Question: Use the data the data from excel sheet Country Year 1: Interest Rate Year 2: Interest Rate Year 3: Interest Rate Year 4: Interest Rate

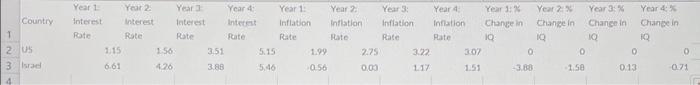

| Country | Year 1: Interest Rate | Year 2: Interest Rate | Year 3: Interest Rate | Year 4: Interest Rate | Year 1: Inflation Rate | Year 2: Inflation Rate | Year 3: Inflation Rate | Year 4: Inflation Rate | Year 1: % Change in IQ | Year 2: % Change in IQ | Year 3: % Change in IQ | Year 4: % Change in IQ |

| US | 1.15 | 1.56 | 3.51 | 5.15 | 1.99 | 2.75 | 3.22 | 3.07 | 0.00 | 0.00 | 0.00 | 0.00 |

| Israel | 6.61 | 4.26 | 3.88 | 5.46 | -0.56 | 0.03 | 1.17 | 1.51 | -3.88 | -1.58 | 0.13 | -0.71 |

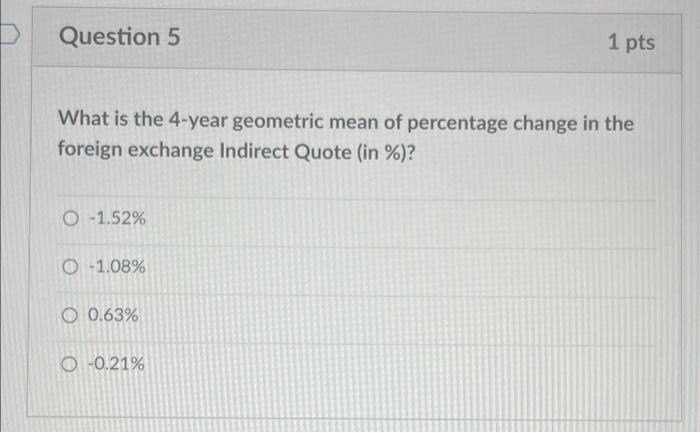

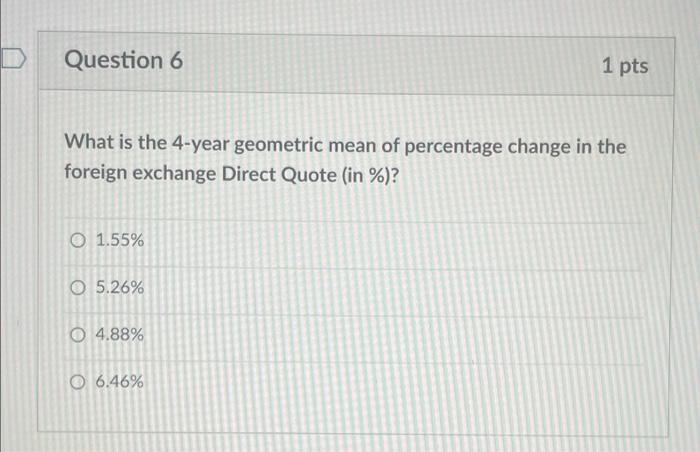

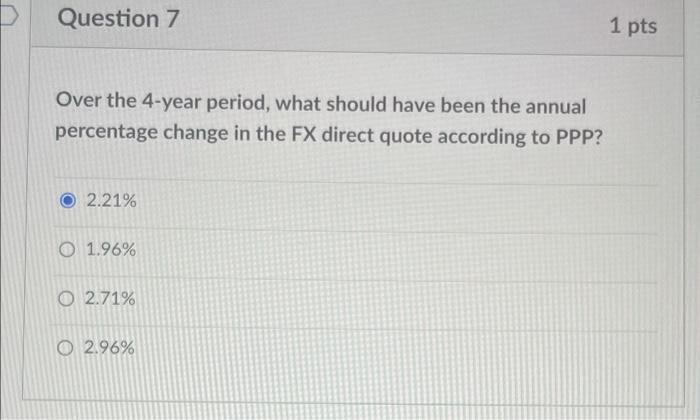

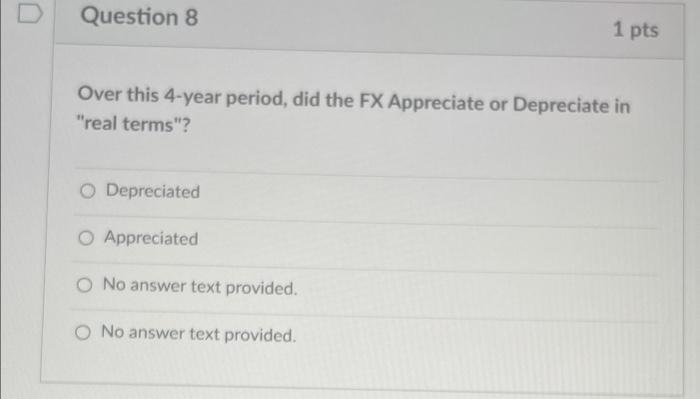

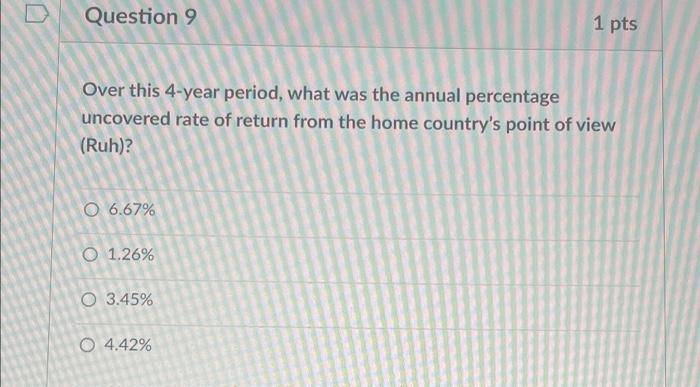

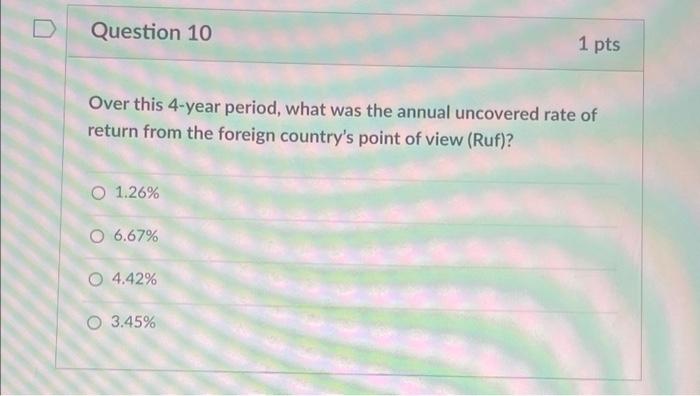

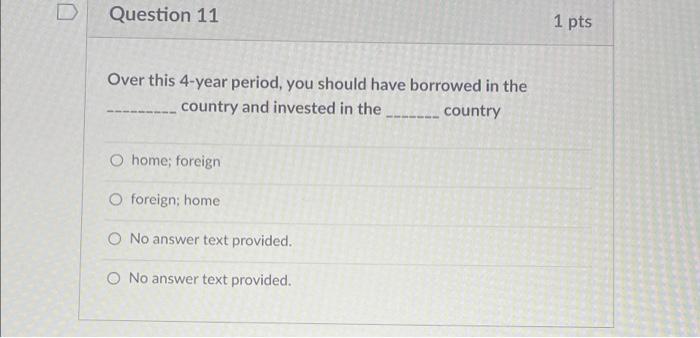

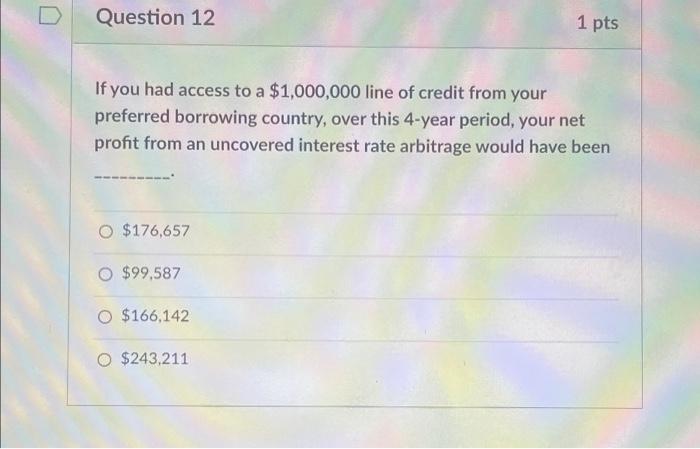

Year a Yeart Year 2 Year Interest Interest Interest Rate Rate Rote 115 156 3.51 Country 1 2 US 3 Israel Rate Year 1 Inflation Rate 5.15 1.99 5:46 0256 Year 2 Year 3: Year 4 Year 1% Year 2: Year 3% Year 4 Inflation Inflation Intation Change in Change in Chance in Chance in Rate Rate Rate 10 10 10 10 2.75 322 307 0 0 0.00 117 1:51 380 1.50 0.13 0.71 6.61 26 3.88 Question 5 1 pts What is the 4-year geometric mean of percentage change in the foreign exchange Indirect Quote (in %)? O -1.52% O -1.08% O 0.63% 0 -0.21% Question 6 1 pts What is the 4-year geometric mean of percentage change in the foreign exchange Direct Quote (in %)? O 1.55% O 5.26% O 4.88% O 6.46% Question 7 1 pts Over the 4-year period, what should have been the annual percentage change in the FX direct quote according to PPP? 2.21% O 1.96% O 2.71% O 2.96% Question 8 1 pts Over this 4-year period, did the FX Appreciate or Depreciate in "real terms"? Depreciated O Appreciated O No answer text provided. O No answer text provided. D Question 9 1 pts Over this 4-year period, what was the annual percentage uncovered rate of return from the home country's point of view (Ruh)? O 6.67% O 1.26% O 3.45% 0 4.42% Question 10 1 pts Over this 4-year period, what was the annual uncovered rate of return from the foreign country's point of view (Ruf)? O 1.26% O 6.67% O 4.42% O 3.45% Question 11 1 pts Over this 4-year period, you should have borrowed in the country and invested in the country O home; foreign O foreign home O No answer text provided. O No answer text provided. D Question 12 1 pts If you had access to a $1,000,000 line of credit from your preferred borrowing country, over this 4-year period, your net profit from an uncovered interest rate arbitrage would have been O $176,657 $99,587 $166,142 O $243,211 Year a Yeart Year 2 Year Interest Interest Interest Rate Rate Rote 115 156 3.51 Country 1 2 US 3 Israel Rate Year 1 Inflation Rate 5.15 1.99 5:46 0256 Year 2 Year 3: Year 4 Year 1% Year 2: Year 3% Year 4 Inflation Inflation Intation Change in Change in Chance in Chance in Rate Rate Rate 10 10 10 10 2.75 322 307 0 0 0.00 117 1:51 380 1.50 0.13 0.71 6.61 26 3.88 Question 5 1 pts What is the 4-year geometric mean of percentage change in the foreign exchange Indirect Quote (in %)? O -1.52% O -1.08% O 0.63% 0 -0.21% Question 6 1 pts What is the 4-year geometric mean of percentage change in the foreign exchange Direct Quote (in %)? O 1.55% O 5.26% O 4.88% O 6.46% Question 7 1 pts Over the 4-year period, what should have been the annual percentage change in the FX direct quote according to PPP? 2.21% O 1.96% O 2.71% O 2.96% Question 8 1 pts Over this 4-year period, did the FX Appreciate or Depreciate in "real terms"? Depreciated O Appreciated O No answer text provided. O No answer text provided. D Question 9 1 pts Over this 4-year period, what was the annual percentage uncovered rate of return from the home country's point of view (Ruh)? O 6.67% O 1.26% O 3.45% 0 4.42% Question 10 1 pts Over this 4-year period, what was the annual uncovered rate of return from the foreign country's point of view (Ruf)? O 1.26% O 6.67% O 4.42% O 3.45% Question 11 1 pts Over this 4-year period, you should have borrowed in the country and invested in the country O home; foreign O foreign home O No answer text provided. O No answer text provided. D Question 12 1 pts If you had access to a $1,000,000 line of credit from your preferred borrowing country, over this 4-year period, your net profit from an uncovered interest rate arbitrage would have been O $176,657 $99,587 $166,142 O $243,211

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts