Question: Use the data contained in the case to estimate the postmerger cash flows for 2018 through 2022 assuming that Lafayette General Hospital is acquired

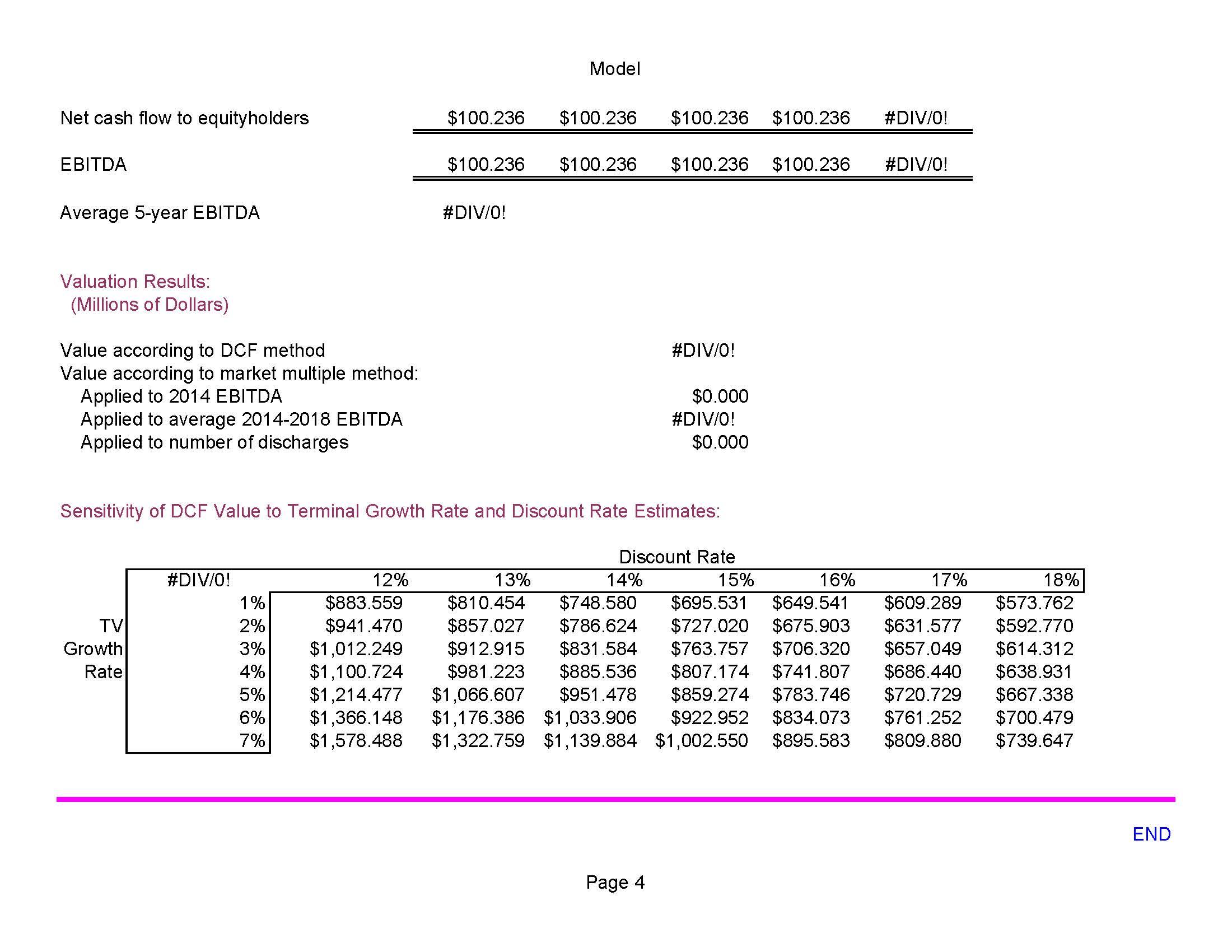

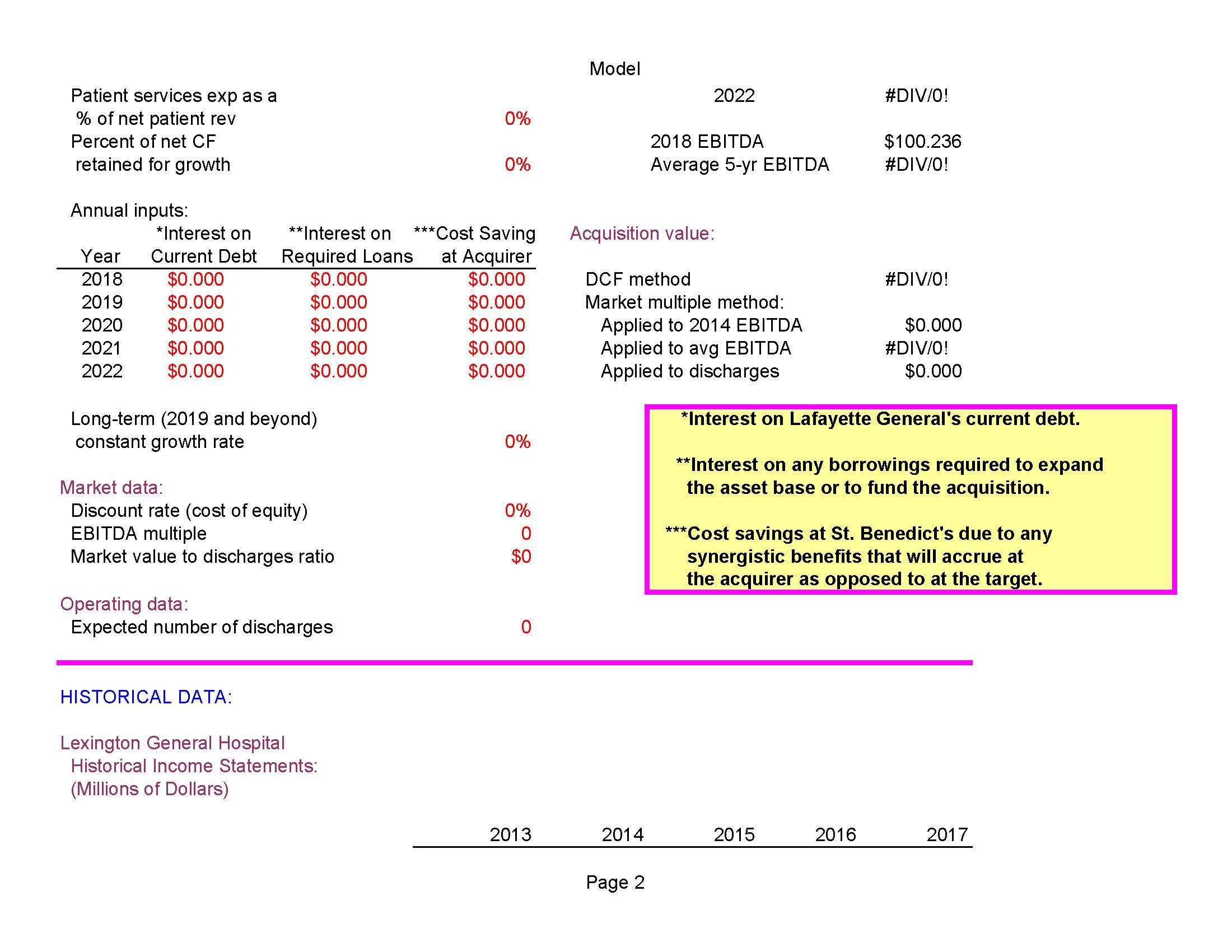

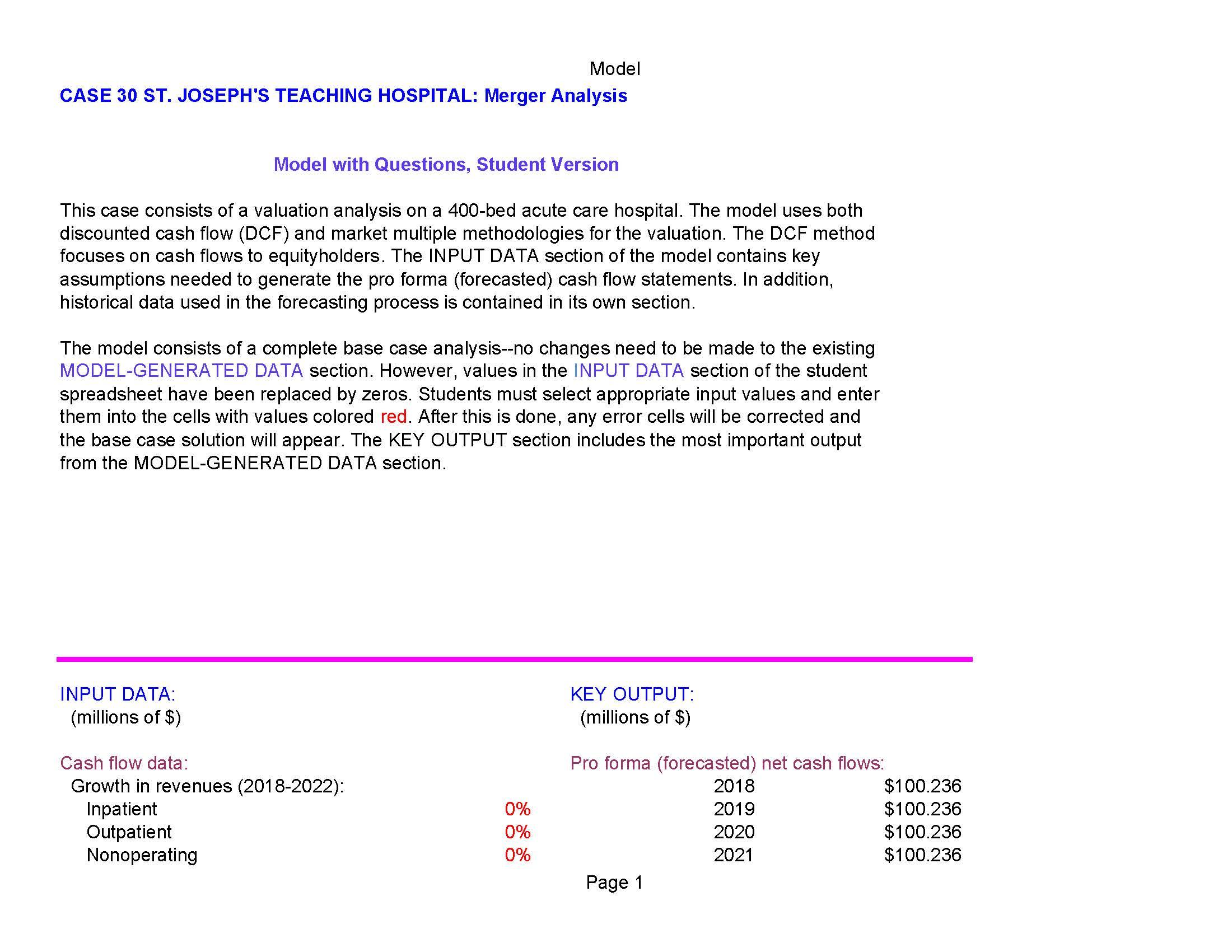

Use the data contained in the case to estimate the postmerger cash flows for 2018 through 2022 assuming that Lafayette General Hospital is acquired by St. Benedict's Teaching Hospital. You have very limited data on which to base your forecasts. The key is to make supportable assumptions about the potential synergies that can be obtained from the merger. Also, any cost savings to St. Benedict's that result from the merger must be included in the analysis. (Hint: Use embedded interest expense in your forecast, but do not include any interest to fund the acquisition.) Net cash flow to equityholders EBITDA Average 5-year EBITDA Valuation Results: (Millions of Dollars) Value according to DCF method Value according to market multiple method: Applied to 2014 EBITDA Applied to average 2014-2018 EBITDA Applied to number of discharges TV Growth Rate #DIV/0! 1% 2% 3% 4% 5% 6% 7% Model $100.236 $100.236 $100.236 $100.236 #DIV/0! $100.236 $100.236 $100.236 $100.236 #DIV/0! #DIV/0! Sensitivity of DCF Value to Terminal Growth Rate and Discount Rate Estimates: #DIV/0! $0.000 #DIV/0! $0.000 Page 4 17% 18% $573.762 12% $883.559 $941.470 $1,012.249 Discount Rate 13% 14% 15% 16% $810.454 $748.580 $695.531 $649.541 $609.289 $857.027 $786.624 $727.020 $675.903 $631.577 $912.915 $831.584 $763.757 $706.320 $657.049 $614.312 $885.536 $686.440 $638.931 $1,214.477 $1,066.607 $951.478 $859.274 $783.746 $720.729 $667.338 $1,366.148 $1,176.386 $1,033.906 $922.952 $834.073 $761.252 $700.479 $1,578.488 $1,322.759 $1,139.884 $1,002.550 $895.583 $809.880 $739.647 $592.770 $1,100.724 $981.223 $807.174 $741.807 END Inpatient revenue Outpatient revenue Net patient service revenue Nonoperating revenue Total revenues Patient services expenses Interest expense Depreciation Total expenses Net income MODEL-GENERATED DATA: Inpatient revenue Outpatient revenue Net patient service revenue Nonoperating revenue $42.472 28.314 $70.786 1.922 $72.708 $60.245 3.045 3.466 $66.756 Lexington General Hospital Pro Forma (Forecasted) Cash Flow Statements: (Millions of Dollars) Total revenues Patient services expenses Interest expense Total expenses Net operating cash flow Cost savings at teaching (other) hospital Growth retentions Terminal value $5.952 2018 $59.513 39.675 $99.188 1.048 $100.236 $0.00 0.000 $0.000 $100.236 0.000 0.000 Model $46.014 30.676 $76.690 1.515 $78.205 $73.858 3.147 3.689 $80.694 ($2.489) 2019 $59.513 39.675 $99.188 1.048 $100.236 $0.00 0.000 $0.000 $100.236 0.000 0.000 Page 3 $53.410 $58.650 35.606 39.100 $89.016 $97.750 1.367 1.725 $90.383 $99.475 $81.525 $90.645 3.093 4.395 $89.013 $1.370 2020 3.002 4.258 $97.905 2021 $59.513 $59.513 39.675 39.675 $99.188 $99.188 1.048 1.048 $100.236 $100.236 $0.00 $0.00 0.000 0.000 $0.000 $0.000 $100.236 $100.236 0.000 0.000 $1.570 0.000 0.000 $59.513 39.675 $99.188 1.048 $100.236 $89.505 2.980 6.031 $98.516 $1.720 2022 $59.513 39.675 $99.188 1.048 $100.236 $0.00 0.000 $0.000 $100.236 0.000 0.000 #DIV/0! Patient services exp as a % of net patient rev Percent of net CF retained for growth Annual inputs: *Interest on Year Current Debt 2018 2019 2020 2021 2022 $0.000 $0.000 $0.000 $0.000 $0.000 **Interest on Required Loans $0.000 $0.000 $0.000 $0.000 $0.000 Long-term (2019 and beyond) constant growth rate Market data: Discount rate (cost of equity) EBITDA multiple Market value to discharges ratio HISTORICAL DATA: Operating data: Expected number of discharges Lexington General Hospital Historical Income Statements: (Millions of Dollars) 0% *** 0% *Cost Saving at Acquirer $0.000 $0.000 $0.000 $0.000 $0.000 0% 0% 0 $0 0 2013 Model Acquisition value: 2014 2022 2018 EBITDA Average 5-yr EBITDA DCF method Market multiple method: Applied to 2014 EBITDA Applied to avg EBITDA Applied to discharges Page 2 *** #DIV/0! 2015 $100.236 #DIV/0! 2016 #DIV/0! $0.000 *Interest on Lafayette General's current debt. **Interest on any borrowings required to expand the asset base or to fund the acquisition. #DIV/0! $0.000 *Cost savings at St. Benedict's due to any synergistic benefits that will accrue at the acquirer as opposed to at the target. 2017 Model CASE 30 ST. JOSEPH'S TEACHING HOSPITAL: Merger Analysis Model with Questions, Student Version This case consists of a valuation analysis on a 400-bed acute care hospital. The model uses both discounted cash flow (DCF) and market multiple methodologies for the valuation. The DCF method focuses on cash flows to equityholders. The INPUT DATA section of the model contains key assumptions needed to generate the pro forma (forecasted) cash flow statements. In addition, historical data used in the forecasting process is contained in its own section. The model consists of a complete base case analysis--no changes need to be made to the existing MODEL-GENERATED DATA section. However, values in the INPUT DATA section of the student spreadsheet have been replaced by zeros. Students must select appropriate input values and enter them into the cells with values colored red. After this is done, any error cells will be corrected and the base case solution will appear. The KEY OUTPUT section includes the most important output from the MODEL-GENERATED DATA section. INPUT DATA: (millions of $) Cash flow data: Growth in revenues (2018-2022): Inpatient Outpatient Nonoperating 0% 0% 0% KEY OUTPUT: (millions of $) Pro forma (forecasted) net cash flows: 2018 2019 2020 2021 Page 1 $100.236 $100.236 $100.236 $100.236

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

ANSWER To estimate the postmerger cash flows for 2018 through 2022 we need to make several assumptions about the potential synergies that can be obtained from the merger and any cost savings that can ... View full answer

Get step-by-step solutions from verified subject matter experts