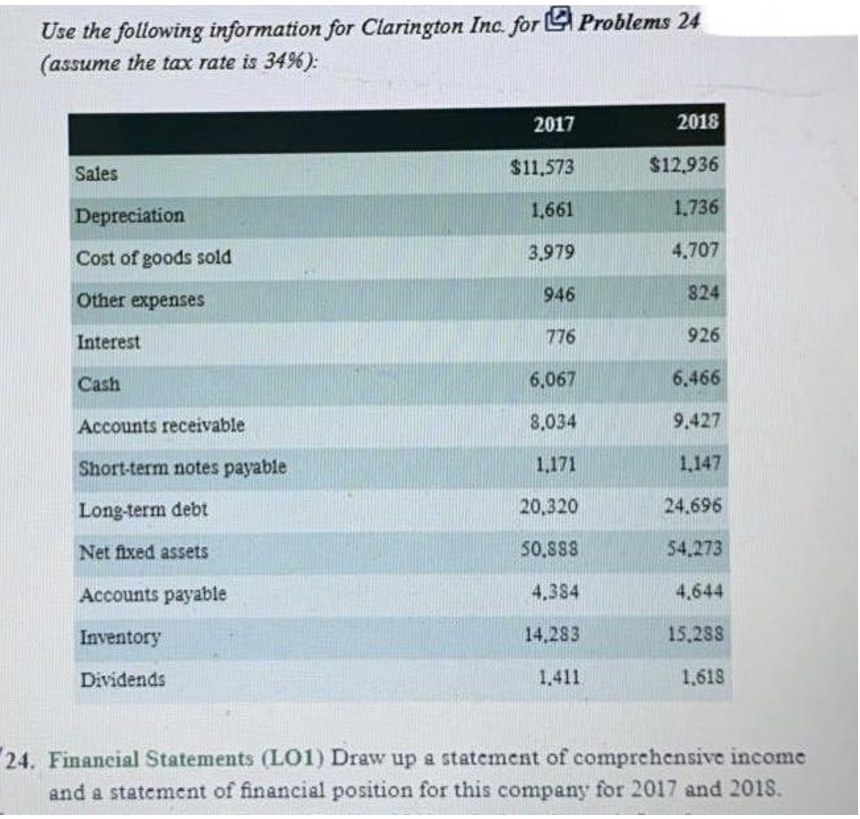

Question: Use the following information for Clarington Inc. for LA Problems 24 (assume the tax rate is 34%): 2017 2018 Sales $11.573 $12.936 Depreciation 1.661 1.736

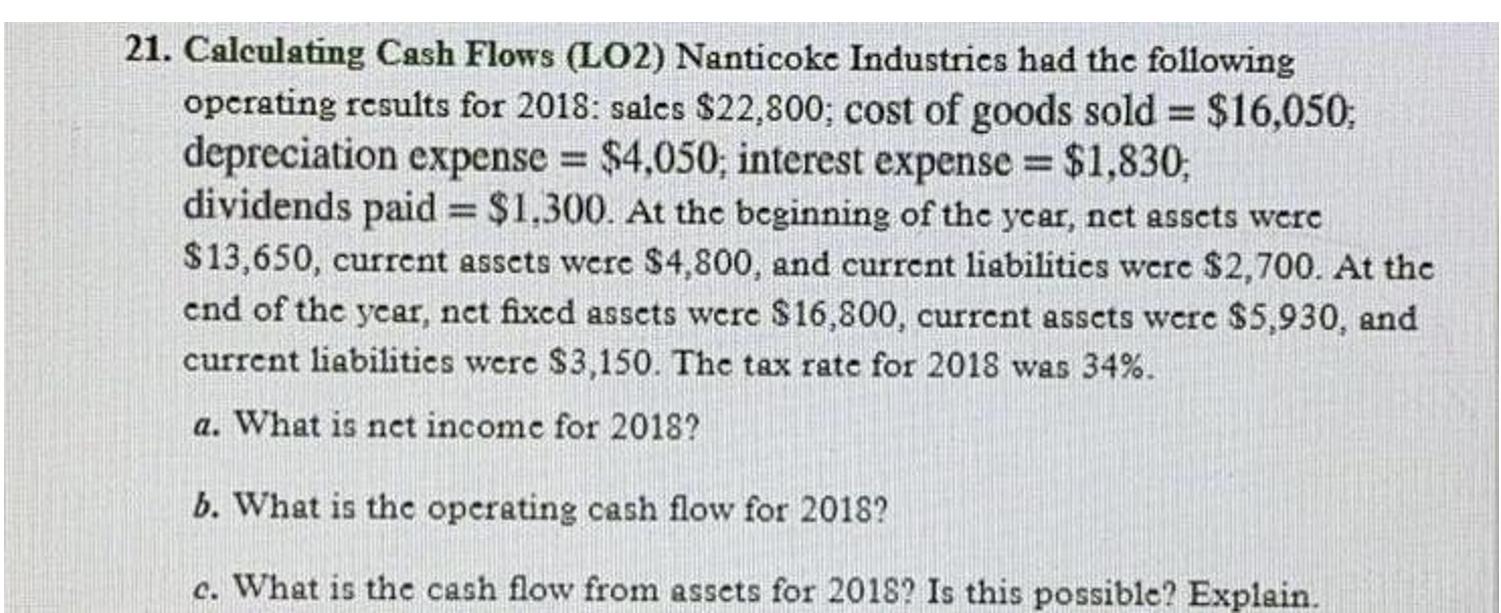

Use the following information for Clarington Inc. for LA Problems 24 (assume the tax rate is 34%): 2017 2018 Sales $11.573 $12.936 Depreciation 1.661 1.736 Cost of goods sold 3.979 4.707 Other expenses 946 824 Interest 776 926 Cash 6.067 6.466 Accounts receivable 8.034 9.427 Short-term notes payable 1,171 1.147 Long-term debt 20.320 24.696 Net fixed assets 50.888 54.273 Accounts payable 4.384 4.644 Inventory 14.283 15.288 Dividends 1.411 1.618 24. Financial Statements (LO1) Draw up a statement of comprehensive income and a statement of financial position for this company for 2017 and 2018.21. Calculating Cash Flows (LO2) Nanticoke Industries had the following operating results for 2018: sales $22,800; cost of goods sold = $16,050, depreciation expense = $4,050, interest expense = $1,830, dividends paid = $1,300. At the beginning of the year, net assets were $13,650, current assets were $4,800, and current liabilities were $2,700. At the end of the year, net fixed assets were $16,800, current assets were $5,930, and current liabilities were $3,150. The tax rate for 2018 was 34%. a. What is net income for 2018? b. What is the operating cash flow for 2018? c. What is the cash flow from assets for 2018? Is this possible? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts