Question: Use the data given for C berdyne Systems to answer questions 6-8. Cyberdyne Systems Corporation's year-end balance sheet is shown below. The company's beforetax cost

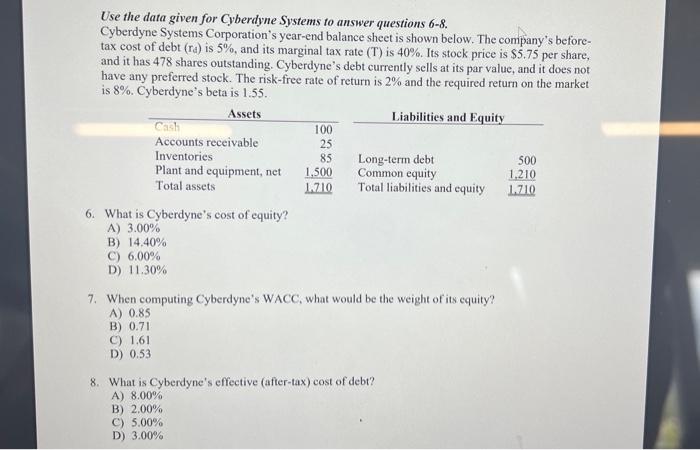

Use the data given for C berdyne Systems to answer questions 6-8. Cyberdyne Systems Corporation's year-end balance sheet is shown below. The company's beforetax cost of debt (ra) is 5%, and its marginal tax rate (T) is 40%. Its stock price is $5.75 per share, and it has 478 shares outstanding. Cyberdyne's debt currently sells at its par value, and it does not have any preferred stock. The risk-free rate of return is 2% and the required return on the market is 8%. Cyberdyne's beta is 1.55 . 6. What is Cyberdyne's cost of equity? A) 3.00% B) 14.40% C) 6.00% D) 11.30% 7. When computing Cyberdyne's WACC, what would be the weight of its equity? A) 0.85 B) 0.71 C) 1.61 D) 0.53 8. What is Cyberdyne's effective (after-tax) cost of debt? A) 8.00% B) 2.00% C) 5.00% D) 3.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts