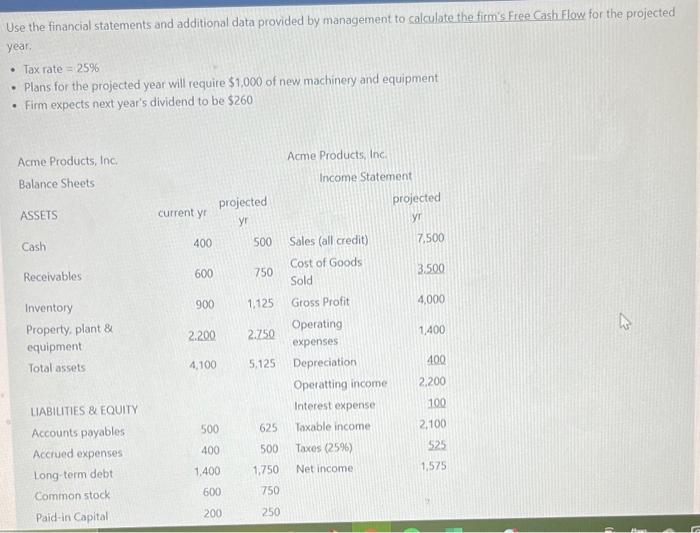

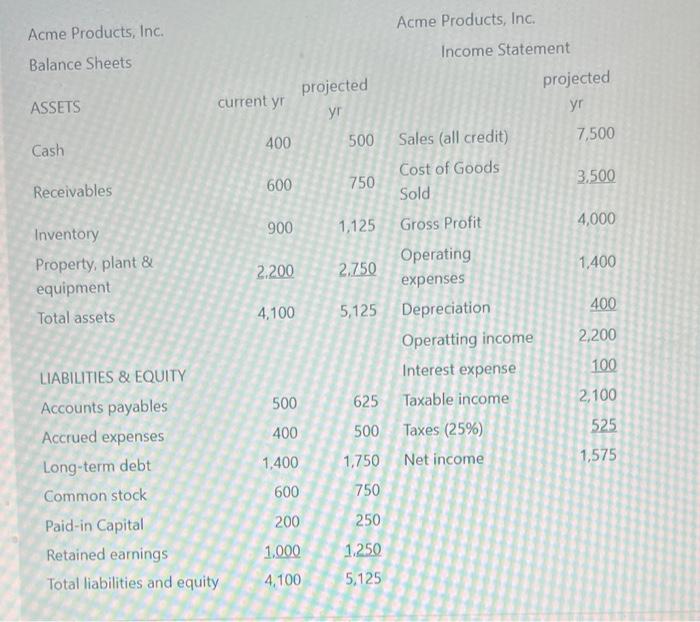

Question: Use the financial statements and additional data provided by management to calculate the firm's Free Cash Flow for the projected year. Tax rate = 25%

Use the financial statements and additional data provided by management to calculate the firm's Free Cash Flow for the projected year. Tax rate = 25% Plans for the projected year will require $1,000 of new machinery and equipment Firm expects next year's dividend to be $260 Acme Products, Inc Acme Products, Inc Balance Sheets Income Statement projected ASSETS current y projected yr y Cash 400 500 7.500 Receivables 600 750 3.500 900 1,125 4,000 Inventory Property, plant & equipment 2.200 2.750 1,400 Sales (all credit) Cost of Goods Sold Gross Profit Operating expenses Depreciation Operatting income Interest expense Taxable income Taxes (259) 4,100 Total assets 5.125 400 2,200 100 500 625 2,100 400 500 525 LIABILITIES & EQUITY Accounts payables Accrued expenses Long-term debt Common stock Paid-in Capital 1.400 1,750 Net income 1.575 600 750 200 250 600 Acme Products, Inc. Acme Products, Inc. Balance Sheets Income Statement projected projected ASSETS current yr yr yr Cash 400 500 Sales (all credit) 7,500 Cost of Goods Receivables 750 3.500 Sold Inventory 900 1,125 Gross Profit 4,000 Property, plant & Operating 2.200 2.750 1.400 equipment expenses Total assets 4,100 5,125 Depreciation 400 Operatting income 2,200 LIABILITIES & EQUITY Interest expense 100 Accounts payables 500 625 Taxable income 2,100 Accrued expenses 500 Taxes (25%) 525 Long-term debt 1,400 1,750 Net income 1,575 Common stock 600 750 Paid-in Capital 200 250 Retained earnings 1.000 1.250 Total liabilities and equity 4,100 5.125 400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts