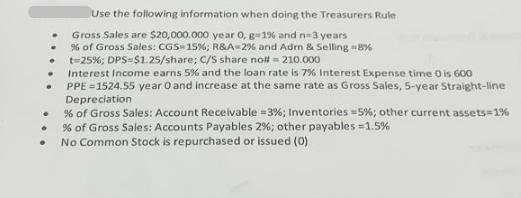

Question: . . . . . Use the following information when doing the Treasurers Rule Gross Sales are $20,000.000 year 0, g-1% and n=3 years

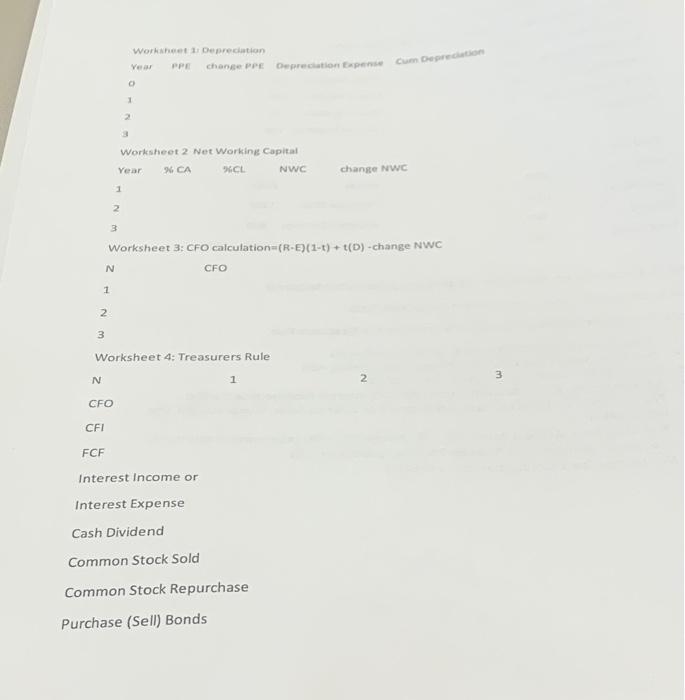

. . . . . Use the following information when doing the Treasurers Rule Gross Sales are $20,000.000 year 0, g-1% and n=3 years % of Gross Sales: CGS-15% ; R&A=2% and Adm & Selling -8% t=25%; DPS-$1.25/share; C/S share no## = 210.000 Interest Income earns 5% and the loan rate is 7% Interest Expense time 0 is 600 PPE = 1524.55 year 0 and increase at the same rate as Gross Sales, 5-year Straight-line Depreciation % of Gross Sales: Account Receivable = 3%; Inventories = 5%; other current assets=1% % of Gross Sales: Accounts Payables 2%; other payables=1.5% No Common Stock is repurchased or issued (0) N 1 2 3 2 3 1 Worksheet 1: Depreciation Year PPE change PPE N CFO O 1 2 Worksheet 2 Net Working Capital Year % CA %CL Worksheet 3: CFO calculation (R-E) (1-1) + t(D)-change NWC CFO Worksheet 4: Treasurers Rule Depreciation Expense Cum Depreciation 1 CFI FCF Interest Income or Interest Expense Cash Dividend Common Stock Sold Common Stock Repurchase Purchase (Sell) Bonds NWC change NWC

Step by Step Solution

3.61 Rating (158 Votes )

There are 3 Steps involved in it

Worksheet 1 Depreciation Year 1 PPE change 152455 given Depreciation Expense 152455 5 30491 Cumulati... View full answer

Get step-by-step solutions from verified subject matter experts