Question: Use the case study information below to complete the assignment. Case Study Ron and Sue Johnson are married with two children, Ed , age 1

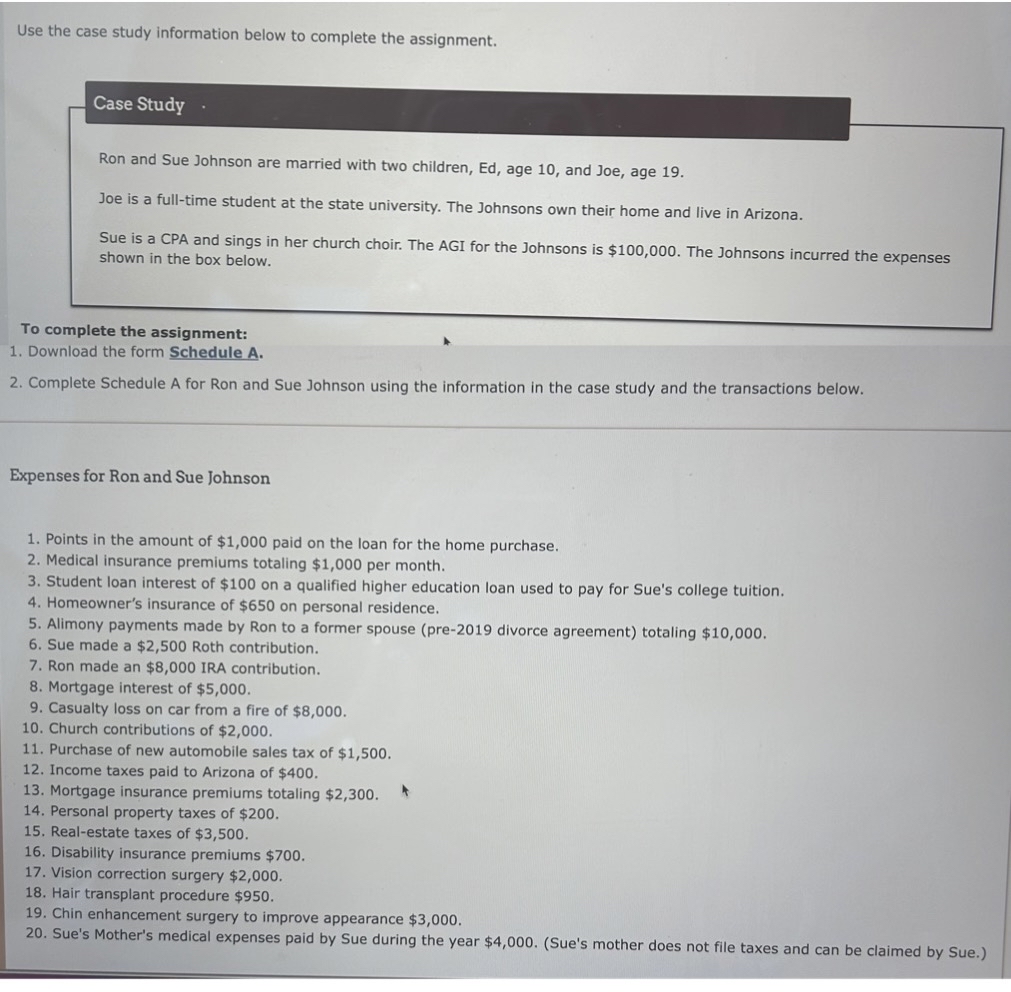

Use the case study information below to complete the assignment.

Case Study

Ron and Sue Johnson are married with two children, Ed age and Joe, age

Joe is a fulltime student at the state university. The Johnsons own their home and live in Arizona.

Sue is a CPA and sings in her church choir. The AGI for the Johnsons is $ The Johnsons incurred the expenses shown in the box below.

To complete the assignment:

Download the form Schedule A

Complete Schedule A for Ron and Sue Johnson using the information in the case study and the transactions below.

Expenses for Ron and Sue Johnson

Points in the amount of $ paid on the loan for the home purchase.

Medical insurance premiums totaling $ per month.

Student loan interest of $ on a qualified higher education loan used to pay for Sue's college tuition.

Homeowner's insurance of $ on personal residence.

Alimony payments made by Ron to a former spouse pre divorce agreement totaling $

Sue made a $ Roth contribution.

Ron made an $ IRA contribution.

Mortgage interest of $

Casualty loss on car from a fire of $

Church contributions of $

Purchase of new automobile sales tax of $

Income taxes paid to Arizona of $

Mortgage insurance premiums totaling $

Personal property taxes of $

Realestate taxes of $

Disability insurance premiums $

Vision correction surgery $

Hair transplant procedure $

Chin enhancement surgery to improve appearance $

Sue's Mother's medical expenses paid by Sue during the year $Sues mother does not file taxes and can be claimed by Sue.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock