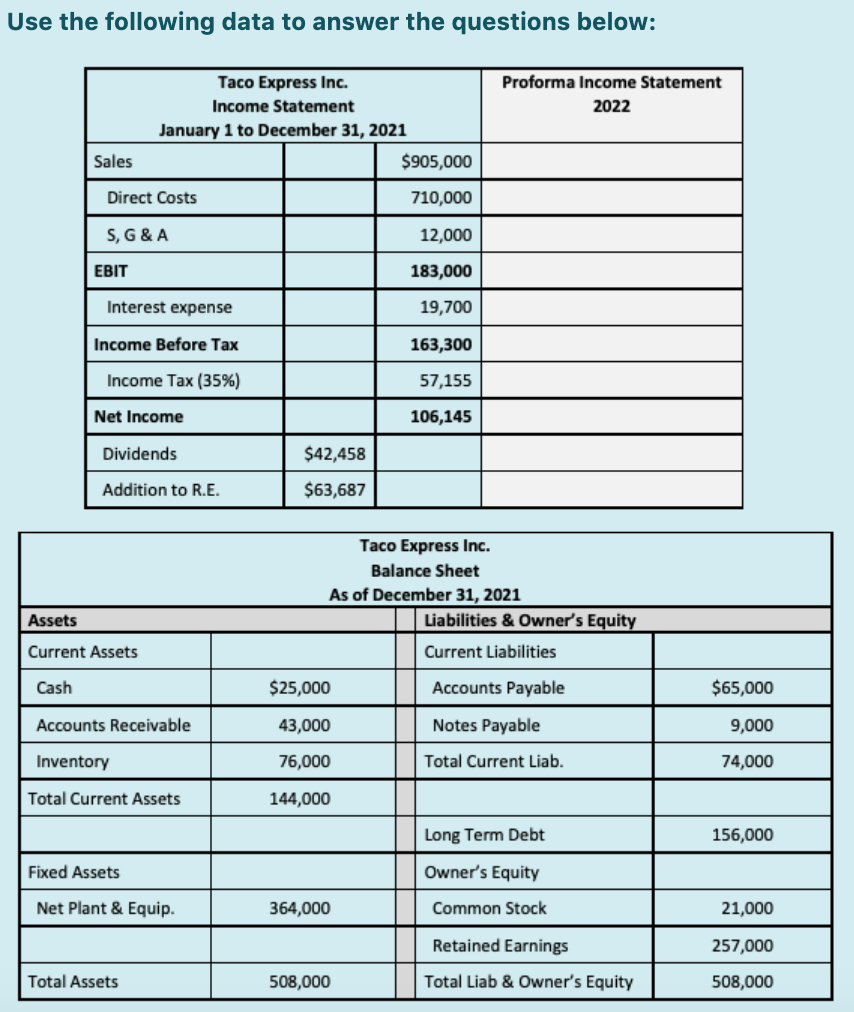

Question: Use the following data to answer the questions below: Proforma Income Statement 2022 Taco Express Inc. Income Statement January 1 to December 31, 2021 $905,000

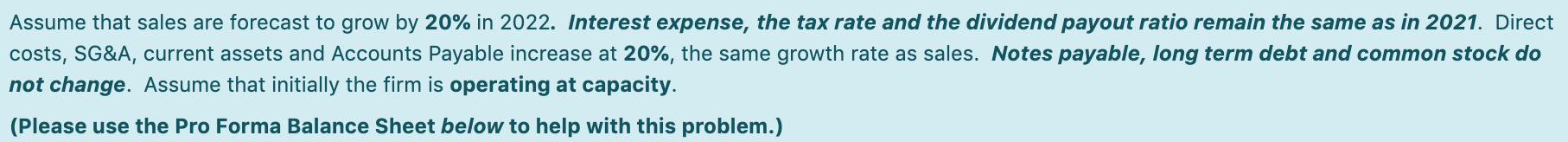

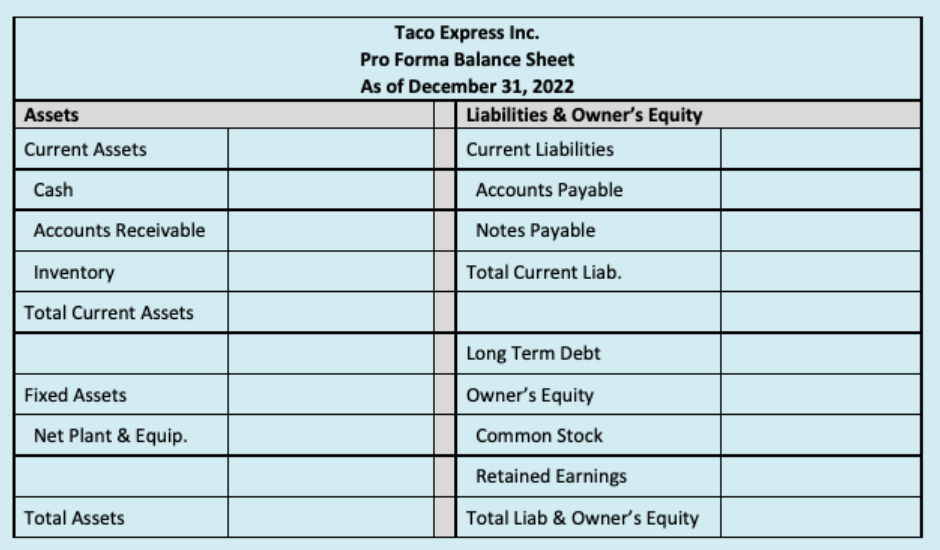

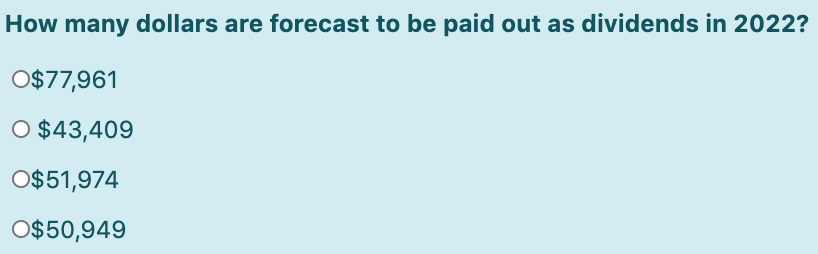

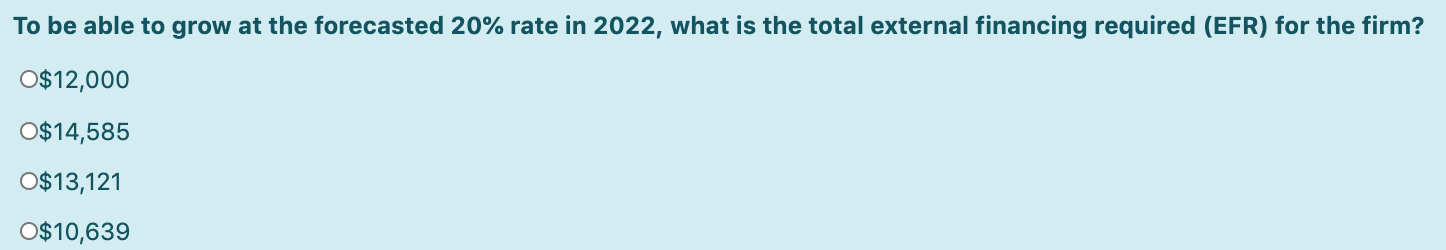

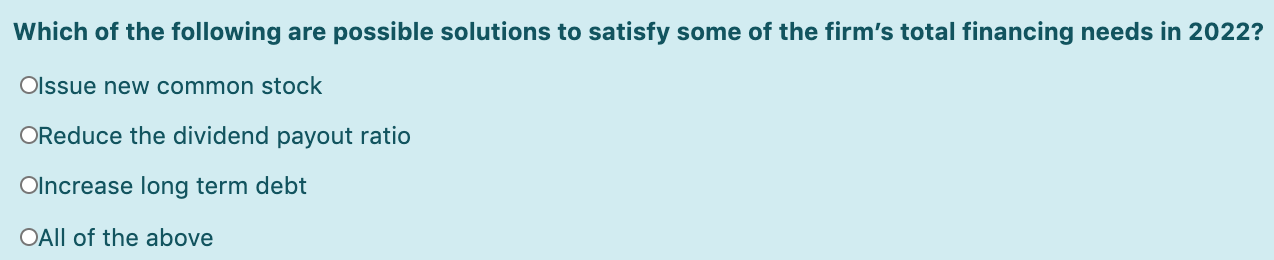

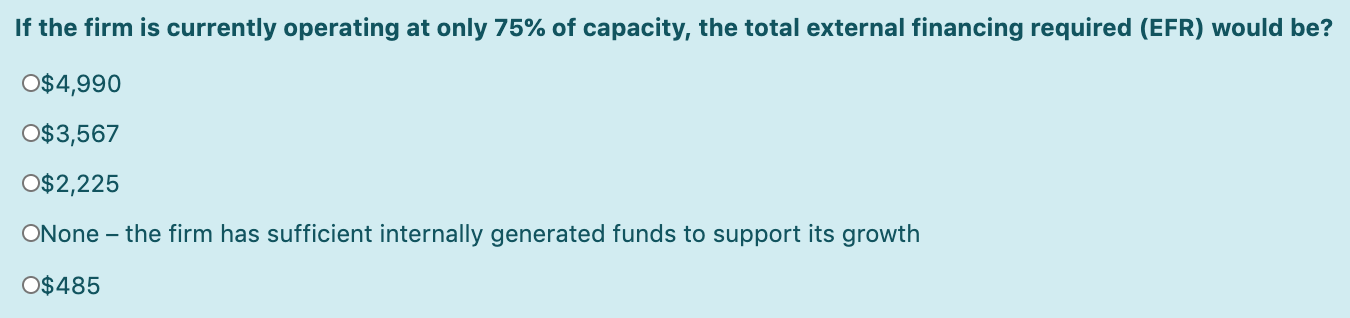

Use the following data to answer the questions below: Proforma Income Statement 2022 Taco Express Inc. Income Statement January 1 to December 31, 2021 $905,000 Sales Direct Costs 710,000 S, G & A 12,000 EBIT 183,000 Interest expense 19,700 Income Before Tax 163,300 Income Tax (35%) 57,155 Net Income 106,145 Dividends $42,458 Addition to R.E. $63,687 Taco Express Inc. Balance Sheet As of December 31, 2021 Liabilities & Owner's Equity Current Liabilities Assets Current Assets Cash $25,000 Accounts Payable $65,000 Accounts Receivable 43,000 Notes Payable 9,000 Inventory 76,000 Total Current Liab. 74,000 Total Current Assets 144,000 Long Term Debt 156,000 Fixed Assets Owner's Equity Net Plant & Equip. 364,000 Common Stock 21,000 Retained Earnings 257,000 Total Assets 508,000 Total Liab & Owner's Equity 508,000 Assume that sales are forecast to grow by 20% in 2022. Interest expense, the tax rate and the dividend payout ratio remain the same as in 2021. Direct costs, SG&A, current assets and Accounts Payable increase at 20%, the same growth rate as sales. Notes payable, long term debt and common stock do not change. Assume that initially the firm is operating at capacity. (Please use the Pro Forma Balance Sheet below to help with this problem.) Taco Express Inc. Pro Forma Balance Sheet As of December 31, 2022 Liabilities & Owner's Equity Current Liabilities Assets Current Assets Cash Accounts Payable Accounts Receivable Notes Payable Inventory Total Current Liab. Total Current Assets Long Term Debt Fixed Assets Owner's Equity Net Plant & Equip. Common Stock Retained Earnings Total Assets Total Liab & Owner's Equity How many dollars are forecast to be paid out as dividends in 2022? O$77,961 O $43,409 O$51,974 o$50,949 Total Assets for 2022 are forecast as: O$584,445 O$615,114 O$621,336 o$609,600 To be able to grow at the forecasted 20% rate in 2022, what is the total external financing required (EFR) for the firm? O$12,000 O$14,585 O$13,121 O$10,639 Which of the following are possible solutions to satisfy some of the firm's total financing needs in 2022? Olssue new common stock OReduce the dividend payout ratio Olncrease long term debt OAll of the above If the firm is currently operating at only 75% of capacity, the total external financing required (EFR) would be? O$4,990 O$3,567 O$2,225 ONone the firm has sufficient internally generated funds to support its growth o$485

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts