Question: Use the data provided and the budgets prepared from JKL Corporation in Assignments 6.1 and 6.2 to help develop the following projected financial statements: 1-

Use the data provided and the budgets prepared from JKL Corporation in Assignments 6.1 and 6.2 to help develop the following projected financial statements:

1- Pro forma statement of condition as of June 30, 20xx. (10 points)

2- Proforma income and expense statement for the quarter ended June 30, 20xx.

3- Pro-forma statement of cash flows for the quarter ended June 30, 20xx.

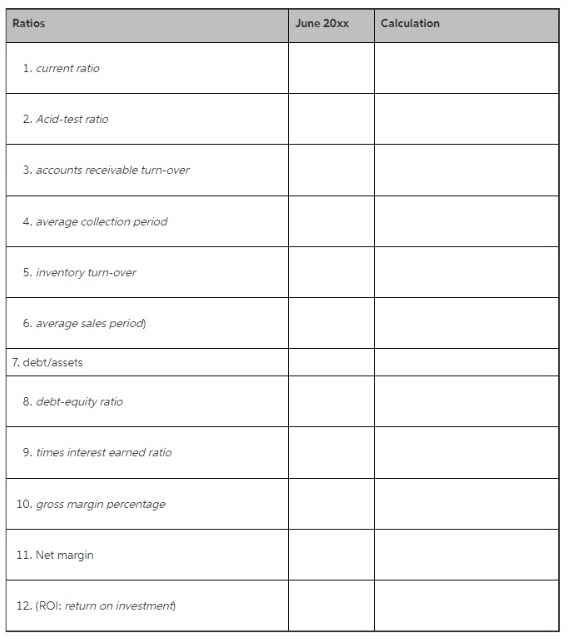

Then, complete the following table of financial analysis rates. It shows the calculation to obtain each rate.

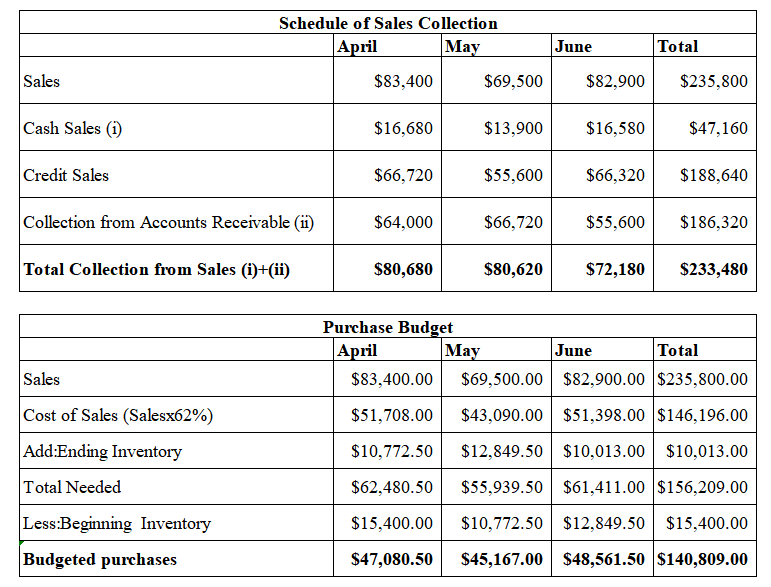

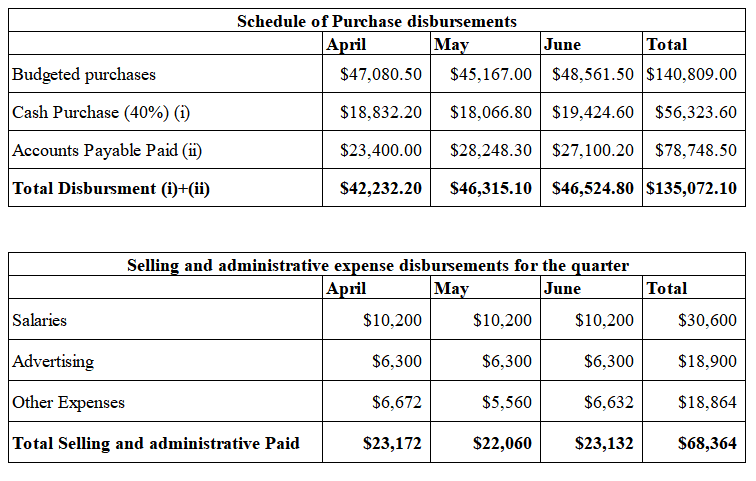

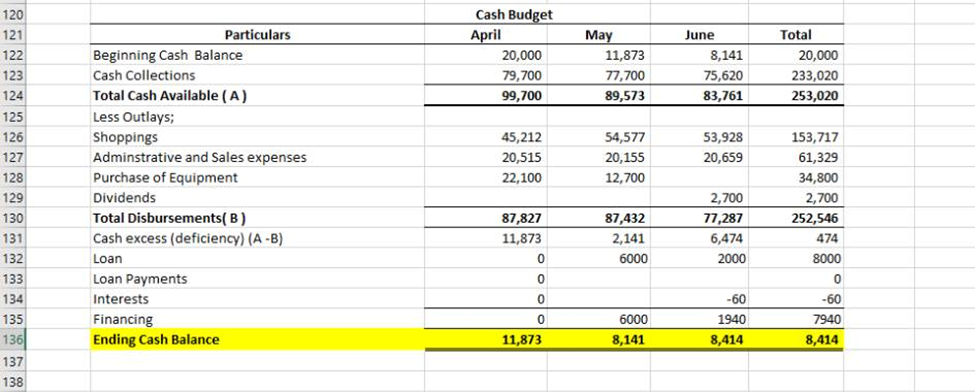

Ratios June 20xx Calculation 1. current ratio 2. Acid-test ratio 3. accounts receivable turn-over 4. average collection period 5. inventory turn-over 6. average sales period) 7. debt/assets B. debt-equity ratio 9. times interest earned ratio 10. gross margin percentage 11. Net margin 12. (ROI: return on investment)Schedule of Sales Collection April May June Total Sales $83.400 $69,500 $82,900 $235,800 Cash Sales (1) $16,680 $13.900 $16,580 $47,160 Credit Sales $66,720 $55,600 $66,320 $188,640 Collection from Accounts Receivable (li) $64.000 $66,720 $55.600 $186.320 Total Collection from Sales (i)+(ii) $80,680 $80,620 $72,180 $233,480 Purchase Budget April May June Total Sales $83,400.00 $69,500.00 $82,900.00 $235,800.00 Cost of Sales (Salesx62%) $51,708.00 $43,090.00 $51,398.00 $146, 196.00 Add:Ending Inventory $10,772.50 $12,849.50 $10,013.00 $10,013.00 Total Needed $62,480.50 $55,939.50 $61,411.00 $156,209.00 Less:Beginning Inventory $15,400.00 $10,772.50 $12,849.50 $15,400.00 Budgeted purchases $47,080.50 $45,167.00 $48,561.50 $140,809.00Schedule of Purchase disbursements April May June Total Budgeted purchases $47,080.50 $45.167.00 $48,561.50 $140,809.00 Cash Purchase (40%) (1) $18,832.20 $18,066.80 $19.424.60 $56.323.60 Accounts Payable Paid (1i) $23,400.00 $28,248.30 $27,100.20 $78,748.50 Total Disbursent (i)+(ii) $42,232.20 $46,315.10 $46,524.80 $135,072.10 Selling and administrative expense disbursements for the quarter April May June Total Salaries $10,200 $10,200 $10.200 $30,600 Advertising $6.300 $6.300 $6.300 $18.900 Other Expenses $6.672 $5.560 $6.632 $18.864 Total Selling and administrative Paid $23,172 $22,060 $23,132 $68,364120 Cash Budget 121 Particulars April May June Total 122 Beginning Cash Balance 20,000 11,873 8,141 20,000 123 Cash Collections 79,700 77,700 75,620 233,020 124 Total Cash Available ( A ) 99,700 89,573 83,761 253,020 125 Less Outlays; 126 Shoppings 45,212 54,577 53,928 153,717 127 Adminstrative and Sales expenses 20,515 20,155 20,659 61,329 128 Purchase of Equipment 22,100 12,700 34,800 129 Dividends 2,700 2,700 130 Total Disbursements( B ) 87,827 87,432 77,287 252,546 131 Cash excess (deficiency) (A -B) 11,873 2,141 6,474 474 132 Loan 6000 2000 8000 133 Loan Payments 0 134 Interests -60 -60 135 Financing O 6000 1940 7940 136 Ending Cash Balance 11,873 8,141 8,414 8,414 137 138