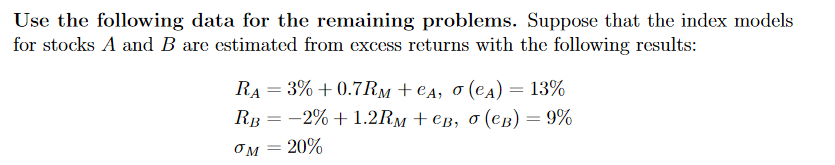

Question: Use the following data for the remaining problems. Suppose that the index models for stocks A and B are estimated from excess returns with the

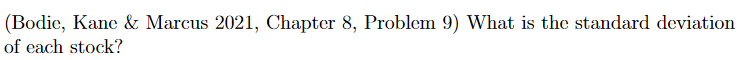

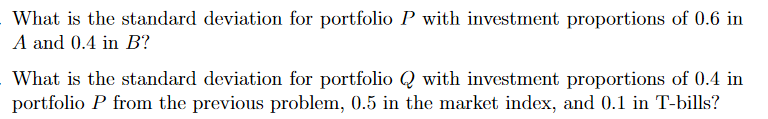

Use the following data for the remaining problems. Suppose that the index models for stocks A and B are estimated from excess returns with the following results: RA = 3% +0.7Rm tea, o (CA) = 13% Rp = -2% +1.2RM +eb, o (Cb) = 9% OM 20% (Bodie, Kane & Marcus 2021, Chapter 8, Problem 9) What is the standard deviation of each stock? What is the standard deviation for portfolio P with investment proportions of 0.6 in A and 0.4 in B? What is the standard deviation for portfolio Q with investment proportions of 0.4 in portfolio P from the previous problem, 0.5 in the market index, and 0.1 in T-bills

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts