Question: Use the following information for problem 4 VT Power Generation, Inc., a virginia-based electric utility, has agreed to buy two gas turbines from Rolls Royce

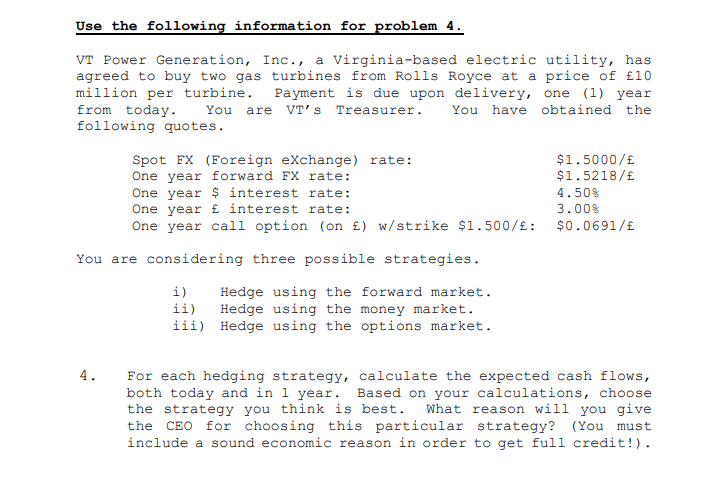

Use the following information for problem 4 VT Power Generation, Inc., a virginia-based electric utility, has agreed to buy two gas turbines from Rolls Royce at a price of 10 million per turbine. Payment is due upon delivery, one (1) year from today. You are VT's Treasure You have obtained the following quotes. Spot FX (Foreign exchange) rate: One year forward FX rate: One year $ interest rate: One year interest rate: One year call option (on ) w/strike $1.500/E: $0.0691/E $1.5000/E $1.5218/E 4. 50% 3. 00% You are considering three possible strategies i) Hedge using the forward market. ii) Hedge using the money market. iii) Hedge using the options market. 4. For each hedging strategy, calculate the expected cash flows, both today and in 1 year. Based on your calculations, choose the strategy you think is best. What reason will you give the CEO for choosing this particular strategy? (You must include a sound economic reason in order to get full credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts