Question: Use the following information for the Exercises below. (Static) [The following information applies to the questions displayed below] Ramer and Knox began a partnership by

![information applies to the questions displayed below] Ramer and Knox began a](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f7883cc0c78_30066f7883c66fbd.jpg)

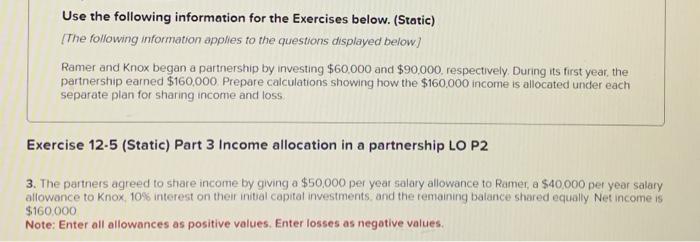

Use the following information for the Exercises below. (Static) [The following information applies to the questions displayed below] Ramer and Knox began a partnership by investing $60,000 and $90,000, respectively. During its first year, the partnership earned $160,000. Prepare calculations showing how the $160,000 income is allocated under each separate plan for sharing income and loss Exercise 12.5 (Static) Part 3 Income allocation in a partnership LO P2 3. The partners agreed to share income by giving a $50,000 per year salary allowance to Ramer, a $40,000 per year salary allowance to Knox. 10% interest on their initual capital investments, and the remaining balance shared equally Net income is $160,000 Note: Enter all allowances as positive values. Enter losses as negative values. Exercise 12-5 (Static) Part 3 Income allocation in a partnership LO P2 3. The partners agreed to share income by giving a $50,000 per year salary allowance to Ramer, a $40,000 per year salary allowance to Knox, 10% interest on their initial capital investments, and the remaining balance shared equally Net income is $160.000. Note: Enter all allowances as positive values. Enter losses as negative values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts