Question: Use the excel sheet to answer the following questions. Please provide excel calculations when answering. Use age 22 and retirement 65. Living until 90. Let

Use the excel sheet to answer the following questions. Please provide excel calculations when answering. Use age 22 and retirement 65. Living until 90. Let me know if you have any questions.

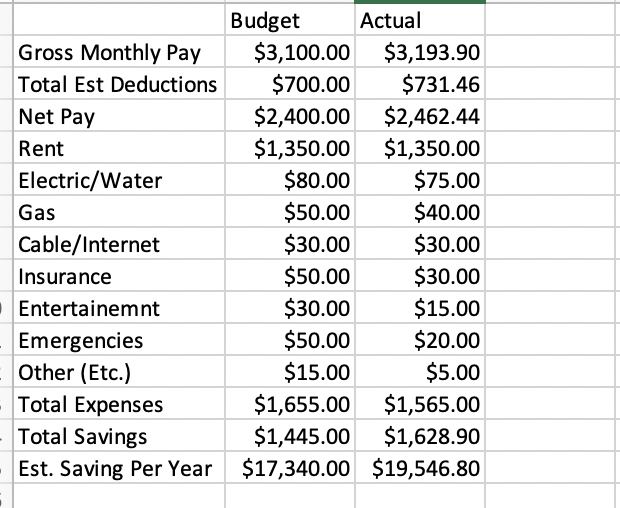

Part 2 A: (must be completed in Excel) - Analysis: Using the budget in part 1; Use as many time lines as you need forecast all your projected savings (investments) to get each investments' future value. You will have to determine your PV, I/y, N, PMT then calc FV If you don't have any idea on the l/y you could use 5 or 6% to be conservative. N depends on your current age and when you think you will retire. Savings 401k or (403B) whichever you use IRA's.... Home Ect....... Once you add up all the future values from step 2 above, and do a time line to determine how much you will be able to spend each year assuming you are going to spend all your money. I.e. your future value will be 0. To calculate N, you have to make a lot of assumptions. For example, if you are planning on retiring at age 65 and think (hope) you will life until you are 90 (25 years) your N will be 25. Part 2 B: (must be completed in Excel) - Scenario Analysis: Run at least 3 different scenarios to see the impact of decisions. Some examples may include: What happens if you delay start of Savings for 5 years? What happens if you work 3 more years? What if the interest rate is higher/lower? What if you have more to save after student loans are paid off? Gross Monthly Pay Total Est Deductions Net Pay Rent Electric/Water Gas Cable/Internet Insurance Entertainemnt Emergencies - Other (Etc.) Total Expenses Total Savings Est. Saving Per Year Budget Actual $3,100.00 $3,193.90 $700.00 $731.46 $2,400.00 $2,462.44 $1,350.00 $1,350.00 $80.00 $75.00 $50.00 $40.00 $30.00 $30.00 $50.00 $30.00 $30.00 $15.00 $50.00 $20.00 $15.00 $5.00 $1,655.00 $1,565.00 $1,445.00 $1,628.90 $17,340.00 $19,546.80 $ Part 2 A: (must be completed in Excel) - Analysis: Using the budget in part 1; Use as many time lines as you need forecast all your projected savings (investments) to get each investments' future value. You will have to determine your PV, I/y, N, PMT then calc FV If you don't have any idea on the l/y you could use 5 or 6% to be conservative. N depends on your current age and when you think you will retire. Savings 401k or (403B) whichever you use IRA's.... Home Ect....... Once you add up all the future values from step 2 above, and do a time line to determine how much you will be able to spend each year assuming you are going to spend all your money. I.e. your future value will be 0. To calculate N, you have to make a lot of assumptions. For example, if you are planning on retiring at age 65 and think (hope) you will life until you are 90 (25 years) your N will be 25. Part 2 B: (must be completed in Excel) - Scenario Analysis: Run at least 3 different scenarios to see the impact of decisions. Some examples may include: What happens if you delay start of Savings for 5 years? What happens if you work 3 more years? What if the interest rate is higher/lower? What if you have more to save after student loans are paid off? Gross Monthly Pay Total Est Deductions Net Pay Rent Electric/Water Gas Cable/Internet Insurance Entertainemnt Emergencies - Other (Etc.) Total Expenses Total Savings Est. Saving Per Year Budget Actual $3,100.00 $3,193.90 $700.00 $731.46 $2,400.00 $2,462.44 $1,350.00 $1,350.00 $80.00 $75.00 $50.00 $40.00 $30.00 $30.00 $50.00 $30.00 $30.00 $15.00 $50.00 $20.00 $15.00 $5.00 $1,655.00 $1,565.00 $1,445.00 $1,628.90 $17,340.00 $19,546.80 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts