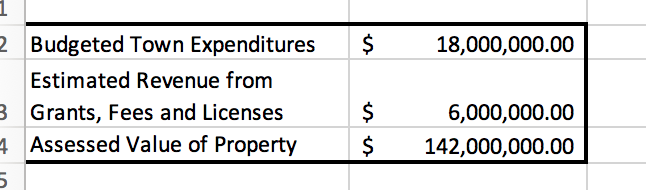

Question: Use the following data ( a t t a c h e d ) for the Town o f Paragon starting i n year 1

Use the following data for the Town Paragon starting year

What the property tax rate dollars per $ assessed value?

The Gillespie family has property with a market value $ The assessment ratio Paragon onethird. The family entitled a mortgage exemption $ which taken against assessed value. What the Gillespie family property tax bill?

Suppose that properties Paragon that the only change assessed value comes from new construction increasing assessed values The state also introduces a levy control for that year, allowing levies increase over their value

Nonproperty tax revenue for Paragon estimated $

What the maximum property tax rate permitted?

What the maximum town expenditure amount

What the property tax bill that the Gillespie family will receive

Suppose that properties Paragon that the only change assessed value comes from new construction increasing assessed values The state also introduces a new property tax control for that year, allowing levies increase only $ per $ over the level

Nonproperty tax revenue for Paragon estimated $

What the maximum property tax rate permitted?

What the maximum town expenditure amount

What the property tax bill that the Gillespie family will receive

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock