Question: Use the following data to answer CFA problems 4-6 Hennessy & Associates manages a $30 million equity portfolio for the multi-fund manager Cairns Superannuation Fund

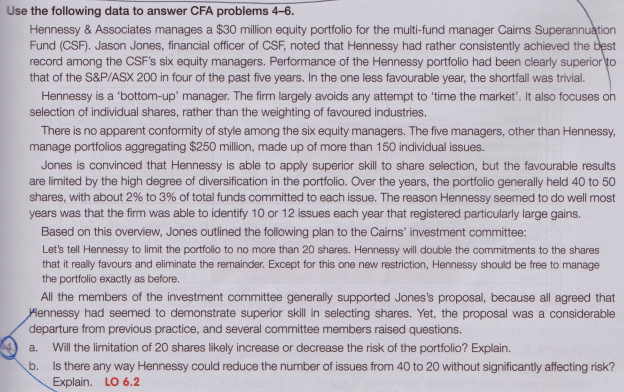

Use the following data to answer CFA problems 4-6 Hennessy & Associates manages a $30 million equity portfolio for the multi-fund manager Cairns Superannuation Fund (CSF). Jason Jones, financial officer of CSF, noted that Hennessy had rather consistently achieved the best record among the CSF's six equity managers. Performance of the Hennessy portfolio had been clearly superior to that of the S&P/ASX 200 in four of the past five years. In the one less favourable year, the shortfall was trivial Hennessy is a 'bottom-up' manager. The firm largely avoids any attempt to 'time the market'. It also focuses on selection of individual shares, rather than the weighting of favoured industries There is no apparent conformity of style among the six equity managers. The five managers, other than Hennessy, manage portfolios aggregating $250 million, made up of more than 150 individual issues. Jones is convinced that Hennessy is able to apply superior skill to share selection, but the favourable results are limited by the high degree of diversification in the portfolio. Over the years, the portfolio generally held 40 to 50 shares, with about 2% to 3% of total funds committed to each issue. The reason Hennessy seemed to do well most years was that the firm was able to identify 10 or 12 issues each year that registered particularly large gains. Based on this overview, Jones outlined the following plan to the Cairns' investment committee: Let's tell Hennessy to limit the portfolio to no more than 20 shares. Hennessy will double the commitments to the shares that it really favours and eliminate the remainder. Except for this one new restriction, Hennessy should be free to manage the portfolio exactly as before. All the members of the investment committee generally supported Jones's proposal, because all agreed that lennessy had seemed to demonstrate superior skill in selecting shares. Yet, the proposal was a considerable departure from previous practice, and several committee members raised questions. a. Will the limitation of 20 shares likely increase or decrease the risk of the portfolio? Explain. b. Is there any way Hennessy could reduce the number of issues from 40 to 20 without significantly affecting risk? Explain. LO 6.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts