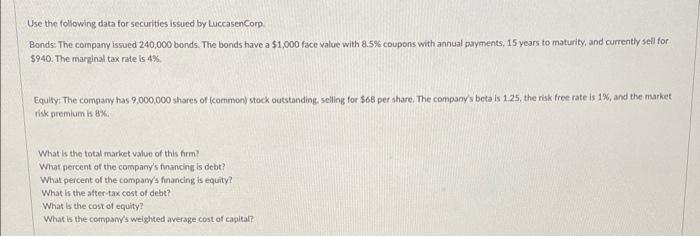

Question: Use the following data for securities issued by LuccasenCorp. Bonds: The company iscued 240,000 bonds. The bonds have a $1,000 face value with 8.5% coupons

Use the following data for securities issued by LuccasenCorp. Bonds: The company iscued 240,000 bonds. The bonds have a $1,000 face value with 8.5% coupons with annial payments, 15 years to maturity, and currently sell for 5940. The marginal tax rate is 4 . Equity: The comgamy has 9,000,000 shares of (common) stock outstanding, selling for $68 per share. The company's beta is 1.25 , the risk free rate is 1%, and the market risk aremium is ish What is the total market value of this firm? What percent of the company's financing is debt? What percent of the compamy's financing is equity? What is the after tax cost of debt? What is the cost of equity? What is the coinpany's weighted average cost of capital? Use the following data for securities issued by LuccasenCorp. Bonds: The company iscued 240,000 bonds. The bonds have a $1,000 face value with 8.5% coupons with annial payments, 15 years to maturity, and currently sell for 5940. The marginal tax rate is 4 . Equity: The comgamy has 9,000,000 shares of (common) stock outstanding, selling for $68 per share. The company's beta is 1.25 , the risk free rate is 1%, and the market risk aremium is ish What is the total market value of this firm? What percent of the company's financing is debt? What percent of the compamy's financing is equity? What is the after tax cost of debt? What is the cost of equity? What is the coinpany's weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts