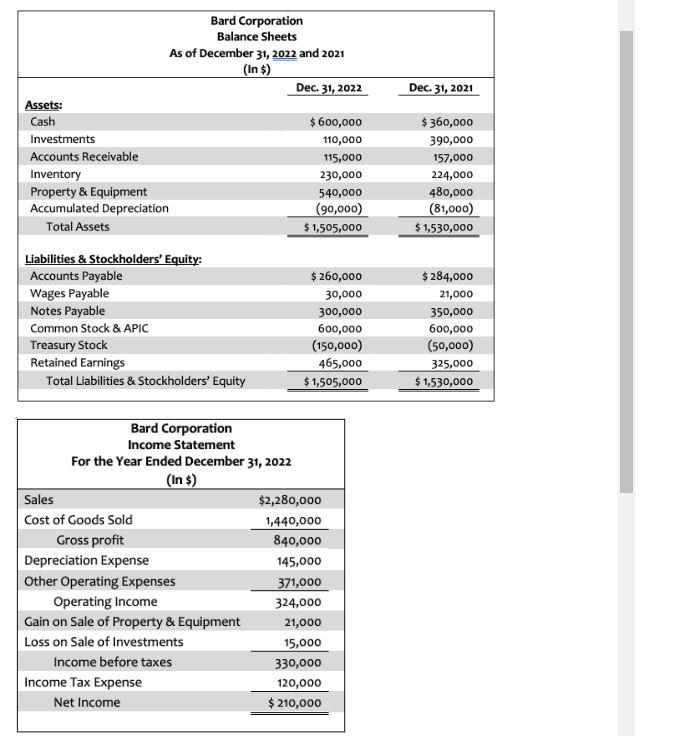

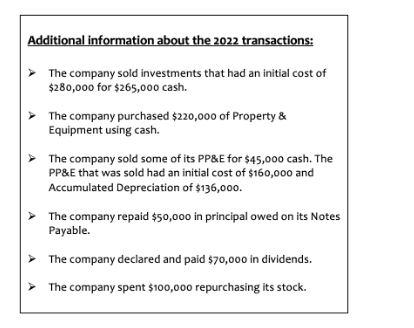

Dec. 31, 2021 Bard Corporation Balance Sheets As of December 31, 2022 and 2021 (In $) Dec 31, 2022 Assets: Cash $ 600,000 Investments 110,000 Accounts Receivable 115,000 Inventory 230,000 Property & Equipment 540,000 Accumulated Depreciation (90,000) Total Assets $ 1,505,000 $360,000 390,000 157,000 224,000 480,000 (81,000) $ 1,530,000 Liabilities & Stockholders' Equity: Accounts Payable Wages Payable Notes Payable Common Stock & APIC Treasury Stock Retained Earnings Total Liabilities & Stockholders' Equity $ 260,000 30,000 300,000 600,000 (150,000) 465,000 $ 1,505,000 $ 284,000 21,000 350,000 600,000 (50,000) 325,000 $ 1,530,000 Bard Corporation Income Statement For the Year Ended December 31, 2022 (In $) Sales $2,280,000 Cost of Goods Sold 1,440,000 Gross profit 840,000 Depreciation Expense 145,000 Other Operating Expenses 371,000 Operating Income 324,000 Gain on Sale of Property & Equipment 21,000 Loss on Sale of Investments 15,000 Income before taxes 330,000 Income Tax Expense 120,000 Net Income $ 210,000 Additional information about the 2022 transactions: The company sold investments that had an initial cost of $280,000 for $265,000 cash. The company purchased $220,000 of Property & Equipment using cash. The company sold some of its PP&E for $45,000 cash. The PP&E that was sold had an initial cost of $160,000 and Accumulated Depreciation of $136,000. The company repaid $50,000 in principal owed on its Notes Payable. The company declared and paid $70,000 in dividends. The company spent $100,000 repurchasing its stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts