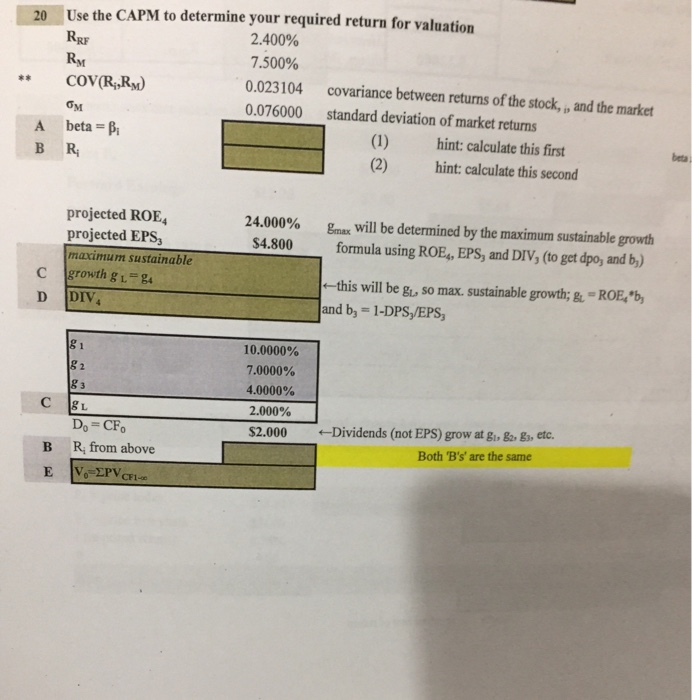

Question: Use the CAPM to determine your required return for valuation RRF Ryt COV(R,RM 20 2.400% 0.023104 covariance between returns of the stock, , and the

Use the CAPM to determine your required return for valuation RRF Ryt COV(R,RM 20 2.400% 0.023104 covariance between returns of the stock, , and the market 0.076000 standard deviation of market returns A beta B B R (1) (2) hint: calculate this first hint: calculate this second beta, projected ROE4 projected EPS3 maximum sustainable 24.000% $4.800 &tax will be determined by the maximum sustainable growth formula using ROE,EPS, and DIV, (to get dpo, and b) C growth gL g D |DIV, -this will be gu, so max. sustainable growth; ROE "b and b, - 1-DPS,/EPS 10.0000% 7.0000% 4.0000% 2.000% $2.000 8 2 g3 Do= CFO B R, from above Dividends (not EPS) grow at gl, go go etc. Both 'B's' are the same CF1-0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts