Question: Use the blank table below to help you determine the standard deviation for the following stocks. Stock A will return a rate of 12%

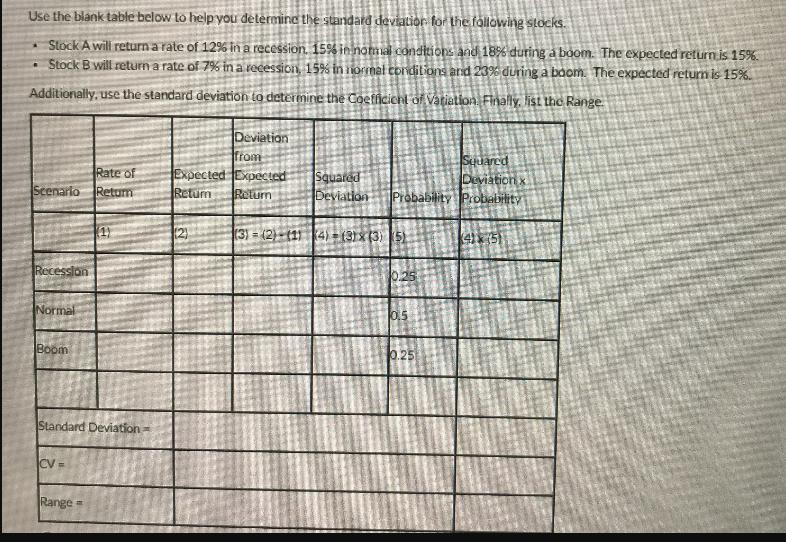

Use the blank table below to help you determine the standard deviation for the following stocks. Stock A will return a rate of 12% in a recession. 15% in normal conditions and 18% during a boom. The expected return is 15%. Stock B will return a rate of 7% in a recession, 15% in normal conditions and 23% during a boom. The expected return is 15%. Additionally, use the standard deviation to determine the Coefficient of Variation. Finally, list the Range Deviation from Rate of Scenario Retum Expected Expected Return Return Squared Squared Deviation x Deviation Probability Probability (3) (2) (114) (3)x(3) (5) (4151 Recession 0.25 Normal Boom Standard Deviation- CV= Range 0.5 0.25 Use the blank table below to help you determine the standard deviation for the following stocks. Stock A will return a rate of 12% in a recession. 15% in normal conditions and 18% during a boom. The expected return is 15%. Stock B will return a rate of 7% in a recession, 15% in normal conditions and 23% during a boom. The expected return is 15%. Additionally, use the standard deviation to determine the Coefficient of Variation. Finally, list the Range Deviation from Rate of Scenario Retum Expected Expected Return Return Squared Squared Deviation x Deviation Probability Probability (3) (2) (114) (3)x(3) (5) (4151 Recession 0.25 Normal Boom Standard Deviation- CV= Range 0.5 0.25

Step by Step Solution

There are 3 Steps involved in it

Standard Deviation for Stocks A and B Lets use the provided table to calculate the standard deviation for Stocks A and B Well assume equal probabilities 25 for each economic scenario Recession Normal ... View full answer

Get step-by-step solutions from verified subject matter experts