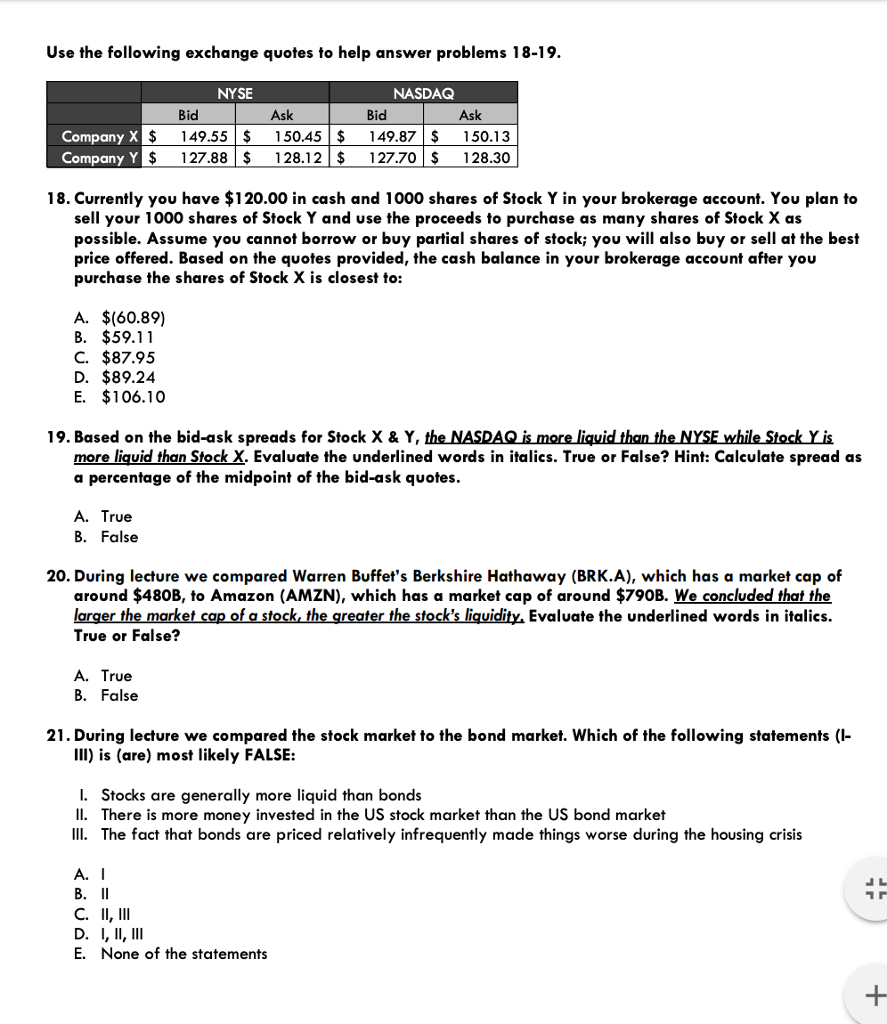

Question: Use the following exchange quotes to help answer problems 18-19. NYSE NASDAQ Bid Ask Bid Ask $149.55$150.45$149.87$ 150.13 $127.88$128.12127.70 S 128.30 CompanyY 18. Currently you

Use the following exchange quotes to help answer problems 18-19. NYSE NASDAQ Bid Ask Bid Ask $149.55$150.45$149.87$ 150.13 $127.88$128.12127.70 S 128.30 CompanyY 18. Currently you have $120.00 in cash and 1000 shares of Stock Y in your brokerage account. You plan to sell your 1000 shares of Stock Y and use the proceeds to purchase as many shares of Stock X as possible. Assume you cannot borrow or buy partial shares of stock; you will also buy or sell at the best price offered. Based on the quotes provided, the cash balance in your brokerage account after you purchase the shares of Stock X is closest to: A. $(60.89) B. $59.11 C. $87.95 D. $89.24 E. $106.10 19. Based on the bid-ask spreads for Stock X & Y' the NASDAQsmore liquidthan theNYSEwhile Stock y is more liquid than Stock X. Evaluate the underlined words in italics. True or False? Hint: Calculate spread as a percentage of the midpoint of the bid-ask quotes. A. True B. False 20. During lecture we compared Warren Buffet's Berkshire Hathaway (BRK.A), which has a market cap of around $480B, to Amazon (AMZN), which has a market cap of around $790B. We concluded that the larger the market cap of a stock the greater the stock's liquidity Evaluate the underlined words in italics. True or False? A. True B. False 21. During lecture we compared the stock market to the bond market. Which of the following statements ( III) is (are) most likely FALSE: I. Stocks are generally more liquid than bonds II. There is more money invested in the US stock market than the US bond market IIl. The fact that bonds are priced relatively infrequently made things worse during the housing crisis A. I E. None of the statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts