Question: USE THE FOLLOWING INFORMATION FOR PROBLEMS 9 THROUGH 16 An estate distributes an asset to its sole income beneficlary. The distribution was not a specific

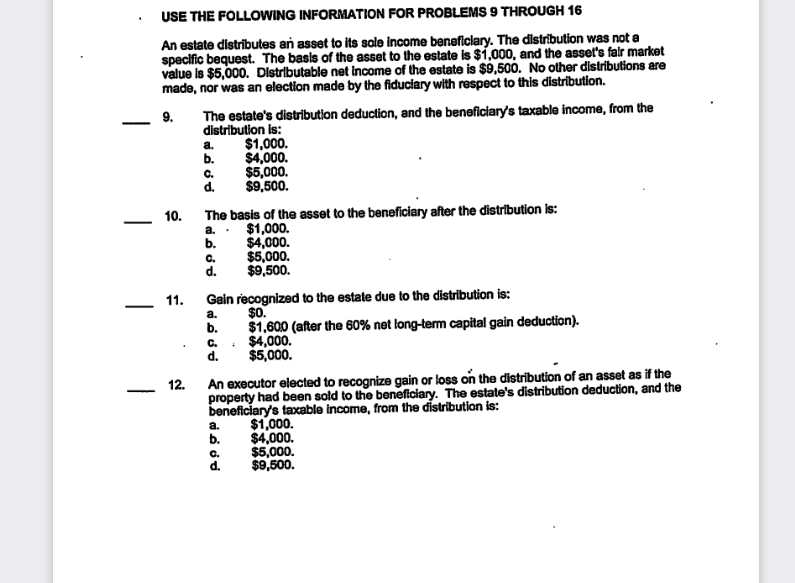

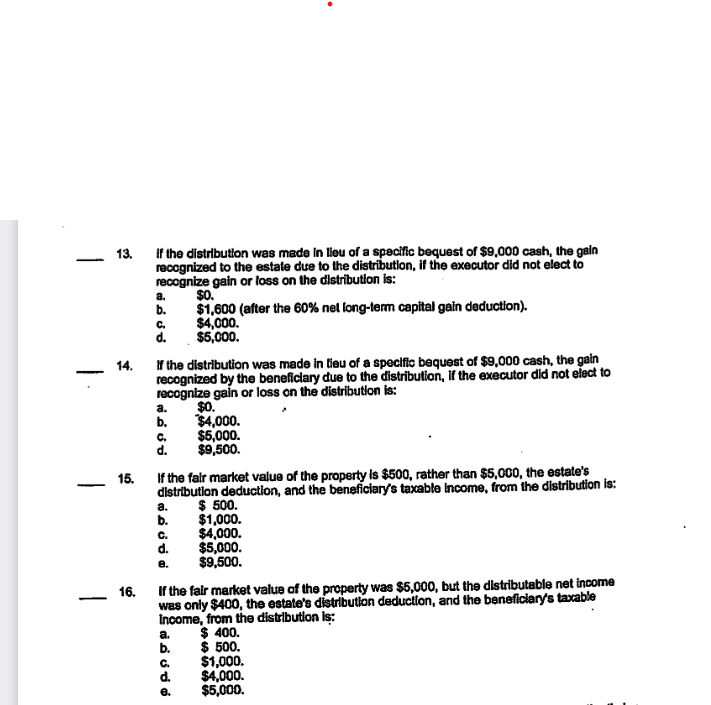

USE THE FOLLOWING INFORMATION FOR PROBLEMS 9 THROUGH 16 An estate distributes an asset to its sole income beneficlary. The distribution was not a specific bequest. The basis of the asset to the estate is $1,000, and the asset's fair market value is $5,000. Distributable net income of the estate is $9,500. No other distributions are made, nor was an election made by the fiduciary with respect to this distribution. 9. The estate's distribution deduction, and the beneficiary's taxable income, from the distribution is: a. $1,000. b. $4,000. c. $5,000. d. $9,500. 10. The basis of the asset to the beneficiary after the distribution is: a. $1,000. b. $4,000. c. $5,000. d. $9,500. 11. Gain recognized to the estate due to the distribution is: a. $0. b. $1,600 (after the 60% net long-term capital gain deduction). c. $4,000. d. $5,000. 12. An executor elected to recognize gain or loss on the distribution of an asset as if the property had been sold to the beneficiary. The estate's distribution deduction, and the beneficiary's taxable income, from the distribution is: a. $1,000. b. $4,000. c. $5,000. d. $9,500. 13. If the distribution was made in lieu of a spectifc bequest of $9,000cash, the gain recognized to the estate due to the distribution, if the executor did not elect to recognize gain or loss on the distribution is: a. $0. b. $1,600 (after the 60% net long-term capital gain deduction). c. $4,000. d. $5,000. 14. If the distribution was made in lieu of a specific bequest of $9,000cash, the gain recognized by the beneficiary due to the distribution, if the executor did not elect to recognize gain or loss on the distribution is: a. $0. b. $4,000. c. $5,000. d. $9,500. 15. If the fair market value of the property is $500, rather than $5,000, the estate's distribution deduction, and the beneficiary's taxable income, from the distribution is: a. $500. b. $1,000. c. $4,000. d. $5,000. e. $9,500. 16. If the falr market value of the property was $5,000, but the distributable net income was only \$400, the estate's distribution deduction, and the beneficiary's taxable income, from the distrbution is: a. $400. b. $500. c. $1,000. d. $4,000. e. $5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts