Question: Use the Following Data to answer Question 1 to 5 Jolan is an analyst at Star Investments, Inc. and is curteatly working on valuing HomeStore,

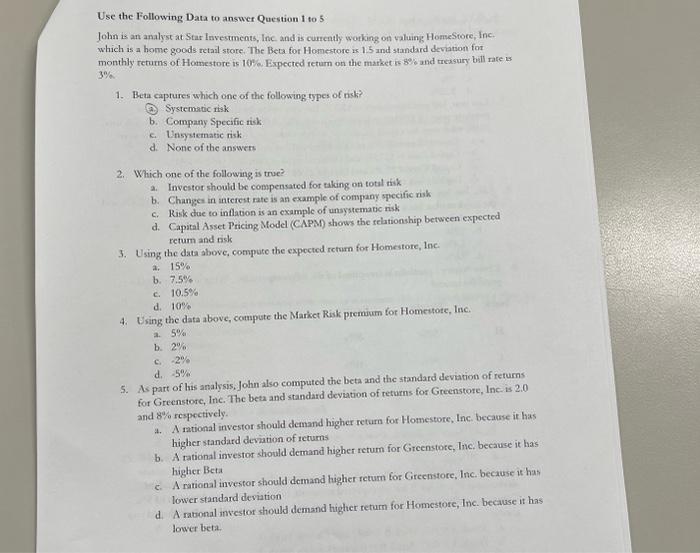

Use the Following Data to answer Question 1 to 5 Jolan is an analyst at Star Investments, Inc. and is curteatly working on valuing HomeStore, Inc. which is a home goods retal stare. The Beta for Homestore is 1.5 and standard devation for monthly retums of Homestore is 16\%. Expected return on the market is 8% and treasury bill rate is 3% 1. Beta captures which one of the following types of nak? (a). Systematic itsk b. Company Specific risk c. Dnsystematic risk d. None of the answets 2. Which one of the following is true? a. Investor should be compensated for taking on total thik b. Changes in anterest ate is an example of company ppecific risk c. Risk doe to inflation is an example of unsystematic risk d. Capital Asset Pricing Model (CAPM) shows the relationship between expected retum and tisk 3. Using the data above, compute the expected return for Homestore, Ine. a. 15% b. 7.5% c. 10.5% d. 10% 4. Wsing the data above, coupute the Marker Risk premium for Homentote, Inc. a. 5% b. 2% c. 2% 5. As part of his analysis, John also computed the beta and the standard deviation of retums d. 5% for Greenstorc, lnc. The beta and standard deviation of returns for Greenstore, Inc- is 2.0 and 8% respectively. a. A mational investor should demand higher return for Homestore, Inc, becanse ie has higher standard deviation of returns b. A rational investor should demand higher retum for Girenstore, Inc. because it has c. A rational investor should demand higher retum for Girecnstote, Inc. because it has higher Beta lower standard deviation d. A rational incestor should demand higher return for Homestore, Inc. because it has lower beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts