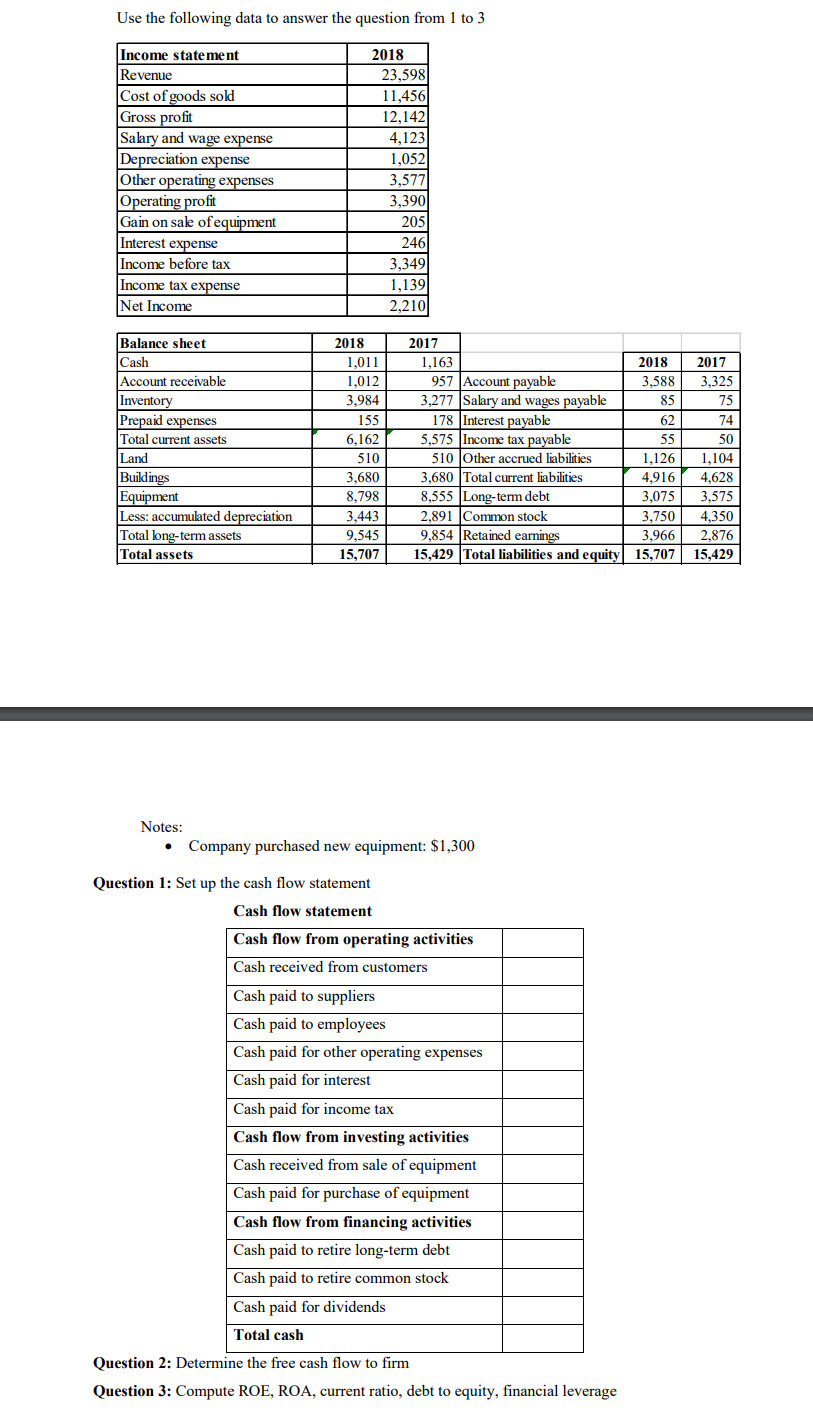

Question: Use the following data to answer the question from 1 to 3 Income statement Revenue Cost of goods sold Gross profit Salary and wage expense

Use the following data to answer the question from 1 to 3 Income statement Revenue Cost of goods sold Gross profit Salary and wage expense Depreciation expense Other operating expenses Operating profit Gain on sale of equipment Interest expense Income before tax Income tax expense Net Income 2018 23,598 11,456 12,1421 4,123 1,052 3,577 3,390 205 246 3,349 1,139 2,210 2018 1,011 1,012 3,984 Balance sheet Cash Account receivable Inventory Prepaid expenses Total current assets Land Buildings Equipment Less: accumulated depreciation Total long-term assets Total assets 155 6,162 510 3,680 8,798 3,443 9,545 15,707 2017 1,163 957 Account payable 3,277 Salary and wages payable 178 Interest payable 5,575 Income tax payable 510 Other accrued liabilities 3,680 Total current liabilities 8,555 Long-term debt 2,891 Common stock 9,854 Retained earnings 15,429 Total liabilities and equity 2018 3,588 85 62 55 1,126 4,916 3,075 3,750 3,966 15,707 2017 3.325 75 74 50 1,104 4,628 3,575 4,350 2,876 15,429 Notes: Company purchased new equipment: $1,300 Question 1: Set up the cash flow statement Cash flow statement Cash flow from operating activities Cash received from customers Cash paid to suppliers Cash paid to employees Cash paid for other operating expenses Cash paid for interest Cash paid for income tax Cash flow from investing activities Cash received from sale of equipment Cash paid for purchase of equipment Cash flow from financing activities Cash paid to retire long-term debt Cash paid to retire common stock Cash paid for dividends Total cash Question 2: Determine the free cash flow to firm Question 3: Compute ROE, ROA, current ratio, debt to equity, financial leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts