Question: Use the following data to answer questions 13 through 15: ease in net working expected 750,000 shares The Franktown Motors is expected to have an

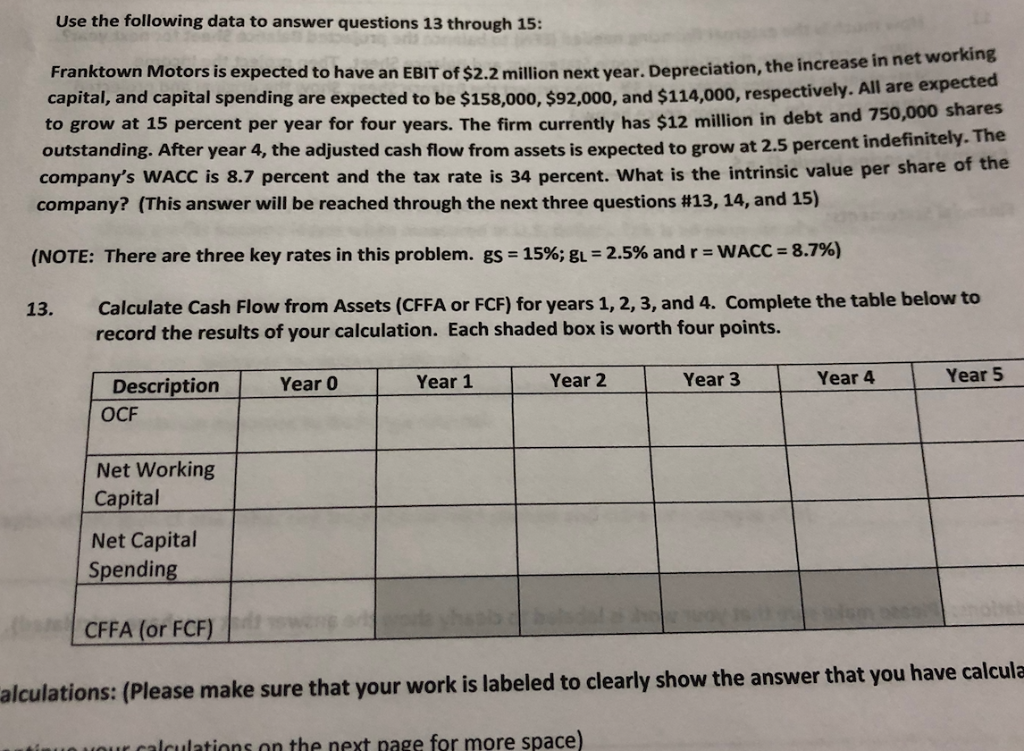

Use the following data to answer questions 13 through 15: ease in net working expected 750,000 shares The Franktown Motors is expected to have an EBIT of $2.2 million next year. Depreciation, the incr capital, and capital spending are expected to be $158,000, $92,000, and $114,000, respectively. All are to grow at 15 percent per year for four years. The firm currently has $12 million in debt and outstanding. After year 4, the adjusted cash flow from assets is expected to grow at 2.5 percent indefinitely. company's WACC is 8.7 percent and the tax rate is 34 percent. Wha company? (This answer will be reached through the next three questions #13, 14, and 15) t is the intrinsic value per share of the (NOTE: There are three key rates in this problem. gs-15%; g.-2.5% and r-VACC-8.796) Calculate Cash Flow from Assets (CFFA or FCF) for years 1, 2, 3, and 4. Complete the table below to record the results of your calculation. Each shaded box is worth four points. 13. Year 5 Year 4 Year 3 Year 2 Year 1 DescriptionYear OCF Net Working Capital Net Capital Spending CFFA (or FCF) alculations: (Please make sure that your work is labeled to clearly show the answer that you have calcula nthe next page for more space) lulations o Use the following data to answer questions 13 through 15: ease in net working expected 750,000 shares The Franktown Motors is expected to have an EBIT of $2.2 million next year. Depreciation, the incr capital, and capital spending are expected to be $158,000, $92,000, and $114,000, respectively. All are to grow at 15 percent per year for four years. The firm currently has $12 million in debt and outstanding. After year 4, the adjusted cash flow from assets is expected to grow at 2.5 percent indefinitely. company's WACC is 8.7 percent and the tax rate is 34 percent. Wha company? (This answer will be reached through the next three questions #13, 14, and 15) t is the intrinsic value per share of the (NOTE: There are three key rates in this problem. gs-15%; g.-2.5% and r-VACC-8.796) Calculate Cash Flow from Assets (CFFA or FCF) for years 1, 2, 3, and 4. Complete the table below to record the results of your calculation. Each shaded box is worth four points. 13. Year 5 Year 4 Year 3 Year 2 Year 1 DescriptionYear OCF Net Working Capital Net Capital Spending CFFA (or FCF) alculations: (Please make sure that your work is labeled to clearly show the answer that you have calcula nthe next page for more space) lulations o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts