Question: Use the following annual bench-mark rates to create a binomial valuation tree for a 3-year, 5% coupon bond. Assume zero volatility of expected forward

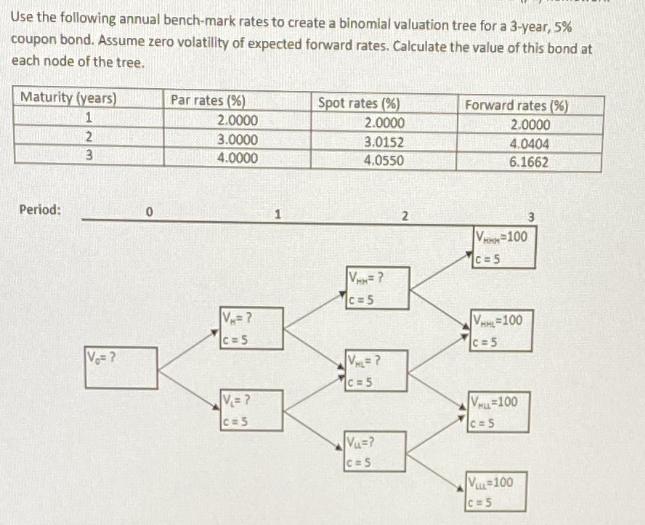

Use the following annual bench-mark rates to create a binomial valuation tree for a 3-year, 5% coupon bond. Assume zero volatility of expected forward rates. Calculate the value of this bond at each node of the tree. Maturity (years) Period: 1 2 3 Par rates (%) Spot rates (%) Forward rates (%) 2.0000 2.0000 2.0000 3.0000 3.0152 4.0404 4.0000 4.0550 6.1662 1 V-100 c=5 V=? c=5 V =? VHL-100 C = 5 C=5 V = ? V=? c=5 V=? V-100 c = 5 c=5 Vu=? c=S V-100 c=5

Step by Step Solution

There are 3 Steps involved in it

To calculate the value of the 3year 5 coupon bond at each node of the binomial valuation tree we can ... View full answer

Get step-by-step solutions from verified subject matter experts