Question: Use the following data for problems 5-11. Suppose that the index model for stocks A and B is estimated with the following results: R_A =

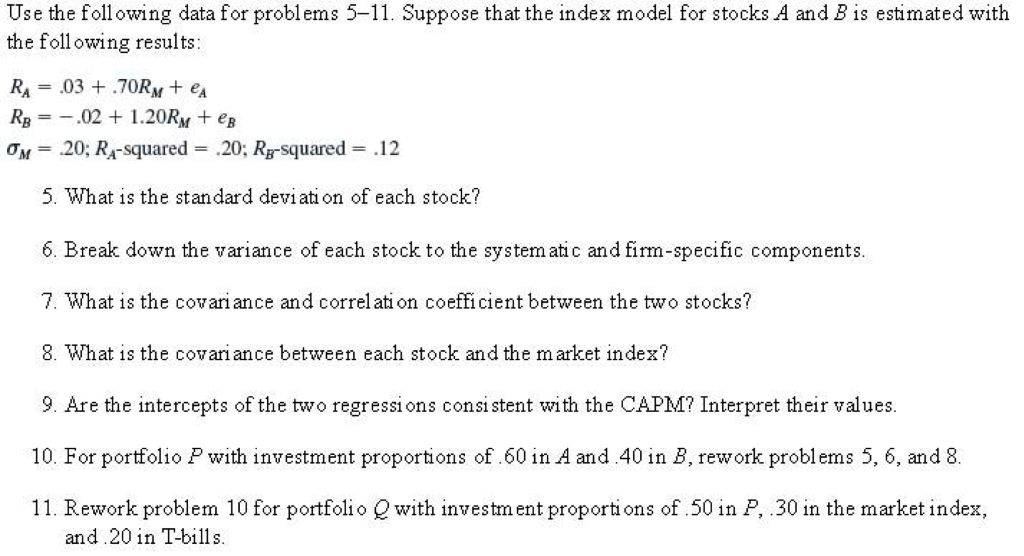

Use the following data for problems 5-11. Suppose that the index model for stocks A and B is estimated with the following results: R_A = .03 + .70R_M + e_A R_B = -.02 + 1.20R_M + e_B sigma_M = .20; R_A - squared = .20; R_B-squared = .12 What is the standard deviation of each stock? Break down the variance of each stock to the systematic and firm-specific components. What is the covariance and correlation coefficient between the two stocks? What is the covariance between each stock and the market index? Are the intercepts of the two regressions consistent with the CAPM? Interpret their values. For portfolio P with investment proportions of .60 in A and .40 in B, rework problems 5, 6, and 8. Rework problem 10 for portfolio Q with investment proportions of .50 in P, .30 in the market index, and .20 in T-bills

Step by Step Solution

There are 3 Steps involved in it

To solve the given problems well break down each part step by step Problem 5 What is the standard deviation of each stock Stock A Beta of A A A 070 Rsquared RAsquared 020 Market Standard Deviation M M ... View full answer

Get step-by-step solutions from verified subject matter experts