Question: Use the following information for part a and b. Current commodity price is $30 per pound. The annual risk-free rate is 5%. Storage costs for

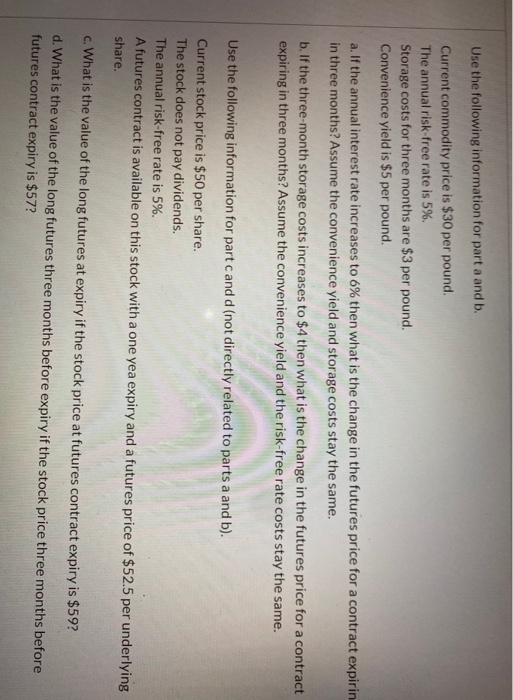

Use the following information for part a and b. Current commodity price is $30 per pound. The annual risk-free rate is 5%. Storage costs for three months are $3 per pound. Convenience yield is $5 per pound. a. If the annual interest rate increases to 6% then what is the change in the futures price for a contract expirin in three months? Assume the convenience yield and storage costs stay the same. b. If the three month storage costs increases to $4 then what is the change in the futures price for a contract expiring in three months? Assume the convenience yield and the risk-free rate costs stay the same. Use the following information for part cand d (not directly related to parts a and b). Current stock price is $50 per share. The stock does not pay dividends. The annual risk-free rate is 5%. A futures contract is available on this stock with a one yea expiry and a futures price of $52.5 per underlying share. c. What is the value of the long futures at expiry if the stock price at futures contract expiry is $592 d. What is the value of the long futures three months before expiry if the stock price three months before futures contract expiry is $57

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts