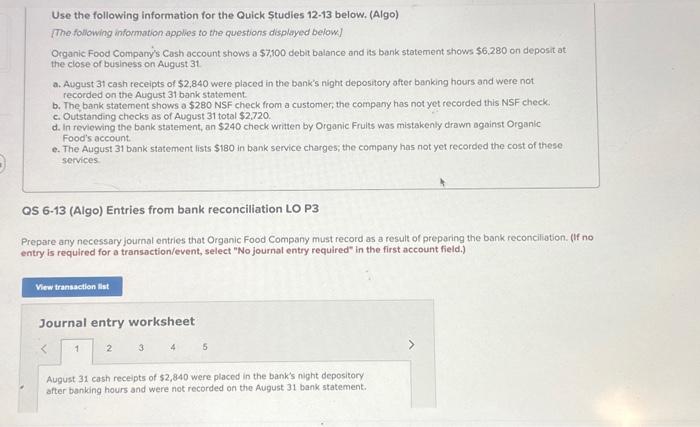

Question: Use the following information for the Quick Studies 1213 below. (Algo) [The following information applies to the questions displayed below] Organic Food Company's Cash account

![[The following information applies to the questions displayed below] Organic Food Company's](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e9579698460_34266e9579637d00.jpg)

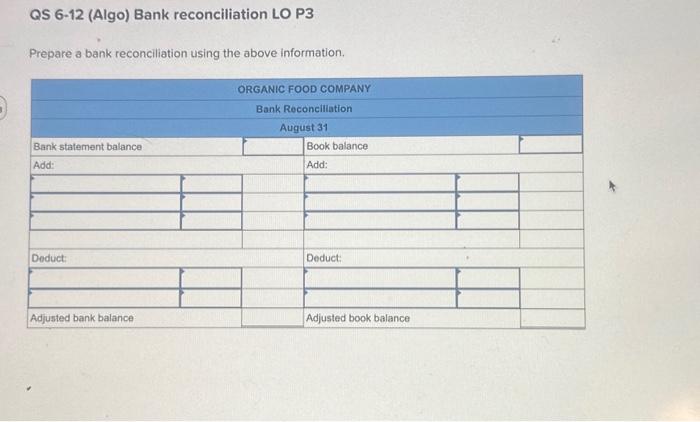

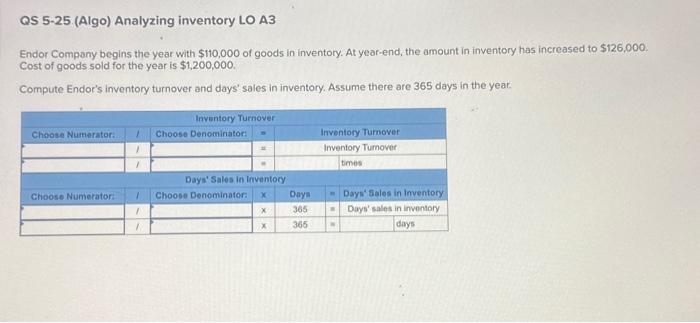

Use the following information for the Quick Studies 1213 below. (Algo) [The following information applies to the questions displayed below] Organic Food Company's Cash account shows a $7,100 debit balance and its bank statement shows $6.280 on deposit at the close of business on August 31. a. August 31 cash receipts of $2,840 were placed in the bank's night depository after banking hours and were not recorded on the August 31 bank statement: b. The bank statement shows a $280 NSF check from a customer, the company has not yet recorded this NSF check. c. Outstanding checks as of August 31 total $2,720. d. In reviewing the bank statement, an $240 chock written by Oiganic Frults was mistakenly drawn against Organic Food's account. e. The August 31 bank statement lists $180 in bank service charges; the company has not yet recorded the cost of these services. QS 6.13 (Algo) Entries from bank reconciliation LO P3 Prepare any necessary journal entries that Organic Food Company must record as a result of preparing the bank reconciliation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 2345 August 31 cash receipts of $2,840 were placed in the bank's night depository after banking hours and were not recorded on the August 31 bank statement. Required information Use the following information for the Quick Studies 1213 below. (Algo) The following informution applies to the questions displayed below.] Organic Food Company's Cash account shows a $7,100 debit balance and its bank statement shows $6,280 on deposh at the close of business on August 31 . a. August 31 cash receipts of $2,840 were placed in the bank's night depository after banking hours and were not recorded on the August 31 bank statement. b. The bank statement shows a $280 NSF check from a customer; the company has not yet recorded this NSF check. c. Outstanding checks as of August 31 total $2,720. d. In reviewing the bank statement, an $240 check written by Organic Fruits was mistakenly drawn against Organic Food's account. e. The August 31 bank statement lists $180 in bank service charges; the company has not yet recorded the cost of these services. QS 6-12 (Algo) Bank reconciliation LO P3 Prepare a bank reconcillation using the above information. QS 6-12 (Algo) Bank reconciliation LO P3 Prepare a bank reconciliation using the above information. QS 5-25 (Algo) Analyzing inventory LO A3 Endor Company begins the year with $110,000 of goods in inventory. At year-end, the amount in inventory has increased to $126,000 Cost of goods sold for the year is $1,200,000. Compute Endor's inventory turnover and days' sales in inventory. Assume there are 365 days in the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts