Question: use the EDGAR website RWP8-5 (Static) Edgar Research Using EDGAR (Electronic Data Gathering. Analysis, and Retrieval system), find the annual report (10-K) for Torget Corporation

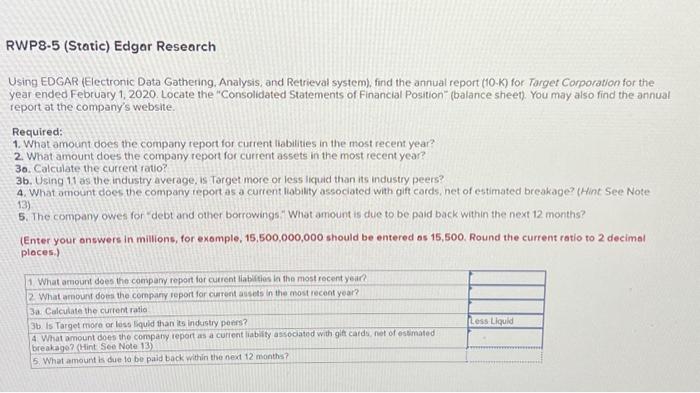

RWP8-5 (Static) Edgar Research Using EDGAR (Electronic Data Gathering. Analysis, and Retrieval system), find the annual report (10-K) for Torget Corporation for the year ended February 1, 2020. Locate the "Consolidated Statements of Financial Position" (balance sheet). You may also find the annual teport at the company's website. Required: 1. What amount does the company report for current liabilities in the most recent year? 2. What amount does the company report for current assets in the most recent year? 30. Calculate the current ratio? 3b. Using 11 as the industry average, is Target more or less liquid than its industry peers? 4. What amount does the company report as a current liobility associated with gift cards, net of estimated breakage? (Hint See Note 13) 5. The company owes for "debt and other borrowings" "What amount is due to be paid back within the next 12 months? (Enter your onswers in millions, for exomple, 15,500,000,000 should be entered os 15,500 . Round the current ratio to 2 decimal ploces.) RWP8-5 (Static) Edgar Research Using EDGAR (Electronic Data Gathering. Analysis, and Retrieval system), find the annual report (10-K) for Torget Corporation for the year ended February 1, 2020. Locate the "Consolidated Statements of Financial Position" (balance sheet). You may also find the annual teport at the company's website. Required: 1. What amount does the company report for current liabilities in the most recent year? 2. What amount does the company report for current assets in the most recent year? 30. Calculate the current ratio? 3b. Using 11 as the industry average, is Target more or less liquid than its industry peers? 4. What amount does the company report as a current liobility associated with gift cards, net of estimated breakage? (Hint See Note 13) 5. The company owes for "debt and other borrowings" "What amount is due to be paid back within the next 12 months? (Enter your onswers in millions, for exomple, 15,500,000,000 should be entered os 15,500 . Round the current ratio to 2 decimal ploces.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts