Question: Use the Dividend Growth Model for questions 4 through 9. 4. A stock's next dividend is $3.50 and it is expected to grow by

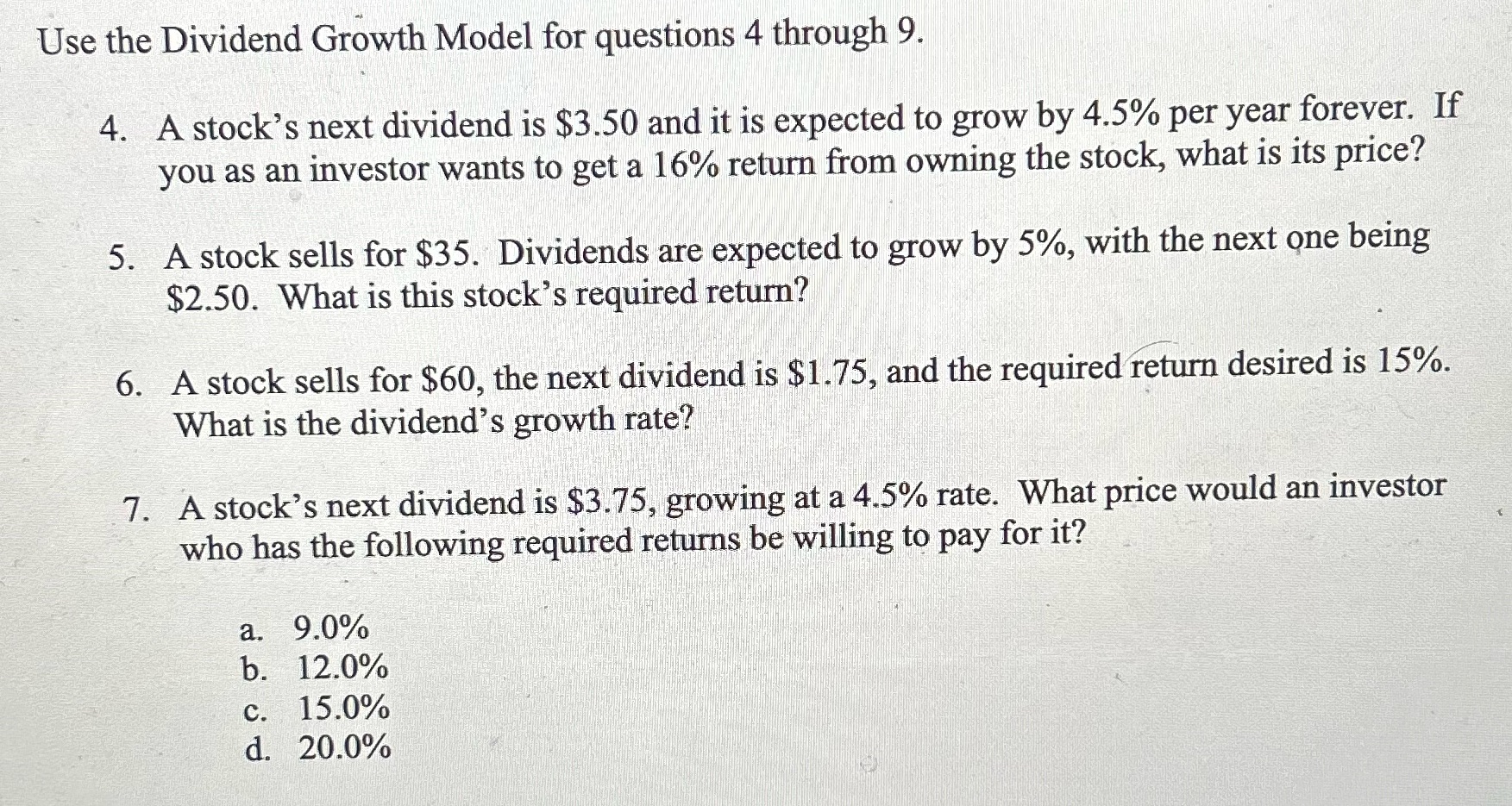

Use the Dividend Growth Model for questions 4 through 9. 4. A stock's next dividend is $3.50 and it is expected to grow by 4.5% per year forever. If you as an investor wants to get a 16% return from owning the stock, what is its price? 5. A stock sells for $35. Dividends are expected to grow by 5%, with the next one being $2.50. What is this stock's required return? 6. A stock sells for $60, the next dividend is $1.75, and the required return desired is 15%. What is the dividend's growth rate? 7. A stock's next dividend is $3.75, growing at a 4.5% rate. What price would an investor who has the following required returns be willing to pay for it? a. 9.0% b. 12.0% C. 15.0% d. 20.0%

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

To answer these questions we will use the Dividend Growth Model formula Price D1 r g where Price is ... View full answer

Get step-by-step solutions from verified subject matter experts