Question: Use the Excel template to complete this assignment and return it to me. Do NOT add or delete rows from the template. Ifyou do your

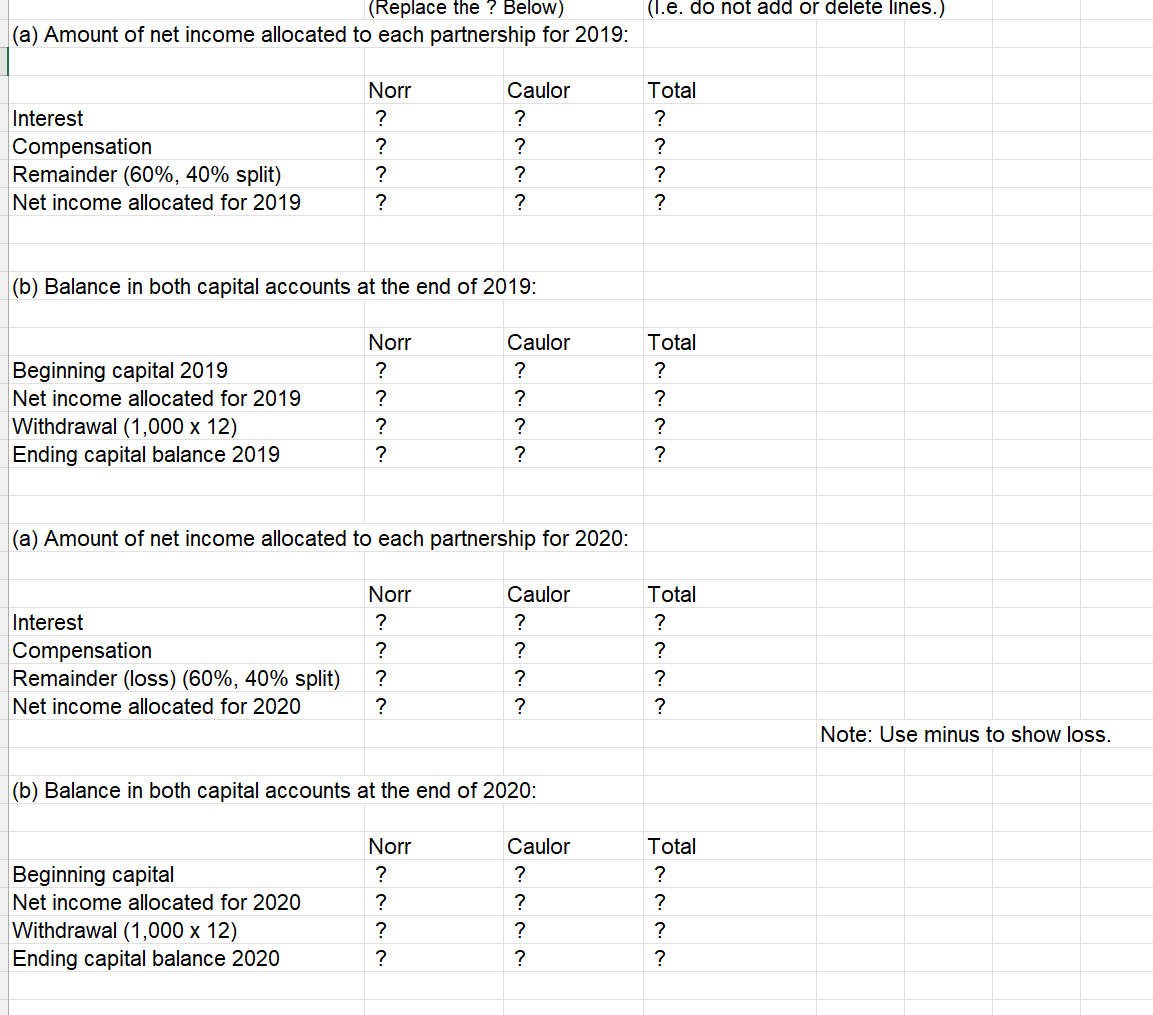

Use the Excel template to complete this assignment and return it to me. Do NOT add or delete rows from the template. Ifyou do your answer will not match with the return solution back to you for reference. Note that there is only one Excel template for this week. There is NO need for you to submit a Word document. Name your file as Week 2 Your first name-Your last name. Do NOT use pdf format because I am not able to make comment, save and return it back to you. So you will not earn any point for submitting your assignment in pdf format. There will be a 10% deduction if you failed to follow the above instruction. Rick Summary: 1. Use the attached Excel template to submit yourassignment. When I said do not make any changes I means do not add, delete,move any rows or columns. Norr and Caylor established a partnership onjanuary 1, 2019. Norr invested cash of $100,000 and Caylor invested $30,000 in cash and equipment with a book value of $40,000 and fair value of $50,000. For both partners, the beginning capital balance was to equal the initial investment. Norr and Caylor agreed to the following procedure for sharing prots and losses: - 12% interest on the yearly beginning capital balance - $10 per hour of work that can be billed to the partnership's clients - the remainder divided in a 3:2 ratio The Articles of Partnership specied that each partner should withdraw no more than $1,000 per month, which is accounted as direct reduction of that partner's capital balance. For 2019, the partnership's income was $70,000. Norr had 1,000 billable hours, and Caylor worked 1,400 billable hours. In 2020, the partnership's income was $24,000, and Norr and Caylor worked 800 and 1,200 billable hours respectively. Each partner withdrew $1,000 per month throughout 2019 and 2020. Complete the following: - Determine the amount of net income allocated to each partner for 2019. - Determine the balance in both capital accounts at the end of 2019. - Determine the amount of net income allocated to each partner for 2020. (Round all calculations to the nearest whole dollar). - Determine the balance in both caDital accounts at the end of 2020 to the nearest dollar. (Replace the ? Below) (l.e. do not add or delete llnes.) (a) Amount of net income allocated to each partnership for 2019: Norr Caulor Total Interest ? ? ? Compensation ? ? ? Remainder (50%, 40% split) ? ? ? Net income allocated for 2019 ? ? ? (b) Balance in both capital accounts at the end of 2019: Norr Caulor Total Beginning capital 2019 ? ? ? Net income allocated for 2019 ? ? ? Withdrawal (1,000 x 12) ? ? ? ? ? ? Ending capital balance 2019 (a) Amount of net income allocated to each partnership for 2020: Norr Caulor Total Interest ? ? ? Compensation ? ? ? Remainder (loss) (50%, 40% split) ? ? ? Net income allocated for 2020 ? ? ? Note: Use minus to show loss. (b) Balance in both capital accounts at the end of 2020: Norr Caulor Total Beginning capital ? ? ? Net income allocated for 2020 ? ? ? Withdrawal (1,000 x 12) ? ? ? Ending capital balance 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts