Question: Use the data provided in the case study to tabulate the cashflows of the interest rate swap based on the two rates and the value

Use the data provided in the case study to tabulate the cashflows of the interest rate swap based on the two rates and the value of the corresponding swap? Show all calculations in detail and report the method or equation used in undertaking calculations. Explain the similarity or differences in value according to valuation.

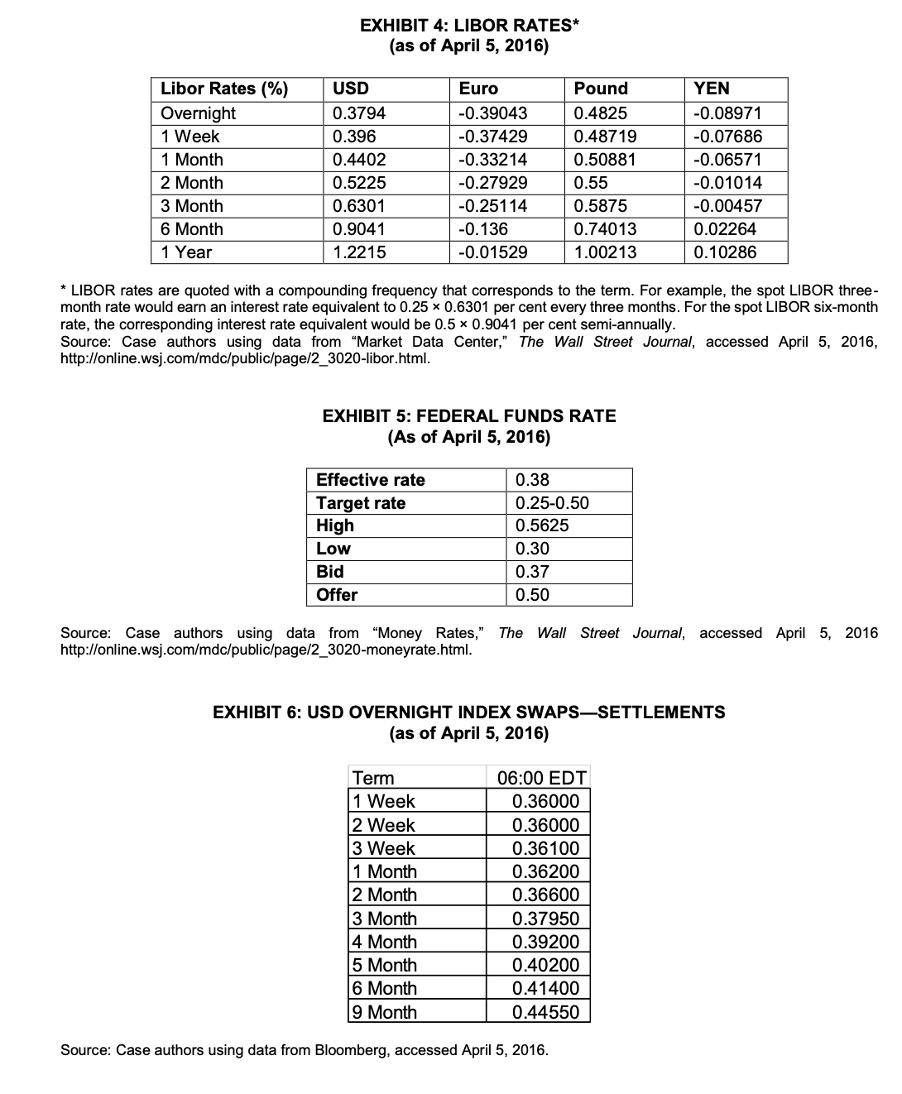

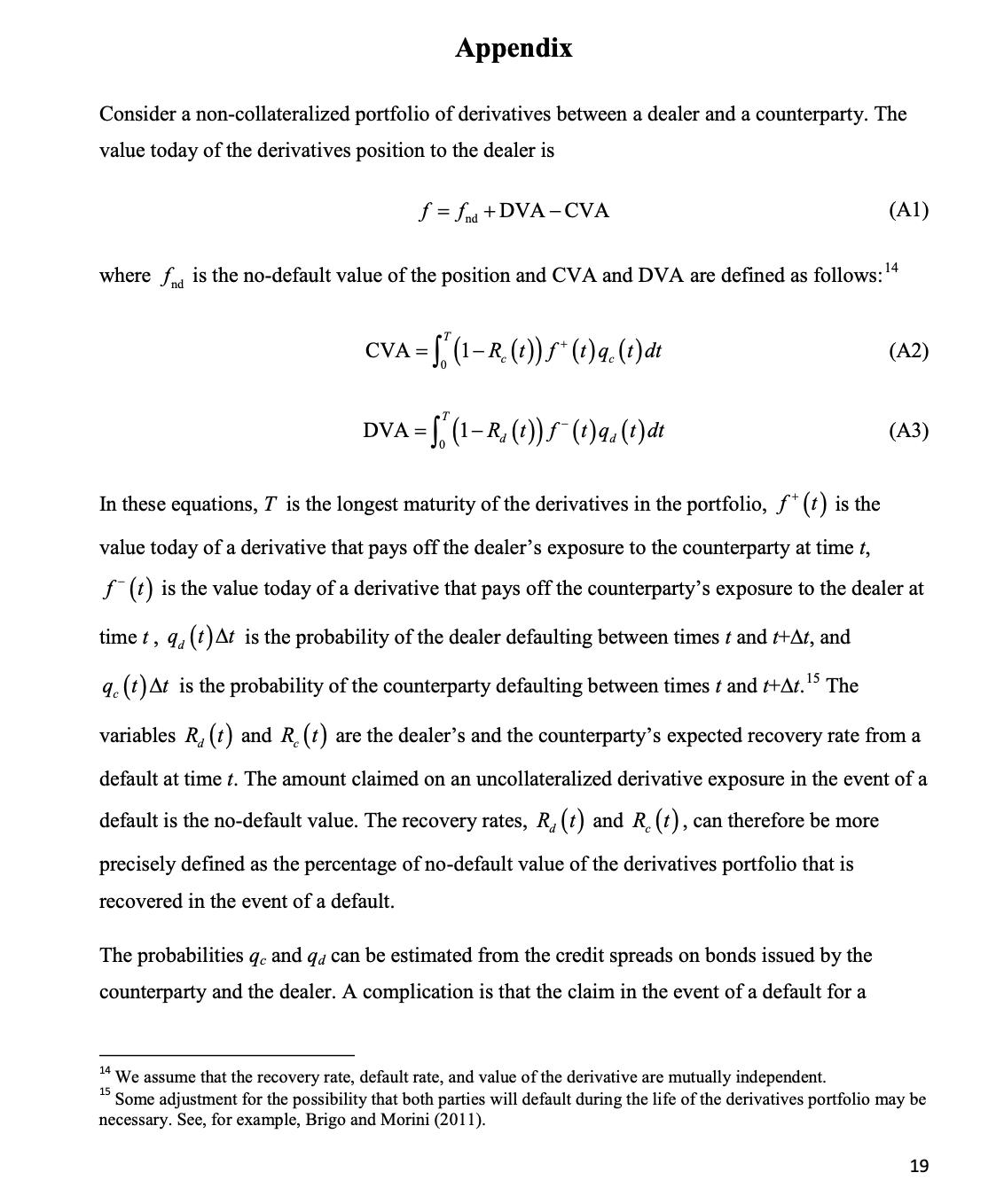

Libor Rates (%) Overnight 1 Week 1 Month 2 Month 3 Month 6 Month 1 Year EXHIBIT 4: LIBOR RATES* (as of April 5, 2016) USD 0.3794 0.396 0.4402 0.5225 0.6301 0.9041 1.2215 Effective rate Target rate High Low Bid Offer Euro -0.39043 -0.37429 -0.33214 -0.27929 -0.25114 -0.136 -0.01529 LIBOR rates are quoted with a compounding frequency that corresponds to the term. For example, the spot LIBOR three- month rate would earn an interest rate equivalent to 0.25 x 0.6301 per cent every three months. For the spot LIBOR six-month rate, the corresponding interest rate equivalent would be 0.5 x 0.9041 per cent semi-annually. Source: Case authors using data from "Market Data Center," The Wall Street Journal, accessed April 5, 2016, http://online.wsj.com/mdc/public/page/2_3020-libor.html. EXHIBIT 5: FEDERAL FUNDS RATE (As of April 5, 2016) Term 1 Week 2 Week 3 Week 1 Month 2 Month Pound 0.4825 0.48719 0.50881 0.55 0.5875 0.74013 1.00213 3 Month 4 Month 5 Month 0.38 0.25-0.50 0.5625 0.30 0.37 0.50 Source: Case authors using data from "Money Rates," The Wall Street Journal, accessed April 5, 2016 http://online.wsj.com/mdc/public/page/2_3020-moneyrate.html. EXHIBIT 6: USD OVERNIGHT INDEX SWAPS-SETTLEMENTS (as of April 5, 2016) YEN -0.08971 -0.07686 -0.06571 -0.01014 -0.00457 0.02264 0.10286 06:00 EDT 0.36000 0.36000 0.36100 0.36200 0.36600 0.37950 0.39200 0.40200 0.41400 0.44550 6 Month 9 Month Source: Case authors using data from Bloomberg, accessed April 5, 2016.

Step by Step Solution

There are 3 Steps involved in it

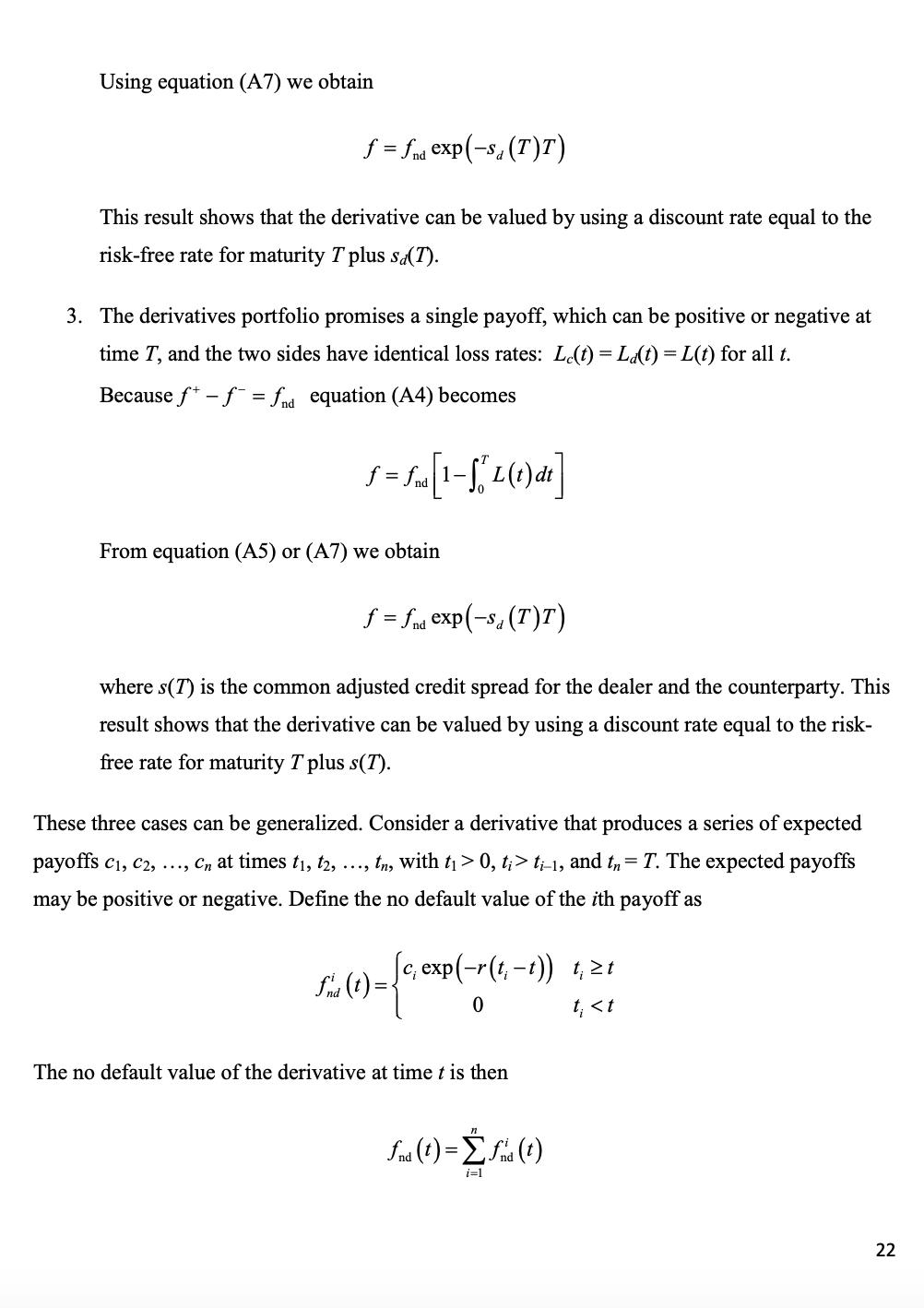

In order to calculate the cash flows of an interest rate swap and the value of the corresponding swap well need to use the provided LIBOR rates for USD from EXHIBIT 4 LIBOR RATES as our reference rate... View full answer

Get step-by-step solutions from verified subject matter experts