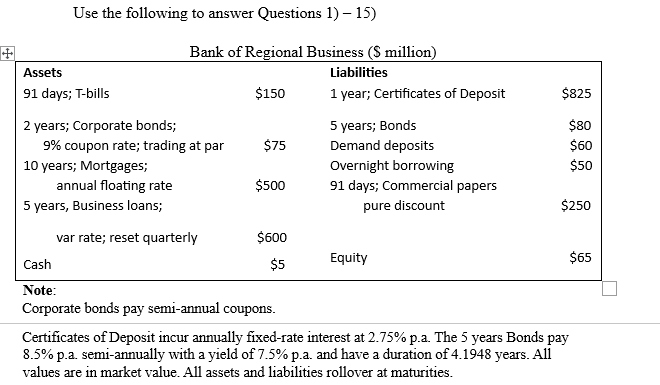

Question: Use the following attachment to answer Questions 1 ) - 1 5 ) for my Finance assignment to compare answers. All the information provided should

Use the following attachment to answer Questions for my Finance assignment to compare answers. All the information provided should be all you need.

What is the bank's financial leverage?

What is the bank's day cumulative repricing dollar gap?

What is the impact on the bank's net interest income if interest rates rise by basis

points over the next quarter?

What is the year cumulative repricing dollar gap?

What is the impact on the bank's net interest income if interest rates fall by basis

points over the next year?

How can the bank eliminate its interest rate risk exposure over the next quarter via

direct refinancing which involves equal amount on both sides of the balance sheet?

And what is the dollar amount involved in each of the transactions?

What is the duration of the Tbills?

What is the duration of the Corporate bonds?

What is the duration of the Mortgages?

What is the duration of the Business loans?

What is the duration of the bank's assets, DA

What is the duration of the bank's liabilities,

What is the bank's duration gap,

What is the impact on the bank's equity values if interest rates fall by basis points

from

How is this bank exposed to ie falling or rising interest rate changes? How can

the bank use direct refinancing to restructure the maturities of its assets orand

liabilities that would modify the and reduce its exposure to interest rate risk?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock