Question: !!!!!! Use the following data to answer the next THREE questions: Iris Company is considering a new investment project. The initial investment for the project

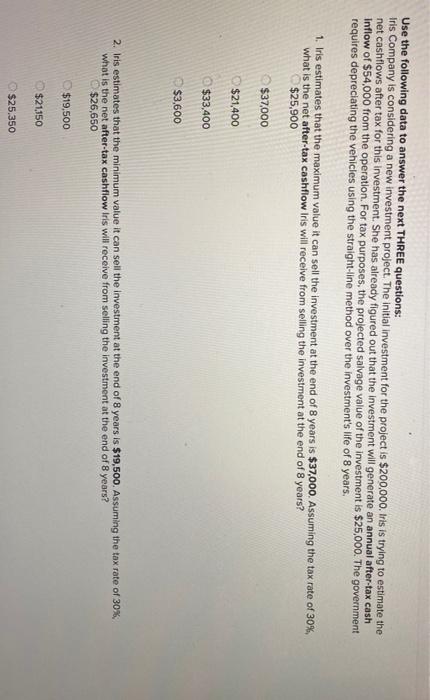

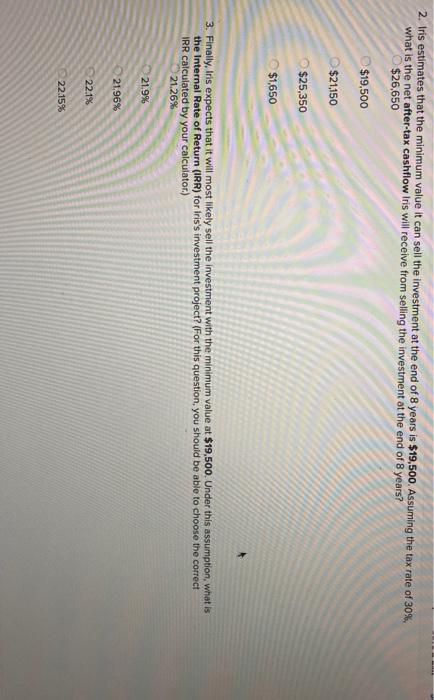

Use the following data to answer the next THREE questions: Iris Company is considering a new investment project. The initial investment for the project is $200,000. Iris is trying to estimate the net cashflows after tax for this investment. She has already figured out that the investment will generate an annual after-tax cash Inflow of $54,000 from the operation. For tax purposes, the projected salvage value of the investment is $25,000. The government requires depreciating the vehicles using the straight-line method over the investment's life of 8 years, 1. Iris estimates that the maximum value it can sell the investment at the end of 8 years is $37,000. Assuming the tax rate of 30% what is the net after-tax cashflow Iris will receive from selling the investment at the end of 8 years? $25,900 $37,000 $21,400 $33,400 $3,600 2. Iris estimates that the minimum value it can sell the investment at the end of 8 years is $19,500. Assuming the tax rate of 30%, what is the net after-tax cashflow Iris will receive from selling the investment at the end of 8 years? $26,650 $19.500 $21,150 $25.350 2. Iris estimates that the minimum value it can sell the investment at the end of 8 years is $19,500. Assuming the tax rate of 30% what is the net after-tax cashflow Iris will receive from selling the investment at the end of 8 years? $26,650 $19,500 $21,150 $25,350 $1,650 3. Finally, Iris expects that it will most likely sell the investment with the minimum value at $19,500. Under this assumption, what is the Internal Rate of Return (IRR) for Iris's investment project? (For this question, you should be able to choose the correct IRR calculated by your calculator) 21.26% 21.9% 21.96% 22.1% 22.15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts