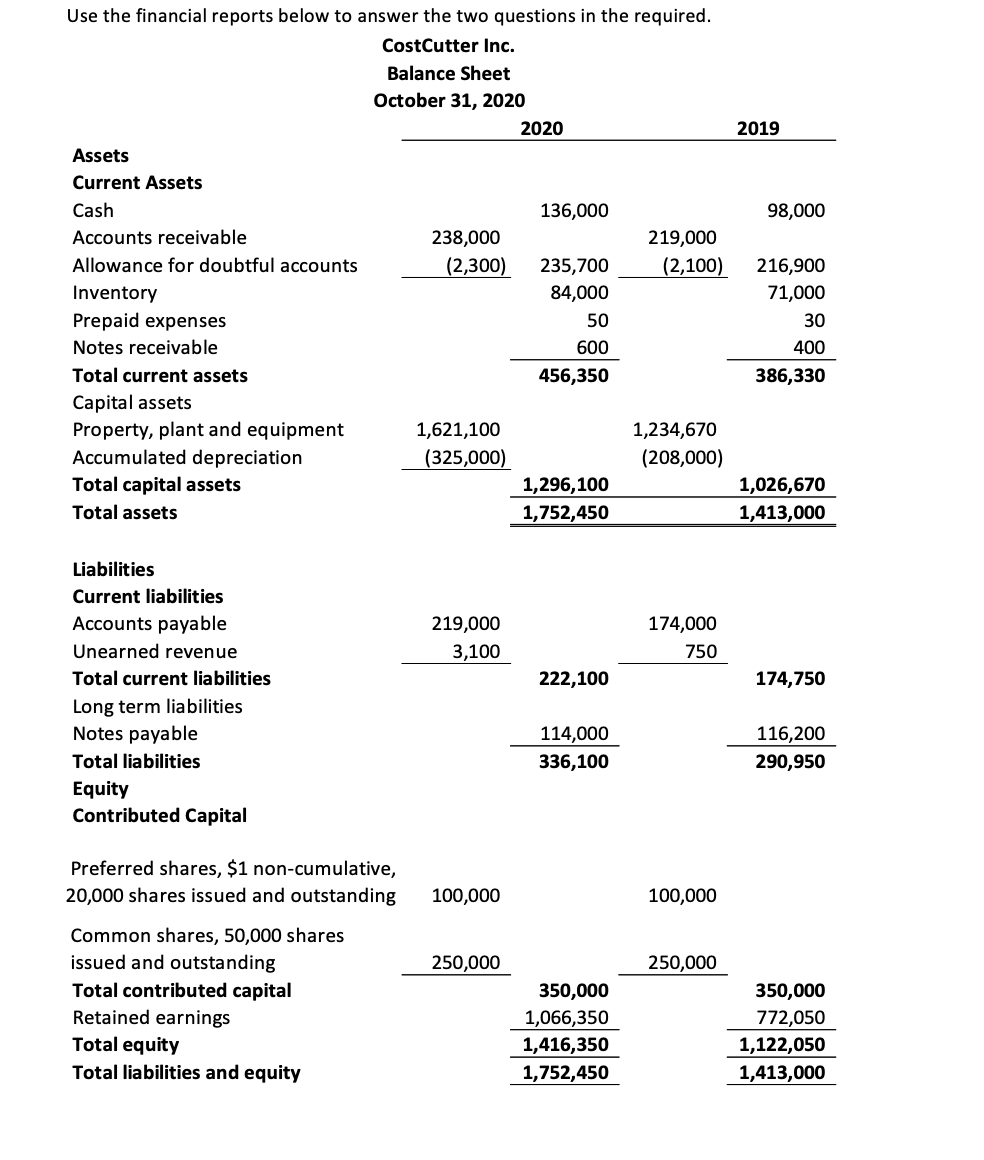

Question: Use the financial reports below to answer the two questions in the required. CostCutter Inc. Balance Sheet October 31, 2020 Assets Current Assets Cash

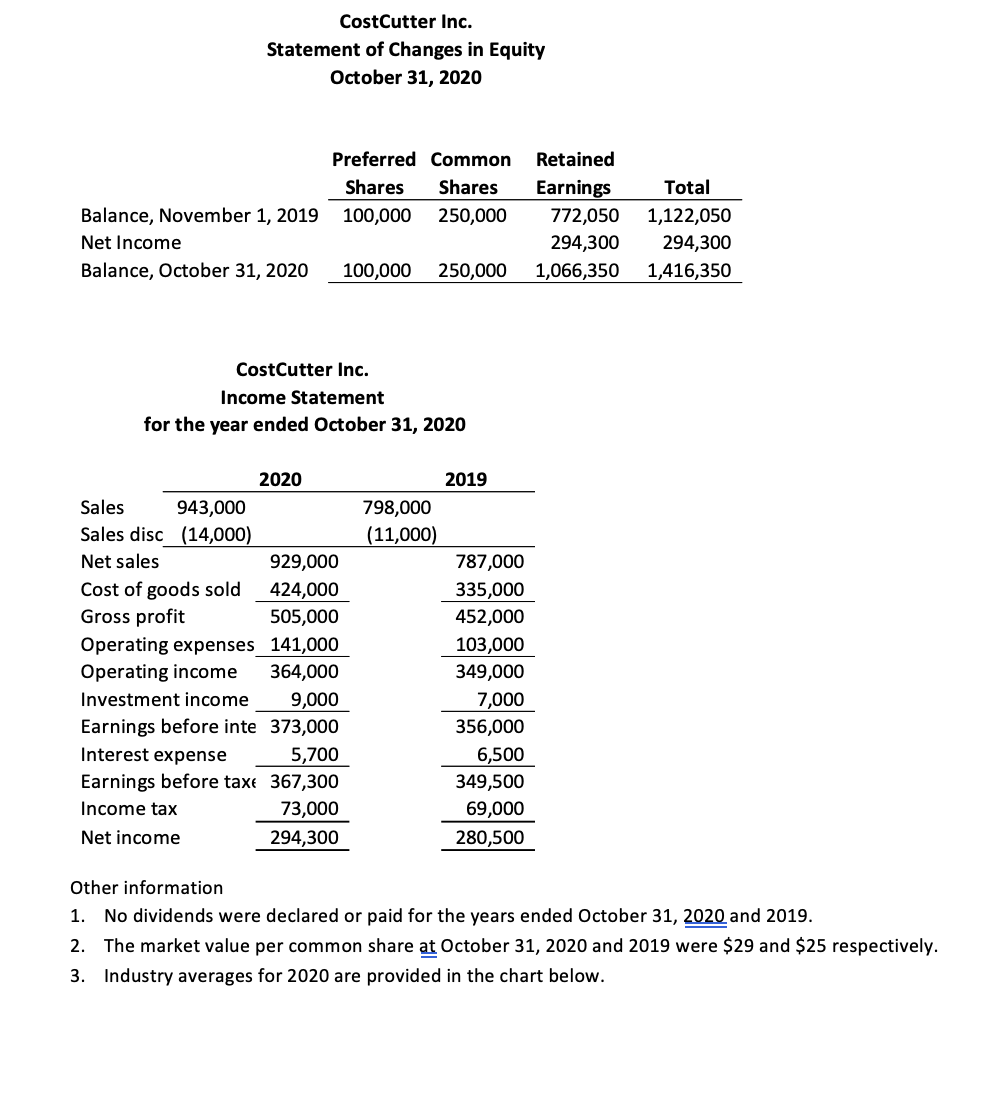

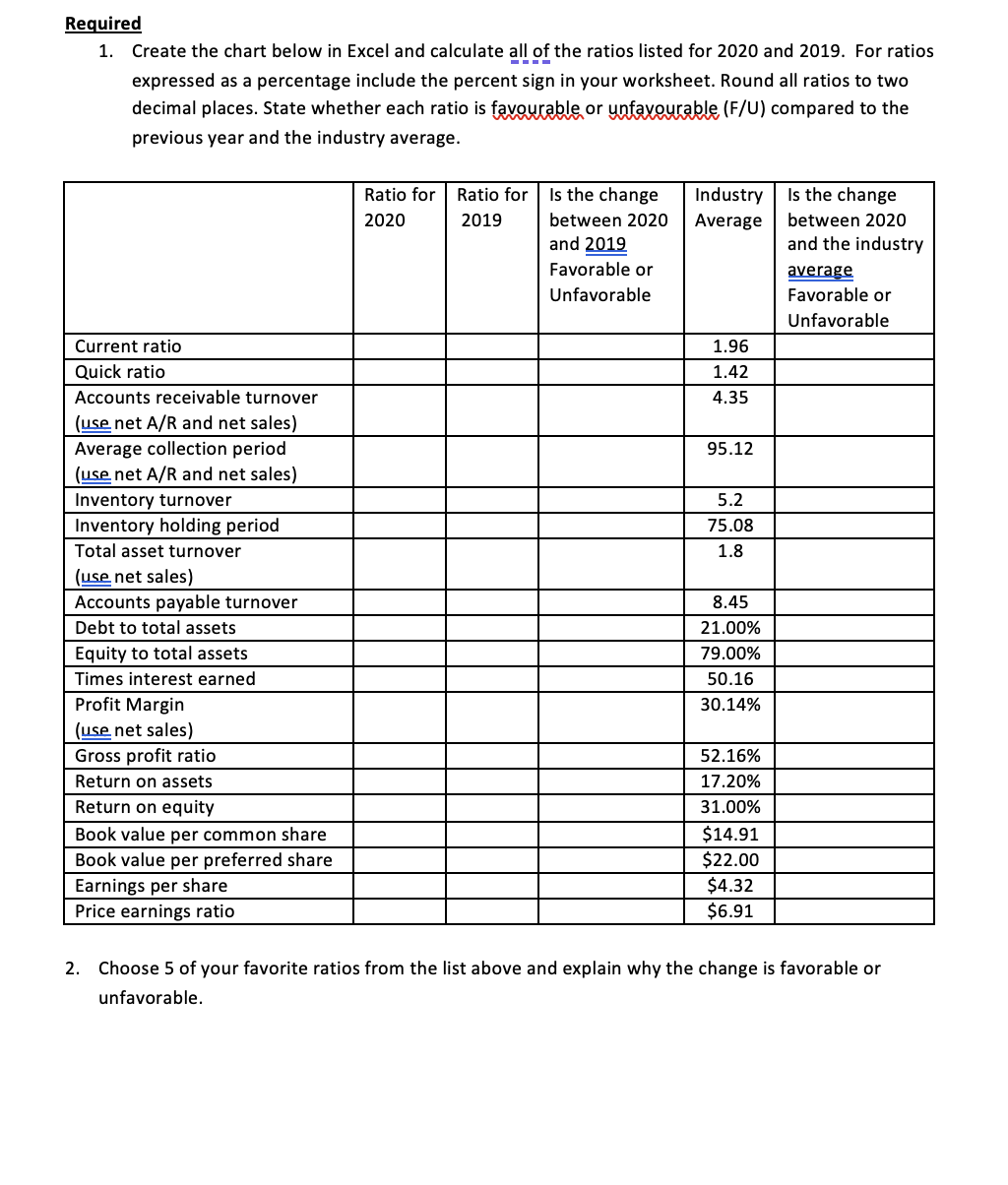

Use the financial reports below to answer the two questions in the required. CostCutter Inc. Balance Sheet October 31, 2020 Assets Current Assets Cash Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Notes receivable Total current assets Capital assets Property, plant and equipment Accumulated depreciation Total capital assets Total assets Liabilities Current liabilities Accounts payable Unearned revenue Total current liabilities Long term liabilities Notes payable Total liabilities Equity Contributed Capital Preferred shares, $1 non-cumulative, 20,000 shares issued and outstanding Common shares, 50,000 shares issued and outstanding Total contributed capital Retained earnings Total equity Total liabilities and equity 238,000 (2,300) 1,621,100 (325,000) 219,000 3,100 100,000 250,000 2020 136,000 235,700 84,000 50 600 456,350 1,296,100 1,752,450 222,100 114,000 336,100 350,000 1,066,350 1,416,350 1,752,450 219,000 (2,100) 1,234,670 (208,000) 174,000 750 100,000 250,000 2019 98,000 216,900 71,000 30 400 386,330 1,026,670 1,413,000 174,750 116,200 290,950 350,000 772,050 1,122,050 1,413,000 CostCutter Inc. Statement of Changes in Equity October 31, 2020 Balance, November 1, 2019 Net Income Balance, October 31, 2020 100,000 250,000 Sales 943,000 Sales disc (14,000) Net sales Cost of goods sold Gross profit CostCutter Inc. Income Statement for the year ended October 31, 2020 Preferred Common Shares Shares 100,000 250,000 Operating expenses Operating income Investment income 2020 929,000 424,000 505,000 141,000 364,000 9,000 Earnings before inte 373,000 Interest expense 5,700 Earnings before taxe 367,300 Income tax 73,000 Net income 294,300 798,000 (11,000) 2019 787,000 335,000 452,000 103,000 349,000 7,000 356,000 6,500 349,500 69,000 280,500 Retained Earnings Total 772,050 1,122,050 294,300 294,300 1,066,350 1,416,350 Other information 1. No dividends were declared or paid for the years ended October 31, 2020 and 2019. 2. The market value per common share at October 31, 2020 and 2019 were $29 and $25 respectively. 3. Industry averages for 2020 are provided in the chart below. Required 1. Create the chart below in Excel and calculate all of the ratios listed for 2020 and 2019. For ratios expressed as a percentage include the percent sign in your worksheet. Round all ratios to two decimal places. State whether each ratio is favourable or unfavourable (F/U) compared to the previous year and the industry average. Current ratio Quick ratio Accounts receivable turnover (use net A/R and net sales) Average collection period (use net A/R and net sales) Inventory turnover Inventory holding period Total asset turnover (use net sales) Accounts payable turnover Debt to total assets Equity to total assets Times interest earned Profit Margin (use net sales) Gross profit ratio Return on assets Return on equity Book value per common share Book value per preferred share Earnings per share Price earnings ratio Ratio for Ratio for 2020 2019 Is the change between 2020 and 2019 Favorable or Unfavorable Industry Average 1.96 1.42 4.35 95.12 5.2 75.08 1.8 8.45 21.00% 79.00% 50.16 30.14% 52.16% 17.20% 31.00% $14.91 $22.00 $4.32 $6.91 Is the change between 2020 and the industry average Favorable or Unfavorable 2. Choose 5 of your favorite ratios from the list above and explain why the change is favorable or unfavorable.

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

1 Chart of Ratios Ratio 2020 2019 Industry Average Changes from 2019 Change from Industry Average FU Current Ratio 205 222 196 Unfavorable ... View full answer

Get step-by-step solutions from verified subject matter experts