Question: Use the following data to answer the next THREE questions: Molly is considering opening a Campus Delivery business. The initial investment for the business is

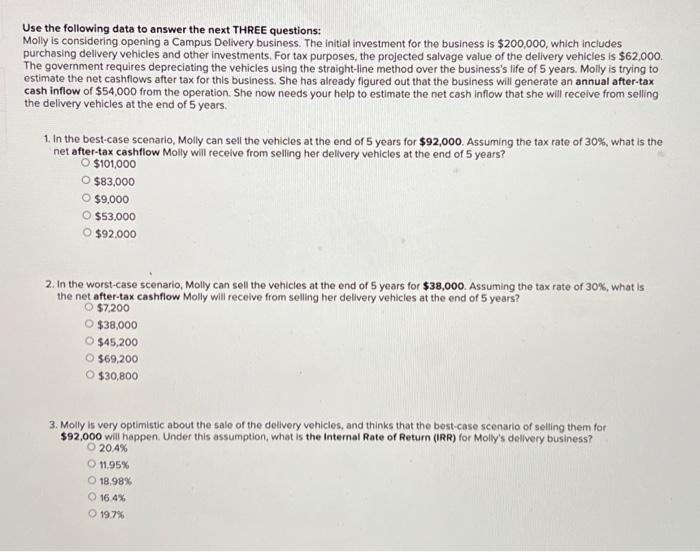

Use the following data to answer the next THREE questions: Molly is considering opening a Campus Delivery business. The initial investment for the business is $200,000, which includes purchasing delivery vehicles and other investments. For tax purposes, the projected salvage value of the delivery vehicles is $62,000. The government requires depreciating the vehicles using the straight-line method over the business's life of 5 years. Molly is trying to estimate the net cashflows after tax for this business. She has already figured out that the business will generate an annual after-tax cash inflow of $54,000 from the operation. She now needs your help to estimate the net cash inflow that she will recelve from selling the delivery vehicles at the end of 5 years. 1. In the best-case scenario, Molly can sell the vehicles at the end of 5 years for $92,000. Assuming the tax rate of 30%, what is the net after-tax cashflow Molly will recelve from selling her delivery vehicles at the end of 5 years? $101,000 $83,000 $9,000 $53.000 $92,000 2. In the worst-case scenario, Molly can sell the vehicles at the end of 5 years for $38,000. Assuming the tax rate of 30%, what is the net after-tax cashflow Molly will recelve from selling her delivery vehicles at the end of 5 years? $7,200$38,000$45,200$69,200$30,800 3. Molly is very optimistic about the sale of the dellvery vehicles, and thinks that the best-case scenario of selling them for $92,000 will happen. Under this assumption, what is the internal Rate of Return (IRR) for Molly's dellivery business? 20.4% 11.95% 18,98% 16.4% 197% Use the following data to answer the next THREE questions: Molly is considering opening a Campus Delivery business. The initial investment for the business is $200,000, which includes purchasing delivery vehicles and other investments. For tax purposes, the projected salvage value of the delivery vehicles is $62,000. The government requires depreciating the vehicles using the straight-line method over the business's life of 5 years. Molly is trying to estimate the net cashflows after tax for this business. She has already figured out that the business will generate an annual after-tax cash inflow of $54,000 from the operation. She now needs your help to estimate the net cash inflow that she will recelve from selling the delivery vehicles at the end of 5 years. 1. In the best-case scenario, Molly can sell the vehicles at the end of 5 years for $92,000. Assuming the tax rate of 30%, what is the net after-tax cashflow Molly will recelve from selling her delivery vehicles at the end of 5 years? $101,000 $83,000 $9,000 $53.000 $92,000 2. In the worst-case scenario, Molly can sell the vehicles at the end of 5 years for $38,000. Assuming the tax rate of 30%, what is the net after-tax cashflow Molly will recelve from selling her delivery vehicles at the end of 5 years? $7,200$38,000$45,200$69,200$30,800 3. Molly is very optimistic about the sale of the dellvery vehicles, and thinks that the best-case scenario of selling them for $92,000 will happen. Under this assumption, what is the internal Rate of Return (IRR) for Molly's dellivery business? 20.4% 11.95% 18,98% 16.4% 197%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts