Question: Use the binomial option pricing model to price a call option. The option has a maturity of one year and a strike price of $95.125.

- Use the binomial option pricing model to price a call option. The option has a maturity of one year and a strike price of $95.125. The current one year rate is 3% and it could either go up 100bp or down to 50bps from the one year rate Each rate has a 50-50 chance of occurring. Your answer should be in dollars out two decimal points (ie. $X.XX)

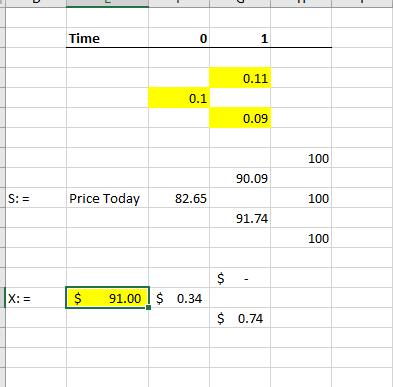

use the excel like this

Time 0 0 1 0.11 0.1 0.09 100 90.09 S: = Price Today 82.65 100 91.74 100 $ - X:= $ 91.00 $ 0.34 $ 0.74 Time 0 0 1 0.11 0.1 0.09 100 90.09 S: = Price Today 82.65 100 91.74 100 $ - X:= $ 91.00 $ 0.34 $ 0.74

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts