Question: Use the following data for Question#9 and Question#10. RA = 3% +0.7RM+ A R-square = 0.20 + Firm-specific standard deviation o(es) = 28% Firm-specific standard

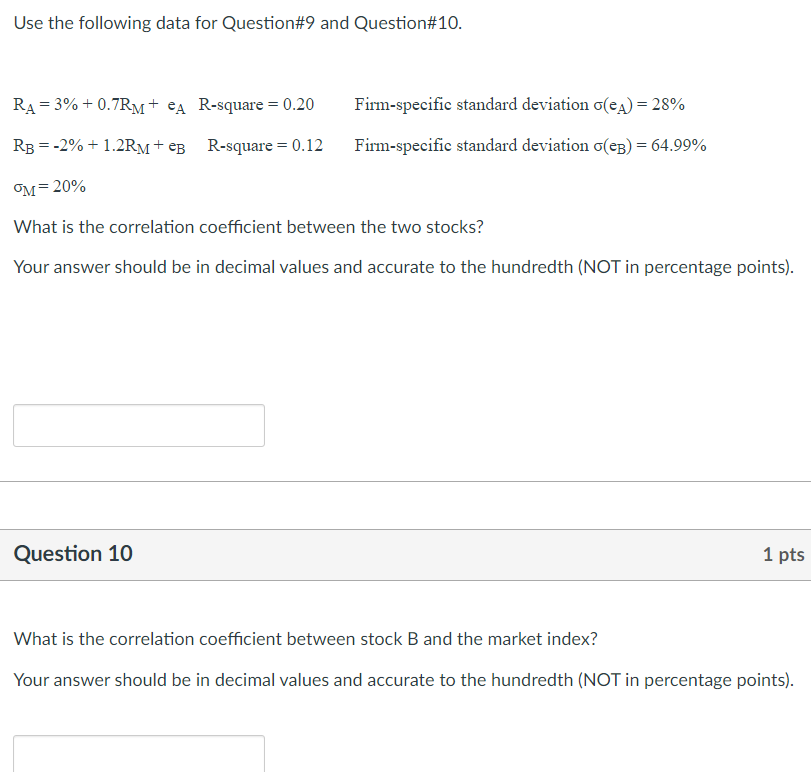

Use the following data for Question#9 and Question#10. RA = 3% +0.7RM+ A R-square = 0.20 + Firm-specific standard deviation o(es) = 28% Firm-specific standard deviation (EB) = 64.99% RB =-2% +1.2Rv+eB R-square = 0.12 OM= 20% What is the correlation coefficient between the two stocks? Your answer should be in decimal values and accurate to the hundredth (NOT in percentage points). Question 10 1 pts What is the correlation coefficient between stock B and the market index? Your answer should be in decimal values and accurate to the hundredth (NOT in percentage points). Use the following data for Question#9 and Question#10. RA = 3% +0.7RM+ A R-square = 0.20 + Firm-specific standard deviation o(es) = 28% Firm-specific standard deviation (EB) = 64.99% RB =-2% +1.2Rv+eB R-square = 0.12 OM= 20% What is the correlation coefficient between the two stocks? Your answer should be in decimal values and accurate to the hundredth (NOT in percentage points). Question 10 1 pts What is the correlation coefficient between stock B and the market index? Your answer should be in decimal values and accurate to the hundredth (NOT in percentage points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts