Question: Use the data in the table below to answer the following questions: a. What is the return for SBUX over the period without including

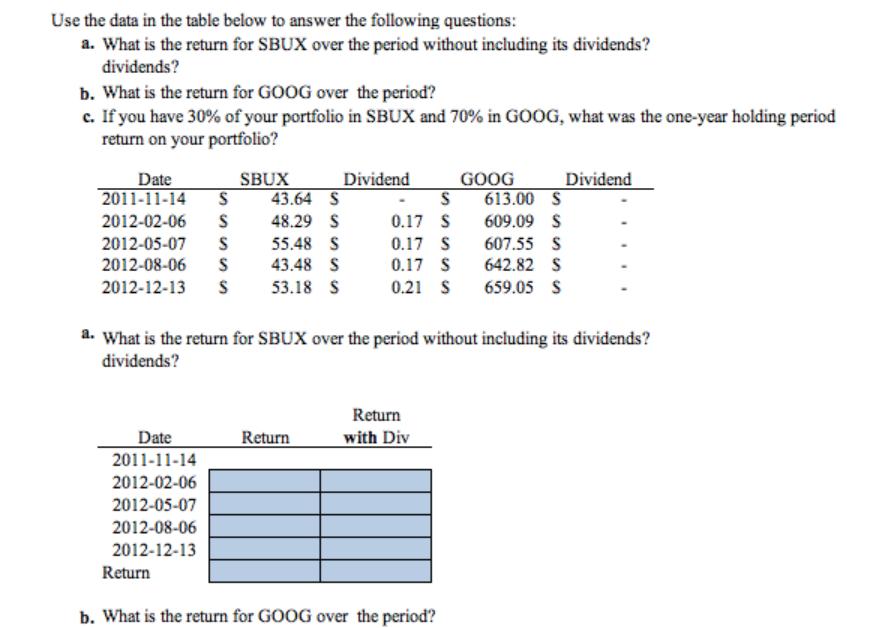

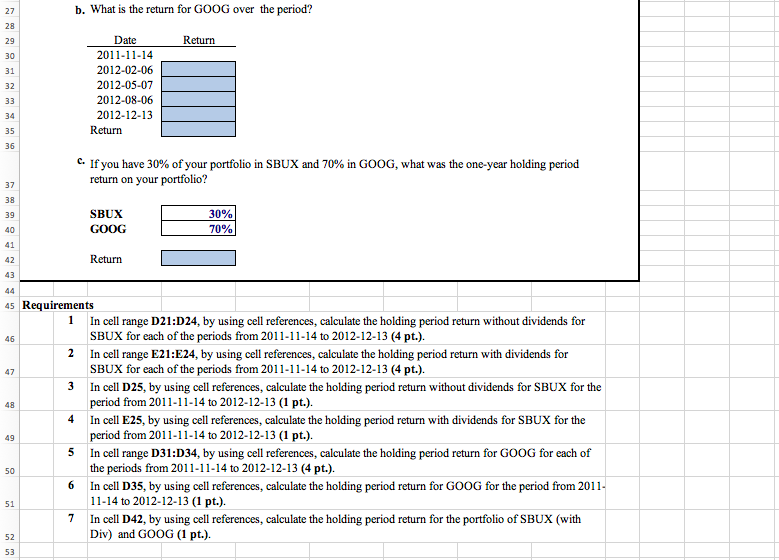

Use the data in the table below to answer the following questions: a. What is the return for SBUX over the period without including its dividends? dividends? b. What is the return for GOOG over the period? c. If you have 30% of your portfolio in SBUX and 70% in GOOG, what was the one-year holding period return on your portfolio? Date 2011-11-14 SBUX Dividend GOOG Dividend S 43.64 S S 613.00 S 2012-02-06 S 48.29 S 0.17 S 609.09 $ 2012-05-07 S 55.48 S 0.17 S 607.55 S 2012-08-06 S 43.48 S 0.17 S 642.82 $ 2012-12-13 53.18 S 0.21 S 659.05 $ a. What is the return for SBUX over the period without including its dividends? dividends? Return Date Return with Div 2011-11-14 2012-02-06 2012-05-07 2012-08-06 2012-12-13 Return b. What is the return for GOOG over the period? b. What is the return for GOOG over the period? 27 28 29 30 Date 2011-11-14 31 2012-02-06 32 2012-05-07 33 2012-08-06 Return 34 35 36 2012-12-13 Return c. If you have 30% of your portfolio in SBUX and 70% in GOOG, what was the one-year holding period return on your portfolio? 37 38 39 SBUX 40 GOOG 41 42 Return 43 44 30% 70% 45 Requirements 46 47 48 49 50 51 52 53 1 In cell range D21:D24, by using cell references, calculate the holding period return without dividends for SBUX for each of the periods from 2011-11-14 to 2012-12-13 (4 pt.). 2 In cell range E21:E24, by using cell references, calculate the holding period return with dividends for SBUX for each of the periods from 2011-11-14 to 2012-12-13 (4 pt.). 3 In cell D25, by using cell references, calculate the holding period return without dividends for SBUX for the period from 2011-11-14 to 2012-12-13 (1 pt.). 4 In cell E25, by using cell references, calculate the holding period return with dividends for SBUX for the period from 2011-11-14 to 2012-12-13 (1 pt.). 5 In cell range D31:D34, by using cell references, calculate the holding period return for GOOG for each of the periods from 2011-11-14 to 2012-12-13 (4 pt.). 6 In cell D35, by using cell references, calculate the holding period return for GOOG for the period from 2011- 11-14 to 2012-12-13 (1 pt.). 7 In cell D42, by using cell references, calculate the holding period return for the portfolio of SBUX (with Div) and GOOG (1 pt.).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts