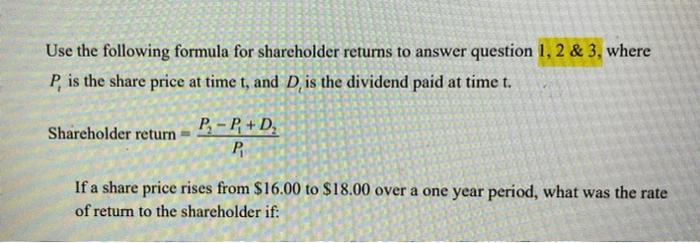

Question: Use the following formula for shareholder returns to answer question 1, 2 & 3, where P, is the share price at time t, and D,

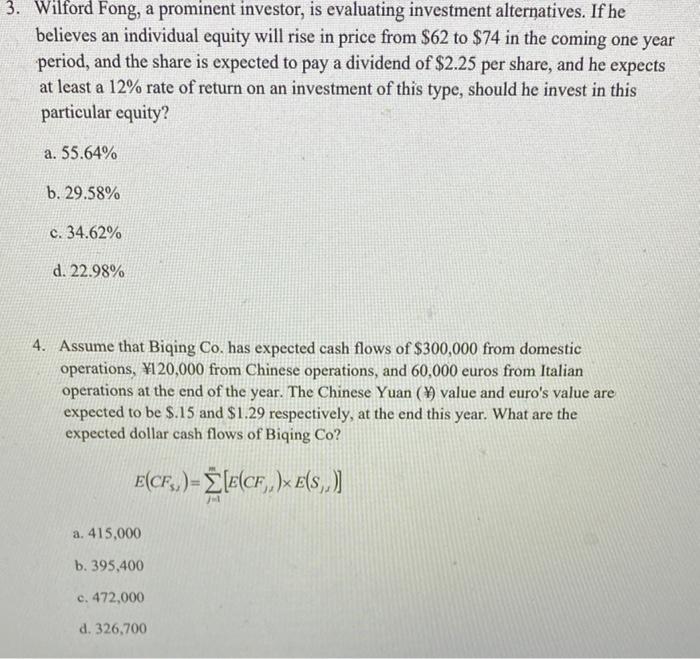

Use the following formula for shareholder returns to answer question 1, 2 & 3, where P, is the share price at time t, and D, is the dividend paid at time t. Shareholder return P-P+D, P If a share price rises from $16.00 to $18.00 over a one year period, what was the rate of return to the shareholder if: 3. Wilford Fong, a prominent investor, is evaluating investment alternatives. If he believes an individual equity will rise in price from $62 to $74 in the coming one year period, and the share is expected to pay a dividend of $2.25 per share, and he expects at least a 12% rate of return on an investment of this type, should he invest in this particular equity? a. 55.64% b. 29.58% c. 34.62% d. 22.98% 4. Assume that Biqing Co. has expected cash flows of $300,000 from domestic operations, 120,000 from Chinese operations, and 60.000 euros from Italian operations at the end of the year. The Chinese Yuan () value and euro's value are expected to be $.15 and $1.29 respectively, at the end this year. What are the expected dollar cash flows of Biqing Co? E(CF,,)=[E(CF,,)xe(s) a. 415,000 b. 395,400 c. 472,000 d. 326,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts