Question: Use the bond term's below to answer the question Maturity 12 years Coupon Rate 7% Face value $1,000 Annual Coupons The bond is callable in

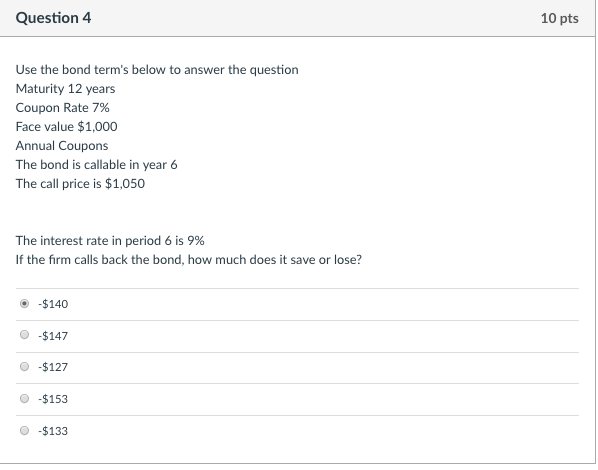

Use the bond term's below to answer the question Maturity 12 years Coupon Rate 7% Face value $1,000 Annual Coupons The bond is callable in year 6 The call price is $1,050 The interest rate in period 6 is 9% If the firm calls back the bond, how much does it save or lose?

(Please just confirm my answers)

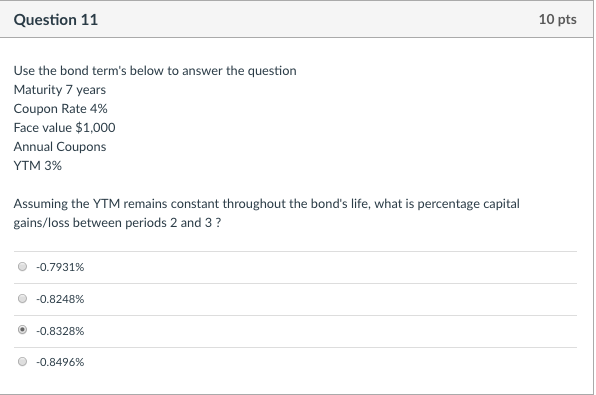

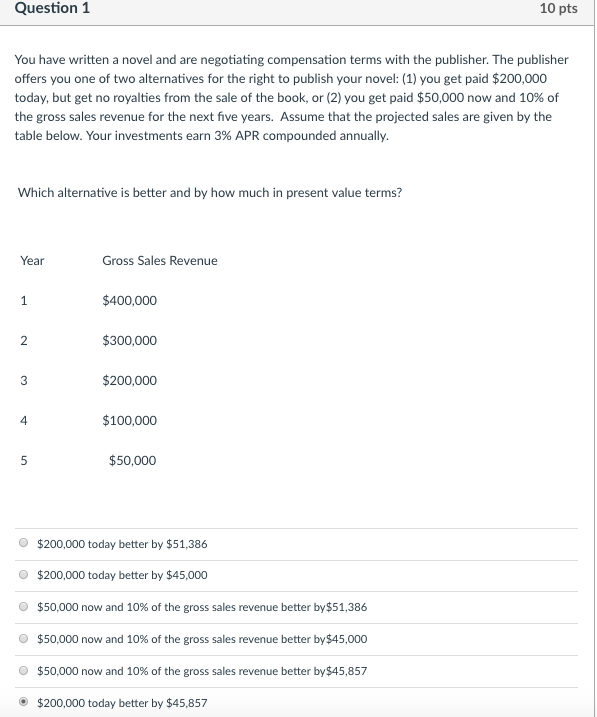

Question 4 10 pts Use the bond term's below to answer the question Maturity 12 years Coupon Rate 7% Face value $1,000 Annual Coupons The bond is callable in year 6 The call price is $1,050 The interest rate in period 6 is 9% If the firm calls back the bond, how much does it save or lose? -$140 0-$147 O-$127 O -$153 O -$133 Question 11 10 pts Use the bond term's below to answer the question Maturity 7 years Coupon Rate 4% Face value $1,000 Annual Coupons YTM 3% Assuming the YTM remains constant throughout the bond's life, what is percentage capital gains/loss between periods 2 and 3? 0-0.7931% ( -0.8248% -0.8328% ( -0.8496% Question 1 10 pts You have written a novel and are negotiating compensation terms with the publisher. The publisher offers you one of two alternatives for the right to publish your novel: (1) you get paid $200,000 today, but get no royalties from the sale of the book, or (2) you get paid $50,000 now and 10% of the gross sales revenue for the next five years. Assume that the projected sales are given by the table below. Your investments earn 3% APR compounded annually. Which alternative is better and by how much in present value terms? Year Gross Sales Revenue $400,000 $300,000 $200,000 2 4 $100,000 $50,000 $200,000 today better by $51,386 $200,000 today better by $45,000 $50,000 now and 10% of the gross sales revenue better by $51,386 $50,000 now and 10% of the gross sales revenue better by $45,000 $50,000 now and 10% of the gross sales revenue better by $45,857 $200,000 today better by $45,857 O O O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts