Question: Use the below inputs to Compute discounted net cash flow starting from development period. development period Initial term 5 years. production period Initial term 20

Use the below inputs to Compute discounted net cash flow starting from development period.

| development period | Initial term 5 years. |

| production period | Initial term 20 years. |

| Royalty | 10% |

| Cost Recovery | 40% |

| Exploration costs | $72mm |

| Tax rate | 35% |

| Capital costs | $508mm, assume to be incurred during the 5 years of development. |

| Depreciation rate | 20% straight |

| Fixed operating costs | $20mm/year |

| Variable operating costs | $ 2/bbl. |

| Reserves | 250mm barrels |

| discount rate | 10% |

| Oil price | 65 $/bbl. |

Some instructions that can help.

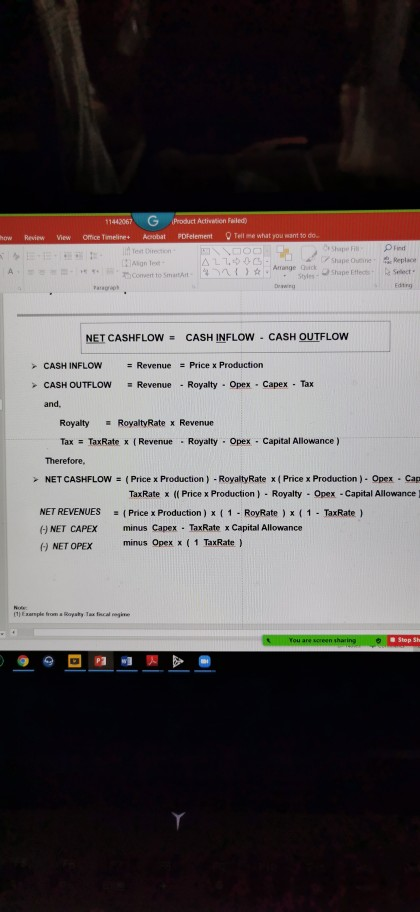

how View 11442067 Product Activation Failed Office Timeline Acrobat PDFelement Tell me what you want to do A rest Direction DOC Agnes AL- Coment to smann- 4) Shape Ourine Find Replace Sche Ed NET CASHFLOW = CASH INFLOW - CASH OUTFLOW CASH INFLOW = Revenue = Price x Production > CASH OUTFLOW = Revenue - Royalty - Opex - Capex - Tax and, Royalty - Royalty Rate x Revenue Tax = Tax Rate x (Revenue - Royalty - Opex - Capital Allowance) Therefore, NET CASHFLOW = (Price x Production) - Royalty Rate x Price x Production) - Opex . Cap Tax Rate x (Price x Production) - Royalty - Opex - Capital Allowance NET REVENUES = (Price x Production) x ( 1 - RoyRate ) x (1 - Tax Rate) A NET CAPEX minus Capex - TaxRate Capital Allowance A NET OPEX minus Opex x ( 1 Tax Rate) (1) Example from Rayahy Tax fiscale You are screen sharing Stop Sh how View 11442067 Product Activation Failed Office Timeline Acrobat PDFelement Tell me what you want to do A rest Direction DOC Agnes AL- Coment to smann- 4) Shape Ourine Find Replace Sche Ed NET CASHFLOW = CASH INFLOW - CASH OUTFLOW CASH INFLOW = Revenue = Price x Production > CASH OUTFLOW = Revenue - Royalty - Opex - Capex - Tax and, Royalty - Royalty Rate x Revenue Tax = Tax Rate x (Revenue - Royalty - Opex - Capital Allowance) Therefore, NET CASHFLOW = (Price x Production) - Royalty Rate x Price x Production) - Opex . Cap Tax Rate x (Price x Production) - Royalty - Opex - Capital Allowance NET REVENUES = (Price x Production) x ( 1 - RoyRate ) x (1 - Tax Rate) A NET CAPEX minus Capex - TaxRate Capital Allowance A NET OPEX minus Opex x ( 1 Tax Rate) (1) Example from Rayahy Tax fiscale You are screen sharing Stop Sh

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts