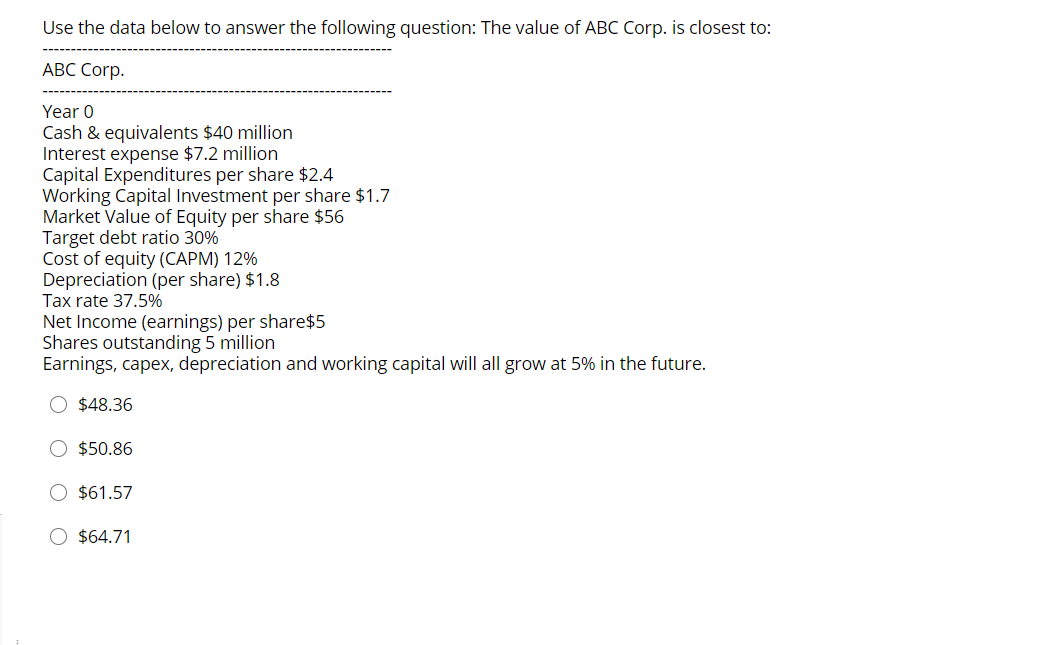

Question: Use the data below to answer the following question: The value of ABC Corp. is closest to: ABC Corp. Year o Cash & equivalents $40

Use the data below to answer the following question: The value of ABC Corp. is closest to: ABC Corp. Year o Cash & equivalents $40 million Interest expense $7.2 million Capital Expenditures per share $2.4 Working Capital Investment per share $1.7 Market Value of Equity per share $56 Target debt ratio 30% Cost of equity (CAPM) 12% Depreciation (per share) $1.8 Tax rate 37.5% Net Income (earnings) per share$5 Shares outstanding 5 million Earnings, capex, depreciation and working capital will all grow at 5% in the future. O $48.36 $50.86 $61.57 $64.71 Use the data below to answer the following question: The value of ABC Corp. is closest to: ABC Corp. Year o Cash & equivalents $40 million Interest expense $7.2 million Capital Expenditures per share $2.4 Working Capital Investment per share $1.7 Market Value of Equity per share $56 Target debt ratio 30% Cost of equity (CAPM) 12% Depreciation (per share) $1.8 Tax rate 37.5% Net Income (earnings) per share$5 Shares outstanding 5 million Earnings, capex, depreciation and working capital will all grow at 5% in the future. O $48.36 $50.86 $61.57 $64.71

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts