Question: Use the Comparative Balance Sheet you prepared in Phase #2 and the following additional information to prepare the Statement of Cash Flows for the month

Use the Comparative Balance Sheet you prepared in Phase #2 and the following additional information to prepare the Statement of Cash Flows for the month of January 2019. The company has elected to use the indirect method to prepare the operating activities section.

- Issued 10,000 new shares of common stock in exchange for a piece of land. The stock was selling on the market at an average price of $10 per share on the date of sale and the par value of the stock was 50 cents.

- Purchased land with a cost $250,000. A down payment was made in the amount of $50,000 cash and a 10% 5-year note payable was signed for the difference.

- Purchased additional store equipment for $50,000 paying cash.

- The $10,000 notes receivable was related to the sale of merchandise inventory to a credit customer this period. Hint: The increase in notes receivable should be reported in the operating activities section of the statement of cash flows.

- Issued bonds with a face amount of $800,000 at 97. Hint: The amortization of the bond discount in the amount of $100 should be reported as an addition to the operating activities section.

- Used the cash proceeds from the bond issue to pay off the mortgage payable of $200,000.

- The company repurchased 20,000 shares of its common stock on the open market for $9 per share.

- The company reissued 12,000 of the treasury shares at a price of $15 per share.

- Issued 1,500 shares of preferred stock at $105 per share.

- Paid cash dividends of $31,060 to preferred and common stockholders.

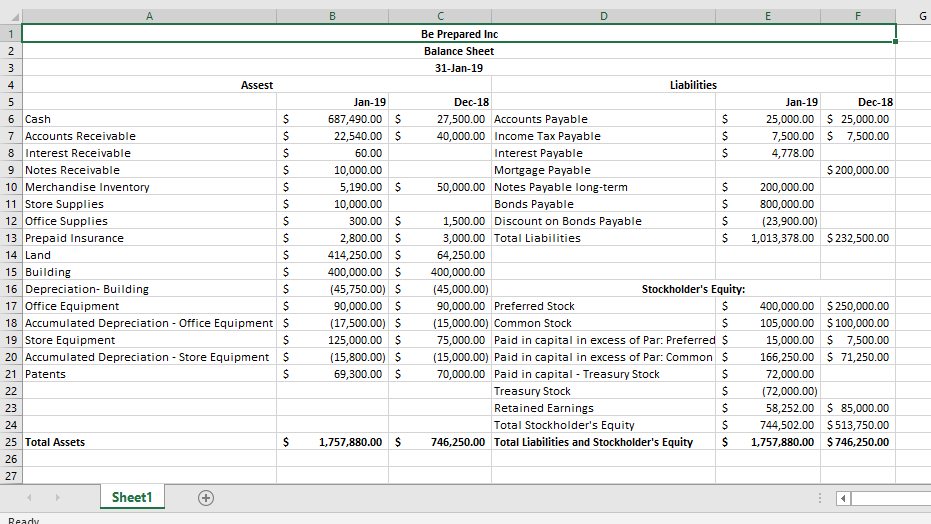

Be Prepared Inc Balance Sheet 31-Jan-19 Liabilities Jan-19 Dec-18 27,500.00 Accounts Payable 40,000.00 Income Tax Payable Jan-19 Dec-18 6 Cash 7 Accounts Receivable 8 Interest Receivable 9 Notes Receivable 10 Merchandise Inventory 11 Store Supplies 12 Office Supplies 13 Prepaid Insurance 14 Land 15 Building 16 Depreciation- Building 17 Office Equipment 18 Accumulated Depreciation - Office Equipment S 19 Store Equipment 20 Accumulated Depreciation - Store Equipment $ 21 Patents 687,490.00 S 22,540.00 S 25,000.00 25,000.00 7,500.00 $ 7,500.00 60.00 4,778.00 Interest Payable Mortgage Payable 10,000.00 $200,000.00 5,190.00$ 50,000.00 Notes Payable long-term 200,000.00 800,000.00 (23,900.00) 10,000.00 Bonds Payable 300.00 $ 2,800.00S 414,250.00 S 1,500.00 Discount on Bonds Payable $ 1,013,378.00 $232,500.00 3,000.00 Total Liabilities 64,250.00 400,000.00$400,000.00 (45,750.00) S 90,000.00 S 17,500.00)S 125,000.00 S (15,800.00) S 69,300.00 S Stockholder's Equity: (45,000.00) 90,000.00 Preferred Stock (15,000.00) Common Stock 75,000.00 Paid in capital in excess of Par: Preferred S (15,000.00) Paid in capital in excess of Par: Common S 70,000.00 Paid in capital Treasury Stock 400,000.00 $250,000.00 105,000.00 $100,000.00 15,000.00 7,500.00 $ 166,250.00 71,250.00 72,000.00 (72,000.00) 58,252.00 85,000.00 $744,502.00 $513,750.00 $1,757,880.00 746,250.00 Total Liabilities and Stockholder's Equity1,757,880.00 $746,250.00 Treasury Stock Retained Earnings Total Stockholder's Equity 24 25 Total Assets 26 27 Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts