Question: use the chart to solve the question please 1. (1pt) Assume you are a single individual with $114,000 in taxable income. Calculate your income taxes

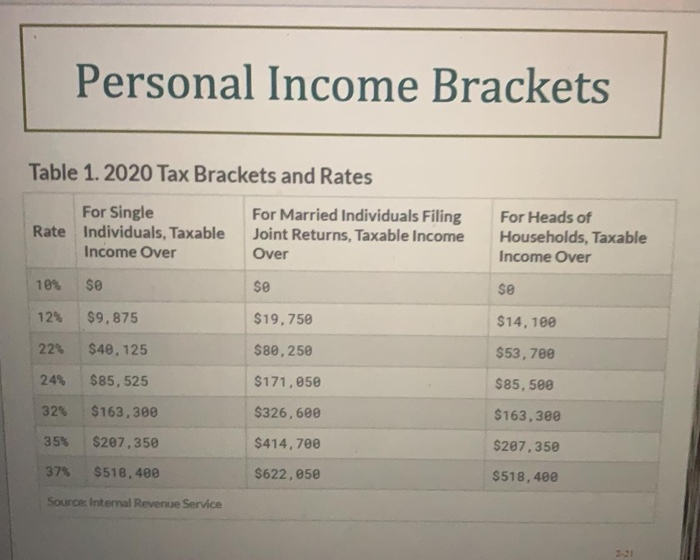

1. (1pt) Assume you are a single individual with $114,000 in taxable income. Calculate your income taxes using the 2020 federal income tax brackets (Table 1 in Slide 2-21). What is the average tax rate? What is the marginal tax rate? Which tax rate is used for decision making? Personal Income Brackets Table 1.2020 Tax Brackets and Rates For Single Rate Individuals, Taxable Income Over For Married Individuals Filing Joint Returns, Taxable income Over For Heads of Households, Taxable Income Over 10% $0 $0 se 12% $9.875 $19,750 $14,100 22% $40, 125 $80,250 $53, 780 24% $85, 525 $171,050 $85,500 32% $ 163,300 $326,600 $ 163,300 35% $207,350 $414,700 $207,350 37% $518,400 $622,050 $518,400 Source: Internal Revenue Service

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts