Question: Use the following information for the Quick Study below. (Algo) (11-14) Skip to question [The following information applies to the questions displayed below.] Trey Monson

Use the following information for the Quick Study below. (Algo) (11-14)

Skip to question

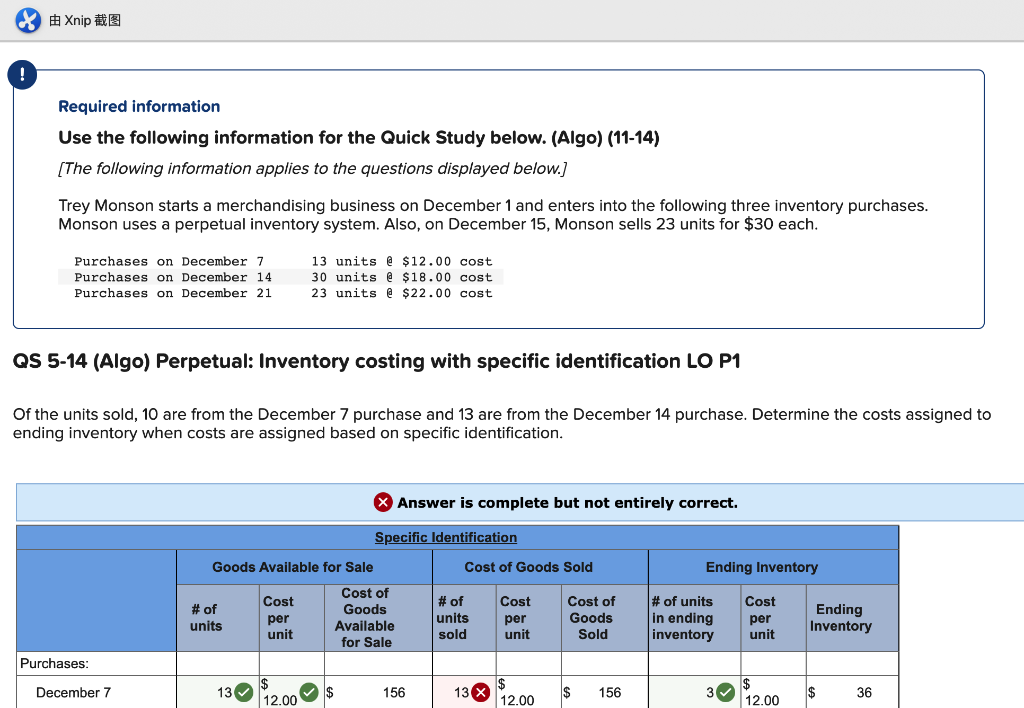

[The following information applies to the questions displayed below.] Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Monson uses a perpetual inventory system. Also, on December 15, Monson sells 23 units for $30 each.

| Purchases on December 7 | 13 units @ $12.00 cost |

|---|---|

| Purchases on December 14 | 30 units @ $18.00 cost |

| Purchases on December 21 | 23 units @ $22.00 cost |

QS 5-14 (Algo) Perpetual: Inventory costing with specific identification LO P1

Of the units sold, 10 are from the December 7 purchase and 13 are from the December 14 purchase. Determine the costs assigned to ending inventory when costs are assigned based on specific identification.

![to question [The following information applies to the questions displayed below.] Trey](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66de4a2b073ad_01066de4a2a7b100.jpg)

Xnip ! Required information Use the following information for the Quick Study below. (Algo) (11-14) [The following information applies to the questions displayed below. Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Monson uses a perpetual inventory system. Also, on December 15, Monson sells 23 units for $30 each. Purchases on December 7 Purchases on December 14 Purchases on December 21 13 units @ $12.00 cost 30 units @ $18.00 cost 23 units @ $22.00 cost QS 5-14 (Algo) Perpetual: Inventory costing with specific identification LO P1 Of the units sold, 10 are from the December 7 purchase and 13 are from the December 14 purchase. Determine the costs assigned to ending inventory when costs are assigned based on specific identification. X Answer is complete but not entirely correct. Specific Identification Goods Available for Sale Cost of Goods Sold Ending Inventory # of units Cost per unit Cost of Goods Available for Sale # of units sold Cost per unit Cost of Goods Sold # of units in ending inventory Cost per unit Ending Inventory Purchases: December 7 12.00 156 13 $ 156 $ 12.00 $ 36 12.00 Return 1 ! Required information Goods Available for Sale Cost of Goods Sold Ending Inventory # of units Cost per unit Cost of Goods Available for Sale # of units sold Cost per unit Cost of Goods Sold # of units in ending inventory Cost per unit Ending Inventory Purchases: December 7 7 13 $ 12.00 $ 156 13 X $ 12.00 $ 156 3 $ 12.00 $ 36 December 14 30 18.00 540 13 18.00 234 30 X 18.00 540 December 21 23 22.00 506 0 23 22.00 506 Total 66 $ 1,202 26 $ 390 56 $ 1,082

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts