Question: Use the following information to answer Excercises E9-18 and E9-19. At January 1, 2018, Hilltop Flagpoles had Accounts Receivable of $28.000, and Allow- ance for

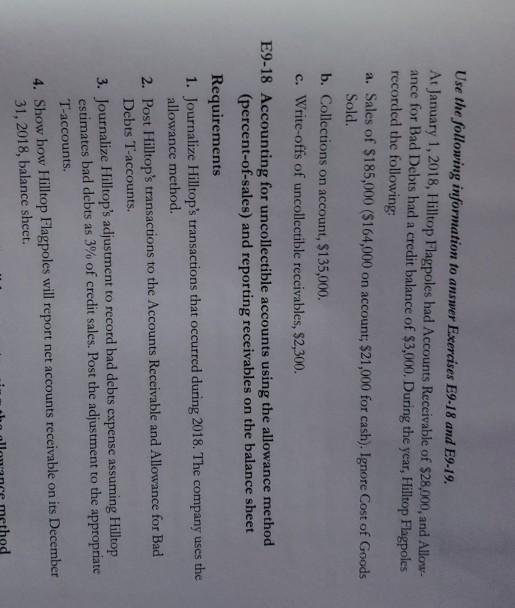

Use the following information to answer Excercises E9-18 and E9-19. At January 1, 2018, Hilltop Flagpoles had Accounts Receivable of $28.000, and Allow- ance for Bad Debts had a credit balance of $3,000. During the year, Hilltop Flagpoles recorded the following: a. Sales of $185,000 ($164,000 on account; $21,000 for cash). Ignore Cost of Goods Sold. b. Collections on account, $135,000. c. Write-offs of uncollectible receivables, $2,300. E9-18 Accounting for uncollectible accounts using the allowance method (percent-of-sales) and reporting receivables on the balance sheet Requirements 1. Journalize Hilltop's transactions that occurred during 2018. The company uses the allowance method. 2. Post Hilltop's transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts. 3. Journalize Hilltop's adjustment to record bad debts expense assuming Hilltop estimates bad debts as 3% of credit sales. Post the adjustment to the appropriate T-accounts. 4. Show how Hilltop Flagpoles will report net accounts receivable on its December 31, 2018, balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts