Question: USE THE FOLLOWING INFORMATION FOR THE NEXT THREE PROBLEMS You expect the risk-free rate (RFR) to be 4 percent and the market return to be

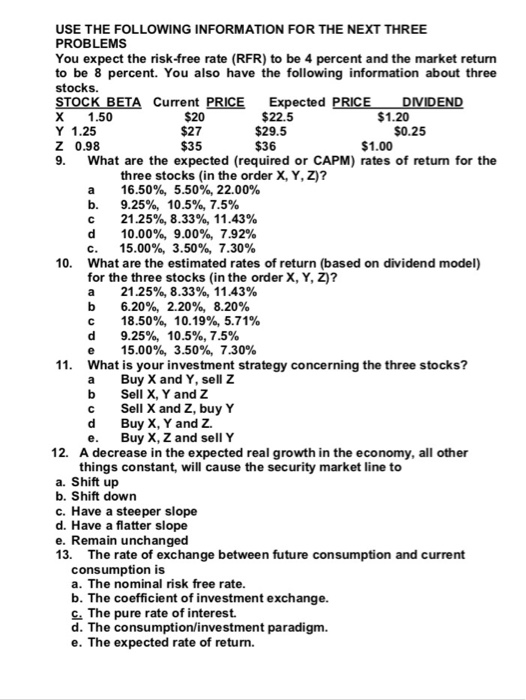

USE THE FOLLOWING INFORMATION FOR THE NEXT THREE PROBLEMS You expect the risk-free rate (RFR) to be 4 percent and the market return to be 8 percent. You also have the following information about three stocks. STOCK BETA Current PRICE Expected PRICE-DIVIDEND X 1.50 Y 1.25 Z 0.98 9. What are the expected (required or CAPM) rates of return for the S20 $27 $35 $22.5 $29.5 $36 $1.20 $0.25 $1.00 three stocks (in the order X, Y, Z)? 16.50%, 5.50%, 22.00% 9.25%, 10.5%, 7.5% 21.25%, 8.33%, 11.43% 10.00%, 9.00%, 7.92% 15.00% 3.50% 7.30% a b. C. What are the estimated rates of return (based on dividend model) for the three stocks (in the order X, Y, Z)? a 21.25%, 8.33%, 11.43% b 6.20%, 2.20%, 8.20% 18.50%, 10.19%,5.71% 10. 9.25%, 10.5%, 7.5% 15.00%, 3.50%, 7.30% 11. What is your investment strategy concerning the three stocks? a Buy X and Y, sell Z b c d Buy X, Y and Z. e. Sell X, Y and Z Sell X and Z, buyY Buy X, Z and sell Y 12. A decrease in the expected real growth in the economy, all other things constant, will cause the security market line to a. Shift up b. Shift down c. Have a steeper slope d. Have a flatter slope e. Remain unchanged 13. The rate of exchange between future consumption and current consumption is a. The nominal risk free rate. b. The coefficient of investment exchange. G. The pure rate of interest. d. The consumption/investment paradigm. e. T he expected rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts