Question: Use the following information for problems 46 through 49: Common stock: 1 million shares outstanding, $40 per share, $1 par value, beta = 0.8 Preferred

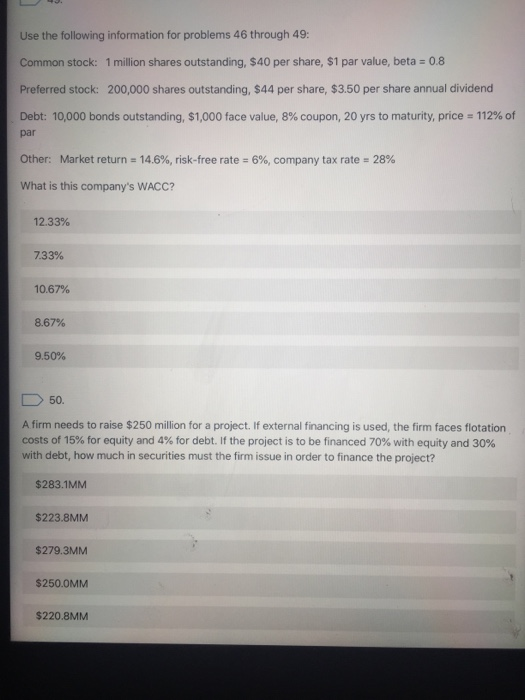

Use the following information for problems 46 through 49: Common stock: 1 million shares outstanding, $40 per share, $1 par value, beta = 0.8 Preferred stock: 200,000 shares outstanding, $44 per share, $3.50 per share annual dividend Debt: 10,000 bonds outstanding, $1,000 face value, 8% coupon, 20 yrs to maturity, price = 112% of par Other: Market return = 14.6%, risk-free rate = 6%, company tax rate = 28% What is this company's WACC? 12.33% 7.33% 10.67% 8.67% 9.50% 50. A firm needs to raise $250 million for a project. If external financing is used the firm faces flotation costs of 15% for equity and 4% for debt. If the project is to be financed 70% with equity and 30% with debt, how much in securities must the firm issue in order to finance the project? $283.1MM $223.8MM $279.3MM $250.0MM $220.8MM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts