Question: Use the data for Starbucks ( SBUX ) and Google ( GOOGL ) in the latle, : . asvir pis ( 6 8 . 9

Use the data for Starbucks SBUX and Google GOOGL in the latle,

:asvir pis

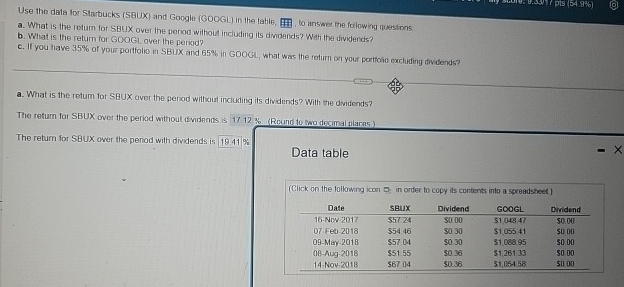

a What is the retum for SBUX over the penod without induding its dmidends? With the dividends?

b What is the return for GOOGL. over the peniod?

c If you have of your portfolio in SBUX and in GOOGL, what was the return on your portioio membing divdends?

a What is the return for SBUX aver the period without including its dividends? With the dividends?

The return for SBUX over the period without dividends is Round to fwo decimal plaras

The return for SBUX over the peniod with dridends is

Data table

tableDatesBux,Dividend,GCOGL,DividendNow$$O Feb$$$SMay$$Aug$$Nov$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock